Will weak support push Bitcoin’s price down to $110k?

Bitcoin [BTC] HODLer pressure is mounting.

On 16 August, $3 billion+ in realized gains hit the market, sparking the largest profit-taking spike of the month. Bitcoin responded with a 1.9% intraday dip to $114,707, kicking the week off in the red.

Sure, we’re barely a week past the ATH. So, calling it a top is premature. However, is $114k shaping up as a “strong” accumulation zone? Compared to $110k, it still sits above the key support cluster, leaving room for a deeper retest.

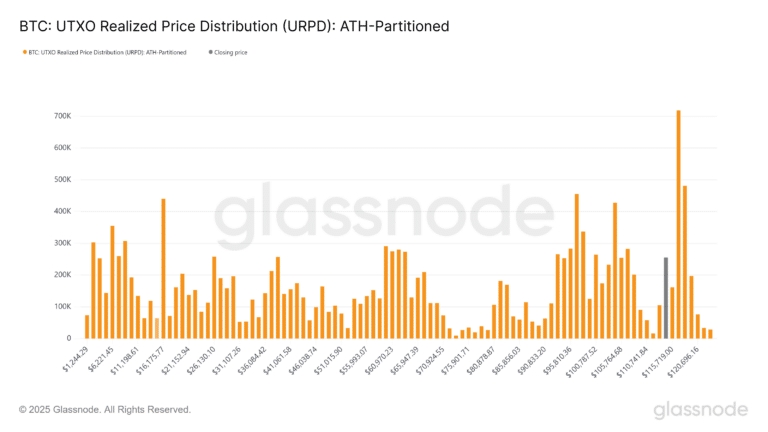

On-chain, $116,963 is Bitcoin’s largest cost-basis cluster, holding 700k+ BTC (3.61% of supply) – Making it a major supply zone that could act as resistance or anchor a pullback.

In simple terms, $114k might attract some buying. However, with a heavy supply cluster near breakeven, the risk of a margin squeeze might be rising. $110k looks like the more probable liquidity grab zone before fresh buying kicks in.

Additionally, Bitcoin’s Accumulation Trend Score flipped orange for the first time this month, tumbling from 0.57 to 0.20 in under a week. It underlined a clear slowdown in HODLer stacking, even at discounted levels.

Tutti i commenti0RecentePopolare

Nessuno storico