Crypto Express

07/07 01:27

As stablecoins rise, does ETH’s control slip?

Imagine USDC, which already plays a key role in Ethereum’s DeFi stack.

Protocols like Aave and Compound rely on it as core collateral. Meanwhile, DAOs, traders, and institutions use it to move capital, manage treasuries and earn yield. All this activity helps fuel Ethereum’s proof-of-stake system.

But the catch is, that liquidity is largely controlled by centralized issuers. In USDC’s case, that’s Circle.

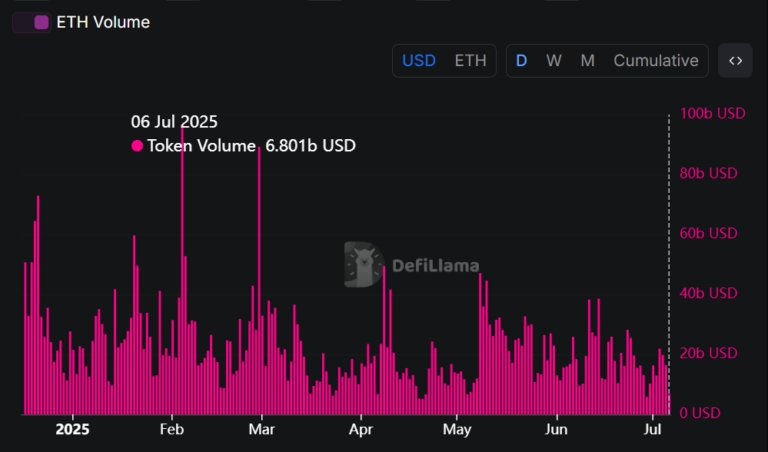

And while stablecoin supply continues to climb, ETH-denominated DeFi volume has dropped to $6.8 billion, down from a $30 billion high earlier this year, highlighting a structural imbalance in Ethereum’s economic model.

This divergence signals a critical shift: Capital is flowing into stable, externally governed assets rather than Ethereum’s native token.

More users are leaning on stablecoins to lend, stake, and move capital, while skipping over ETH entirely.

Consequently, ETH’s demand slips, decentralization gets harder to sustain, and the market cap starts feeling the pressure.

With capital favoring stability over the asset that secures the chain, Ethereum may be facing the early signs of a deeper structural shift.

#Join HTX On A Fitness Journey To Mars#Check In Weekly, Win Prizes Weekly — Join the Fun!#Claim1,200 USDT in the Monthly Creation Challenge

54Condividi

Tutti i commenti0RecentePopolare

Nessuno storico