Against a backdrop of a somewhat fatigued market, Memecoins, though no longer frenzied, remain a battleground in the attention economy.

Memecoins Haven't Reached the End, They've Changed Direction

Compared to the scene in 2024 where Memecoins stole the show, they have indeed quieted down a lot after $TRUMP this year. However, this is not the end, but rather the market evolving to the next stage.

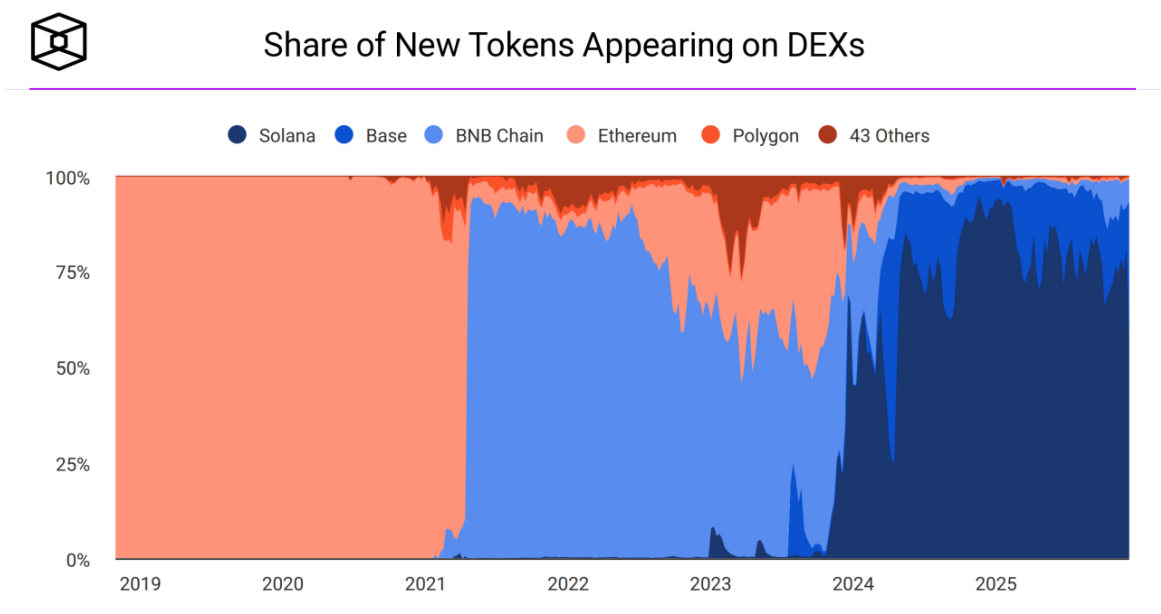

• From Solana to Base, BNB Chain: Initially, Solana monopolized 90% of the new token issuance share with its low fees and high speed. The launch of Pump.fun, in particular, significantly decentralized the power to issue tokens, catalyzing a year-long Meme frenzy in 2024. However, with multi-chain expansion and the continued efforts of other public chains, Solana's share has now dropped to 57%, with BNB Chain, Base Chain, and others continuously grabbing on-chain market share.

Source : https://www.theblock.co/data/decentralized-finance/dex-non-custodial/share-of-new-tokens-appearing-on-dexs

• Small and Medium-Sized Memes Become Mainstream: The Memecoin market narrative has shifted from being dominated by Ethereum chain tokens with multi-billion dollar market caps like DOGE, SHIB, and PEPE, to Solana chain birthing large Memecoins with multi-billion dollar market caps like BONK, WIF, FARTCOIN, and TRUMP, and now to small and medium-sized Memecoins with tens of millions in market cap born on various chains, such as BRETT and TOSHI on Base chain, and Binance Life, BROCCOLI on BNB Chain. This indicates the market cap ceiling for Memecoins is continuously lowering, and the market is maturing.

• Accelerated Rotation Pace: With limited liquidity growth and an accelerating trend in the number of Memecoins, the market rotation pace has shifted from "weekly" to "hourly." Particularly thanks to the proliferation of AI tools and upgrades in social media algorithms, the speed of viral spread and decay has increased dramatically. This results in a large number of new coins reaching their peak within just 24-48 hours of launch, with a lifecycle far shorter than the previous weekly cycles.

Recent Hot Memecoins: Social Media Hype + Small/Mid Cap

Browsing recent popular Memecoins undoubtedly confirms the above changes.

$Franklin: Franklin The Turtle was originally a classic children's character from a series of books and TV shows in Canada in the 1980s and 1990s. The current U.S. Secretary of Defense recently posted a politically satirical image on X, expressing a tough stance on U.S. cross-border military anti-drug operations. Subsequently, the同名 Memecoin portrayed Franklin the Turtle as a satirical, militarized anti-drug warrior. The coin launched on December 1st, reached a peak FDV of $24.36M by the 10th, and has currently retraced to $5.4M.

