G.CHINTHAN

09/04 11:06

Grid Trading: What It Is and When to Use It?

Grid trading is a popular trading strategy used by crypto and forex traders to take advantage of price fluctuations in sideways or ranging markets. Unlike directional strategies that rely on predicting whether the market will rise or fall, grid trading focuses on making profits from market volatility itself.

What is Grid Trading?

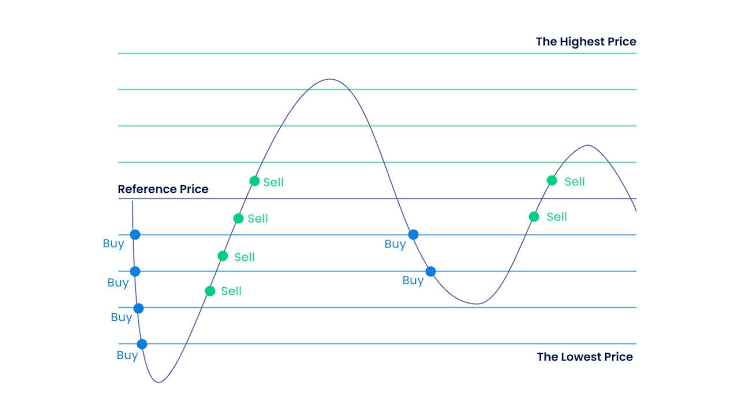

Grid trading works by placing a series of buy and sell orders at preset price intervals—forming a "grid." For example, a trader may set buy orders at every 1% drop in price and sell orders at every 1% rise. As the market moves up and down, these orders are triggered, generating small but frequent profits.

The idea is simple:

Buy low when the price drops.

Sell high when the price rises.

Repeat automatically within a defined price range.

Many exchanges and trading bots allow automated grid trading, making it easier for traders to run this strategy 24/7 without constant monitoring.

Market Conditions Suitable for Grid Trading

Not all markets are ideal for grid trading. It works best under the following conditions:

1. Sideways or Range-Bound Markets

Grid trading thrives when prices move up and down within a defined range without strong trends. This allows multiple buy and sell orders to be executed repeatedly.

2. High Volatility Without Clear Direction

The strategy benefits from frequent price swings. The more the price fluctuates within the grid, the more profit opportunities arise.

3. Stable or Moderate Markets

If the market is relatively stable and not trending sharply upward or downward, grid trading can steadily generate income.

When to Avoid Grid Trading

Strong Uptrends or Downtrends: If the market is trending strongly in one direction, grid trading may result in holding losing positions for a long time.

Low-Volatility Markets: With very little price movement, few orders will be triggered, reducing profitability.

Conclusion

Grid trading is not about predicting market direction—it’s about capitalizing on natural price movements. It is especially effective in sideways, ranging, or moderately volatile markets. For traders who want consistent small gains over time and are comfortable with risk management, grid trading can be a powerful tool.

#HTX community ✖ SUNPUMP Creator Championship

236分享

全部評論0最新熱門

暫無記錄