Original | Odaily Planet Daily (@OdailyChina)

Author | Wenser (@wenser 2010)

2026, survival is paramount.

In the previous article "2026, Survive: A Bear Market Survival and Counterattack Manual for Crypto Enthusiasts", we systematically outlined this year's "survival strategy", emphasizing the allocation of assets such as gold and other precious metals as a key component. For those aiming to combat inflation, mitigate fiat currency devaluation, the decline of the US dollar exchange rate, and other issues through gold, how to allocate gold-related assets has become the next challenge.

In this regard, based on the author's personal understanding, XAUT, issued by Tether, is relatively perhaps the best way for crypto users to allocate gold assets. Combined with the recent introduction of a new unit of account "Scudo" for Tether Gold (XAU₮), the entry barrier for gold token allocation has also sharply dropped to as low as a few dollars.

Odaily Planet Daily will systematically analyze in this article whether XAUT is worth allocating in one's portfolio.

Potential Supports for Gold's Rise: US Policy, ETF Inflows, Bank Ratings

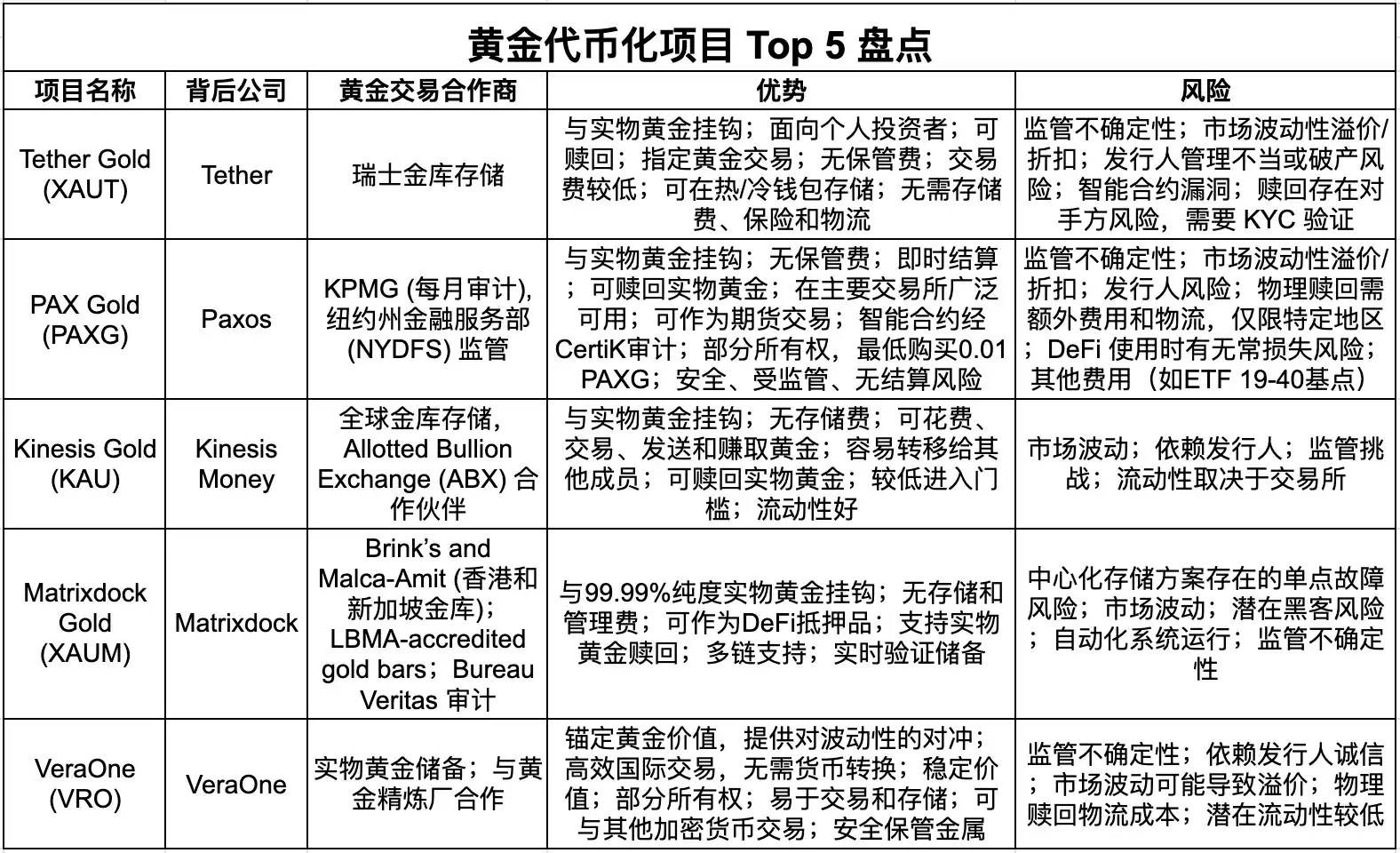

Last September, when the spot gold price was still around $3400-$3500, we introduced five major gold tokens in the article "Gold Price Expected to Continue Surging to $3900/oz, Here's a List of 5 Gold Tokens", with XAUT being one of them. Looking back 3 months later, the spot gold price per ounce once surged to around $4550. It must be said, impressively so.

