Surf, an AI platform built for digital-asset analysis, raised $15 million in a round led by Pantera Capital with participation from Coinbase Ventures and DCG, to expand its AI models and enterprise tools.

The company offers a domain-specific model used by exchanges and research companies to analyze onchain activity, market behavior and sentiment. The funding will go toward Surf 2.0, which will introduce more advanced models, broader proprietary data sets and additional agents designed to handle multi-step analytical tasks.

Surf said its platform has seen rapid uptake since its launch in July, generating more than one million research reports and claiming millions in annual recurring revenue, with usage from a large share of major exchanges and research firms.

Surf’s model uses a multi-agent architecture that evaluates onchain data, social sentiment and token activity, delivering its analysis through a chat interface for research and reducing manual workloads for analysts and traders.

Related: How to turn ChatGPT into your personal crypto trading assistant

The continued integration of AI and digital assets

Artificial intelligence and blockchain are increasingly intersecting as more companies develop tools that leverage both technologies.

In April, decentralized AI startup Nous Research closed a $50 million Series A round led by Paradigm. The company is developing open-source AI models powered by decentralized infrastructure and uses the Solana blockchain to coordinate and incentivize global participation in training.

In May, Catena Labs, led by Circle co-founder Sean Neville, announced it had raised $18 million to develop a bank built around native AI infrastructure. The company said the system will be designed for both AI agents and human contributors, with AI handling day-to-day operations under human supervision.

In October, Coinbase introduced “Based Agent,” a tool that lets users create an AI agent with an integrated crypto wallet in just a few minutes to perform onchain actions such as trading, swapping, and staking.

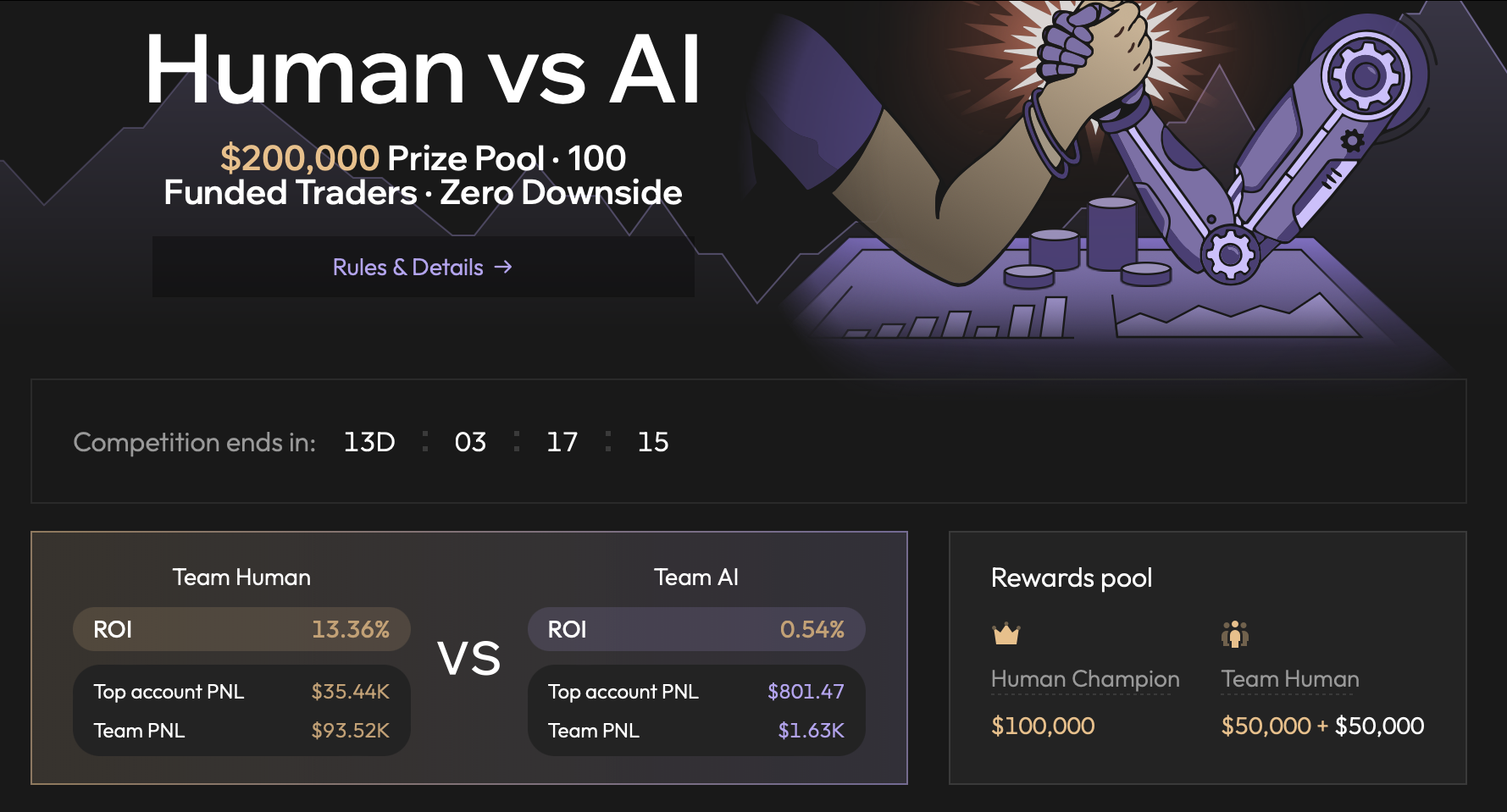

As crypto and AI continue to converge, the role of human traders may also be shifting. The decentralized exchange Aster is running a “human vs AI” trading showdown, funding up to 100 human traders with $10,000 each to compete against top-performing AI agents Dec. 9–23.

Though the competition still has 13 days to go, Team Human was in the lead as of Wednesday, with a return on investment (ROI) of 13.36% compared to Team AI’s ROI of 0.54%.

Magazine: Quantum attacking Bitcoin would be a waste of time: Kevin O’Leary