$DOYR: The起因 (cause) was that DYOR was misspelled as DOYR. Then, spurred by a reply post saying "DOYR = DO YouR meme?", the BNB Chain community quickly launched a同名 Memecoin. The coin launched on December 6th, reached a peak FDV of $31.34M the next day, and has currently retraced to $3.4M.

$马到成功 (Horse Success): Originating from the Chinese community's blessing phrase "马到成功" (meaning immediate success), it is a popular Chinese Memecoin following others like "Binance Life" and "Vulgar Penguin". The coin launched on November 15th, reached a peak FDV of $5.03M on December 2nd, and has currently retraced to $2.6M.

$jesse: A personal Memecoin issued by Base co-founder Jesse in November. The coin launched on November 21st, reached a peak FDV of $28.08M on the same day, and has currently retraced to $10M.

Opportunities in the Structural Changes of Memecoins

Starting from DOGE's dog meme to today's vast ecosystem where any topic can become a coin, Memecoins are no longer just simple internet jokes, but a perfect fusion of community narrative, attention propagation, and speculative frenzy.

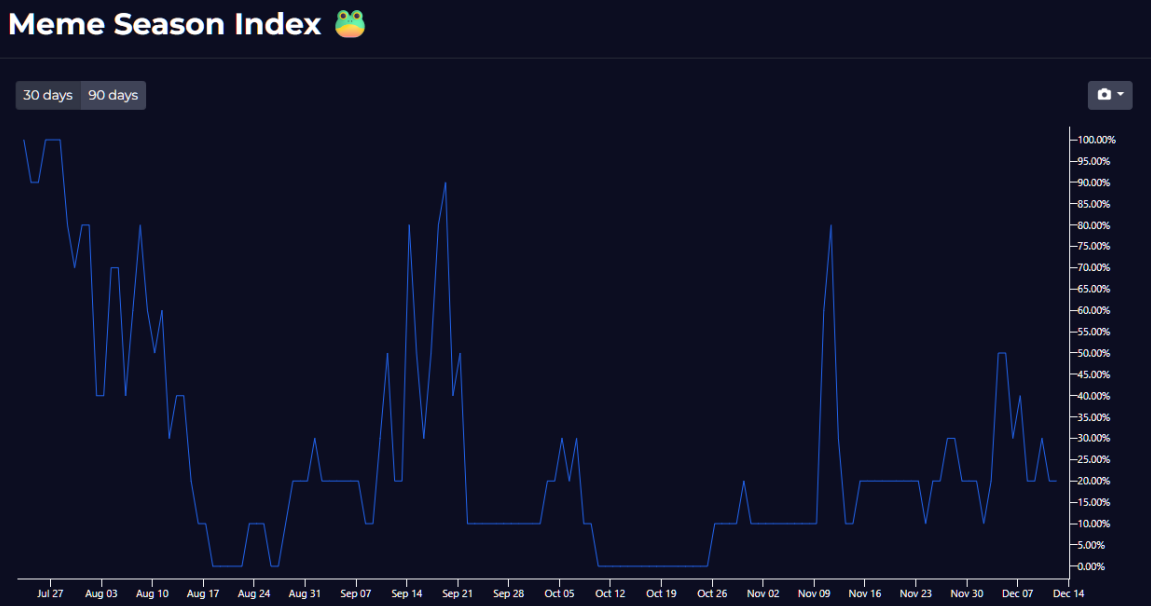

This year's Memecoin market has been as刺激 (stimulating) as a roller coaster: accelerated rotation, smaller scale, multi-chain expansion—all marking a transition from狂欢 (carnival) to成熟 (maturity).

Source : https://whaleportal.com/meme-season-index/

It is foreseeable that, regardless of bull or bear markets, the Memecoin market will not fall silent, because as long as there is attention, someone will go all-in on a dog picture to spread emotion.

However, in the flash-in-the-pan era, Memecoins are beginning to transform from "jokes" into "cultural indices." For example, older tokens like DOGE, SHIB, and BONK are shedding their religious constraints, continuously undergoing technical upgrades, and applications are empowering the Meme. Meanwhile, more newly produced small and medium Memecoins are turning to "social media heat + data-driven," which carries higher risks but offers more refined opportunities. The rise and fall of these Memecoins also represent the ebb and flow of heat around certain social topics.

No matter how you look at it, this structural change will reshape investment logic, bringing more opportunities for participants while also demanding greater DYOR.

* This article is provided by WEEX Labs, intended solely for the purpose of trend research and discussion, and does not constitute any form of investment advice or commitment. The content, data, and opinions involved in the article are for reference only. Investors need to make their own judgments and bear the corresponding risks.