Not only that, although there has been a阶段性回调 in price recently, the upward trend of spot gold has not been significantly interrupted. Specifically, the support for the gold price stems from the following aspects:

World Gold Council: US Supreme Court Tariff Decision and Two Other Factors Only Constitute Short-Term Fluctuation Impact on Gold's Future Trend

The World Gold Council reported that the surge in precious metals (including silver and platinum) in December and the rebalancing of commodity indices may trigger market volatility in the short term. However, apart from short-term fluctuation impacts, gold is expected to continue its own operating logic. The upcoming ruling by the US Supreme Court on tariff policy may have a significant impact on US trade policy. The impact on gold may be more complex but could constitute potential support. Finally, ongoing geopolitical conflicts (with recent US moves in Venezuela being the latest example) also provide support for the gold price.

Gold Price Set 53 Historical Records in 2025, ETFs Saw Unprecedented Inflows

The World Gold Council stated that as the gold price set 53 historical records in 2025, global investors poured unprecedented funds into gold ETFs. North American funds contributed the main part of the global inflows in 2025. Meanwhile, gold holdings in the Asian region nearly doubled, and Europe also showed significant demand.

Gold Rose About 65% in 2025 and Set Over 50 New Highs, Silver Rose About 150%

The 2025 precious metals行情 showed that spot gold closed down 0.46% on December 31st at $4318.65/oz. Against the backdrop of global "de-dollarization", the Federal Reserve restarting its interest rate cut cycle, and continued gold purchases by central banks, gold became the most dazzling "star asset" of 2025, with a rising trend throughout the year, rising about 65% for the year, once refreshing a historical high to $4549.96/oz, and setting over 50 new highs during the year.

UBS Group: Raises Gold Price Targets for March, June, and September 2026 to $5000 Per Ounce

UBS Group stated that it remains bullish and has raised its gold price targets for March, June, and September 2026 to $5000 per ounce (previously $4500 per ounce). It is expected that by the end of 2026, the gold price will slightly fall to $4800 per ounce.

Based on the above information, the gold行情 is continuously看好 for the next year. Let's talk about why Tether's gold token XAUT is worth allocating.

4 Major Advantages of XAUT Allocation: High Market Cap, Low Threshold, Good Liquidity, Leverage Available

First, Tether's strong financial support and the gold reserves and sufficient liquidity behind XAUT.

At the beginning of the month, Tether CEO Paolo Ardoino stated that Tether purchased 8888 Bitcoins on New Year's Eve 2025, worth approximately $780 million. This transaction increased the public Bitcoin holdings of the stablecoin issuer to over 96,000. Tether currently allocates 15% of its quarterly profits to Bitcoin regularly. Furthermore, Tether purchased 26 tons of gold in the third quarter of 2025, bringing its total gold holdings to 116 tons, ranking among the top 30 gold holders globally. A market cap of around $2.3 billion is also proof of XAUT's sufficient liquidity.

Second, Tether recently introduced a new unit of account "Scudo" for XAUT.

According to official news, Tether officially launched the new计价 unit Scudo for Tether Gold (XAUT). This unit aims to reintroduce gold as a means of payment. 1 Scudo is defined as one-thousandth of a troy ounce of gold or one-thousandth of an XAUT (approximately $4.40). This move addresses the issue of users having to handle long decimals when trading or pricing by introducing a simpler计价 method, making gold more practical in daily economic activities. Tether Gold is currently fully backed by physical gold in secure vaults; the introduction of Scudo does not change the structure or backing of XAUT.

Third, XAUT is listed on major mainstream CEX and DEX platforms and supports spot buying or contract leverage operations.

According to Coingecko information, XAUT supports buying and selling on CEXs such as Bybit, OKX, Bitget, and DEXs such as Uniswap, Fluid, Curve.

Finally, Tether's dominant position in the stablecoin track and the超高利润 of its business revenue also provide strong support for the growth and development of XAUT. Its industry application popularity is expected to further increase in 2026.

According to a Bloomberg report citing Artemis Analytics data, global stablecoin transaction volume surged 72% year-on-year in 2025, reaching a record $33 trillion. Among them, USDC issued by Circle had a transaction volume of $18.3 trillion, ranking first; Tether's USDT transaction volume was $13.3 trillion, also maintaining a high level. The two together account for the vast majority of stablecoin trading activity.

Considering the continuous decline in the US dollar to RMB exchange rate, for most ordinary people with relatively limited liquid funds and lower investment risk appetite, converting some fiat currency into the gold token XAUT might be a relatively better solution.