Crypto Express

06/12 11:40

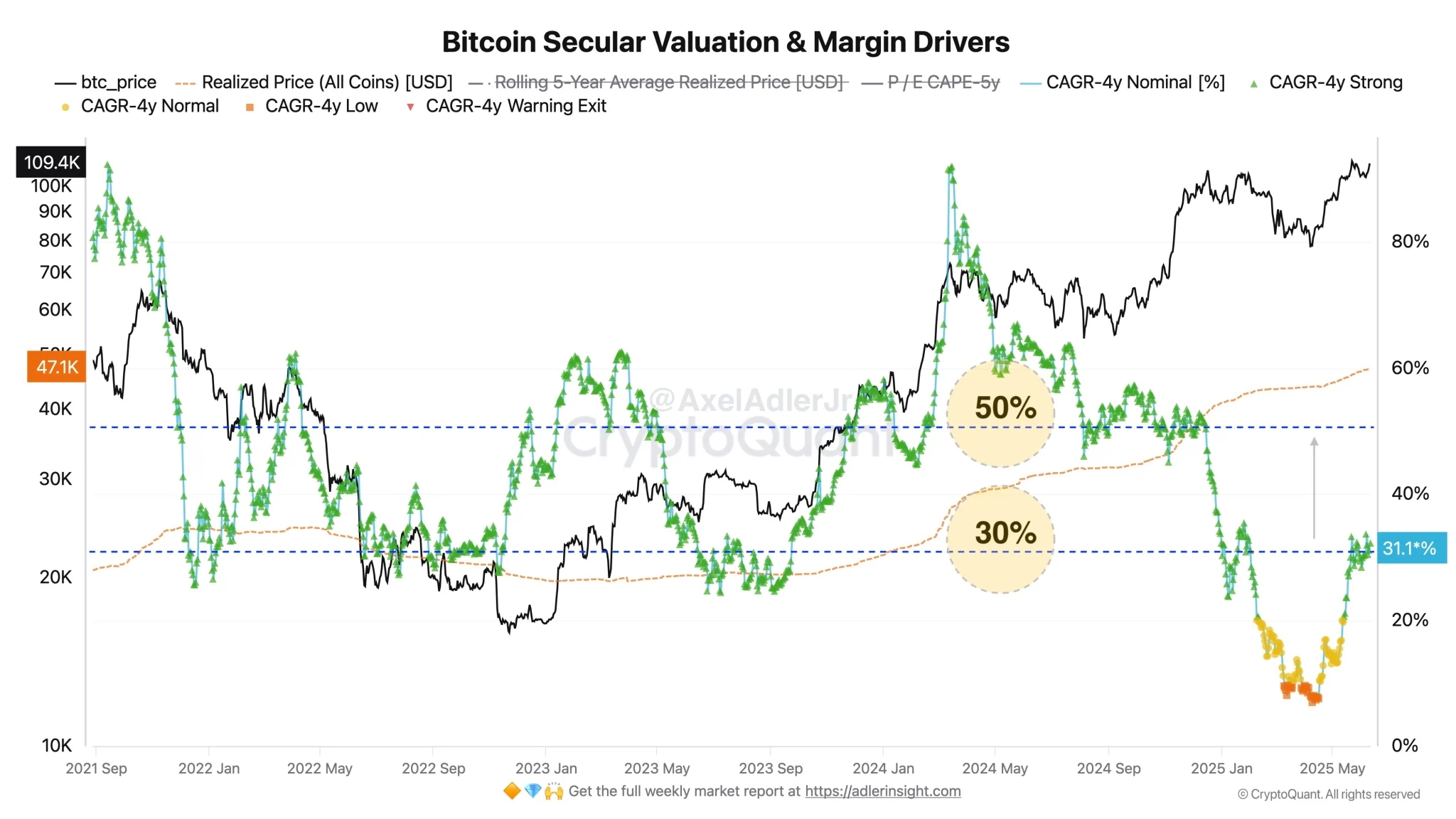

BTC $168K BTC by October?

Axel Adler Jr forecasts a possible Bitcoin price target of $168,000 by October 2025, assuming momentum in the futures market and leverage continues.

He bases this projection on accelerating growth and historical patterns observed during prior bull runs.

Adjusting for Risk: CAGR vs. Standard Deviation

In the discussion thread, X user Manu suggested a more refined way to interpret CAGR—by dividing it by the standard deviation to eliminate volatility and highlight risk-adjusted returns.

Adler agreed with the approach, stating it offers a cleaner view of market performance, but also emphasized another critical point:

“The real inflection point comes when investors start taking profits based on expected returns.”

According to him, the risk of a bear market grows once BTC trading volume crosses 1 million coins, as large-scale profit-taking can disrupt supply-demand balance.

#Post To Earn Bonus#Share Your Thoughts on Popular Assets in June#Claim1,200 USDT in the Monthly Creation Challenge

27Partilhar

Todos os comentários0Mais recentePopular

Sem registos