Mr.Abrash

02/10 08:25

XRP Futures Open Interest Plunge 37% Are Altcoin

XRP Futures Open Interest Plunge 37%

Are Altcoin Traders Jumping?

In the seven days to February 6, XRP experienced a sharp 25.7% correction. However, the $2.30 support level has attracted strong buying interest every time it has been tested. On February 7, XRP rose 8% to $2.50, but it was not widely accepted as professional traders cut leveraged positions significantly.

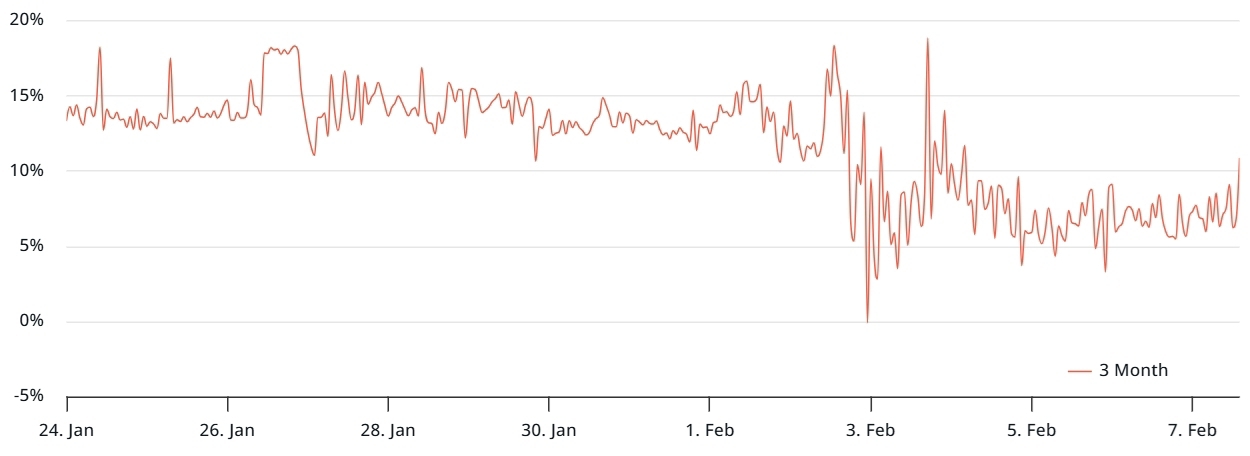

Total open interest in XRP futures, which reflects the overall demand for these contracts, has fallen 37% since its peak on January 15.

It is worth noting that in the derivatives market, long (buy) and short (sell) positions always coincide. Therefore, a decrease in the total number of contracts should not be considered a purely bearish signal. However, growing interest from institutional investors is generally seen as a positive sign as it tends to increase liquidity and attract more trading capital.

To determine whether XRP whales have turned bearish, the premium of the monthly futures contract should be analyzed. In a neutral market, these contracts typically trade at an annual premium of 5% to 10% to compensate for the long settlement period.

There are two key points to note when analyzing XRP futures data. First, after a sudden drop to $1.76 on February 3, the premium quickly rebounded to the neutral threshold of 5%. More importantly, the annual futures premium has returned to a bullish level of 10% despite XRP trading 25.5% below its all-time high of $3.40.

XRP is heavily influenced by retail trading, however. Total open interest in perpetual contracts (inverse swaps) across platforms is close to $2.5 billion. To understand whether the so-called "XRP army" is weakening, it is worth examining futures funding rates, which typically exceed 1.9% per month in bull markets.

XRP's perpetual funding rate is currently 0.2% per month, which is at the low end of the neutral range and approaching bear market territory. While this is an improvement from the levels seen on February 3, it is still well below the 0.9% seen two weeks ago. From a derivatives perspective, this suggests a lack of optimism among retail traders.

XRP Adoption and Financial Inclusion Claims Lack Evidence

XRP price action is often closely tied to news and events, even rumors that have no hard evidence. For example, some influencers have claimed that Ripple CEO Brad Garlinghouse is about to be appointed to the Trump administration’s cryptocurrency commission, despite a lack of reliable sources to support this claim.

Other influencers have suggested that traditional banks could “become nodes on the Ripple network to access XRP.” This claim is highly questionable, as Ripple has already shifted its focus to integrating tokenized assets into its network.

Neither in the fable of XRP adoption in traditional finance nor in the fable of XRP adoption in government strategic reserves, there is hard evidence to support these ideas. According to DefiLlama, XRP remains a highly speculative asset with a total value locked (TVL) of less than $100 million.

While XRP may retest the $3 level, nothing fundamental has changed other than the emergence of a more crypto-friendly government. Such a development increases Ripple's chances of winning the ongoing legal battle, but will not directly affect XRP's price.

The main legal case directly related to Ripple is the SEC lawsuit, which revolves around whether certain XRP sales constitute an unregistered securities offering. The case is currently being appealed. However, the outcome is unlikely to significantly change the trajectory of XRP adoption or the public ledger network used by the banking industry.

#Grab $100,000 Surprise Gifts#Share Your Thoughts on Popular Assets in March#Hit March's Interaction Leaderboard

2Bagikan

Semua Komentar0TerkiniHangat

Tidak ada catatan