Written by: Decentralised.co

Compiled by: AididaoJP, Foresight News

In the article "Internet Pricing," we once argued: when metered payments are frictionless, machines will automatically pay. Humans have not fully embraced micropayments because monitoring the metering process consumes energy and mental effort. But machines are different; they only see 1s and 0s. Mental capacity or task switching does not affect their execution ability. If breaking down to sub-cent levels makes the process more efficient, they will do it, unlike humans.

We ended the last article with a question: what happens when an agent messes up? It doesn't matter if the agent's intent is correct. The key point is, it's impossible to supervise the agent step by step.

This leaves us in a dilemma: the new technology fails to inherit a major advantage of the old infrastructure, such as the ability to reverse payments when things go wrong. This is precisely the issue this article will explore. We will discuss what is needed for agents to achieve autonomy, who is building the foundation for this, and why new startups are emerging at the intersection of blockchain payment channels and autonomous agents.

Emerging Standards

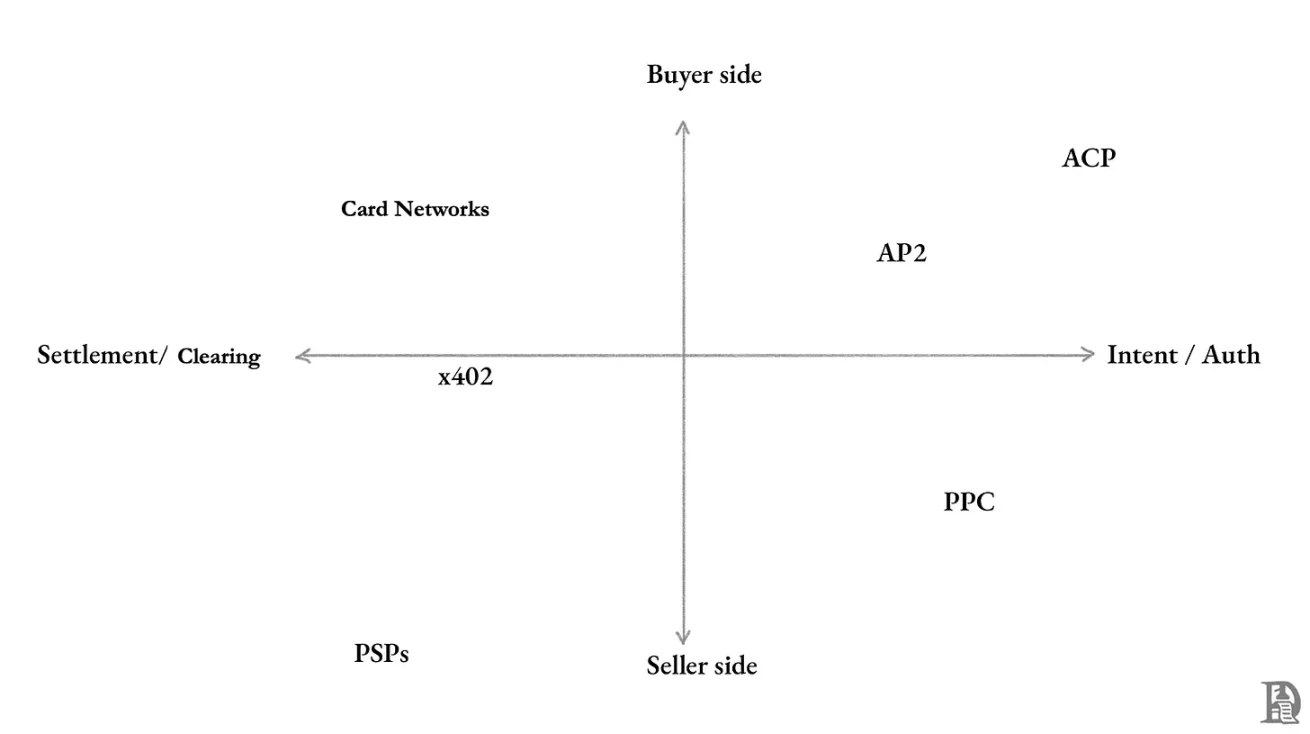

Any commercial activity involves three parties: the buyer, the seller, and the intermediary that enables the transaction. The intermediary can be a platform or marketplace like Amazon, or a card network like Visa that processes payments.

Buyer

Consumer applications are typically responsible for handling funds or transactions and take a cut. But what happens when the consumer is an AI acting on our behalf? Several emerging standards are currently seeking answers.

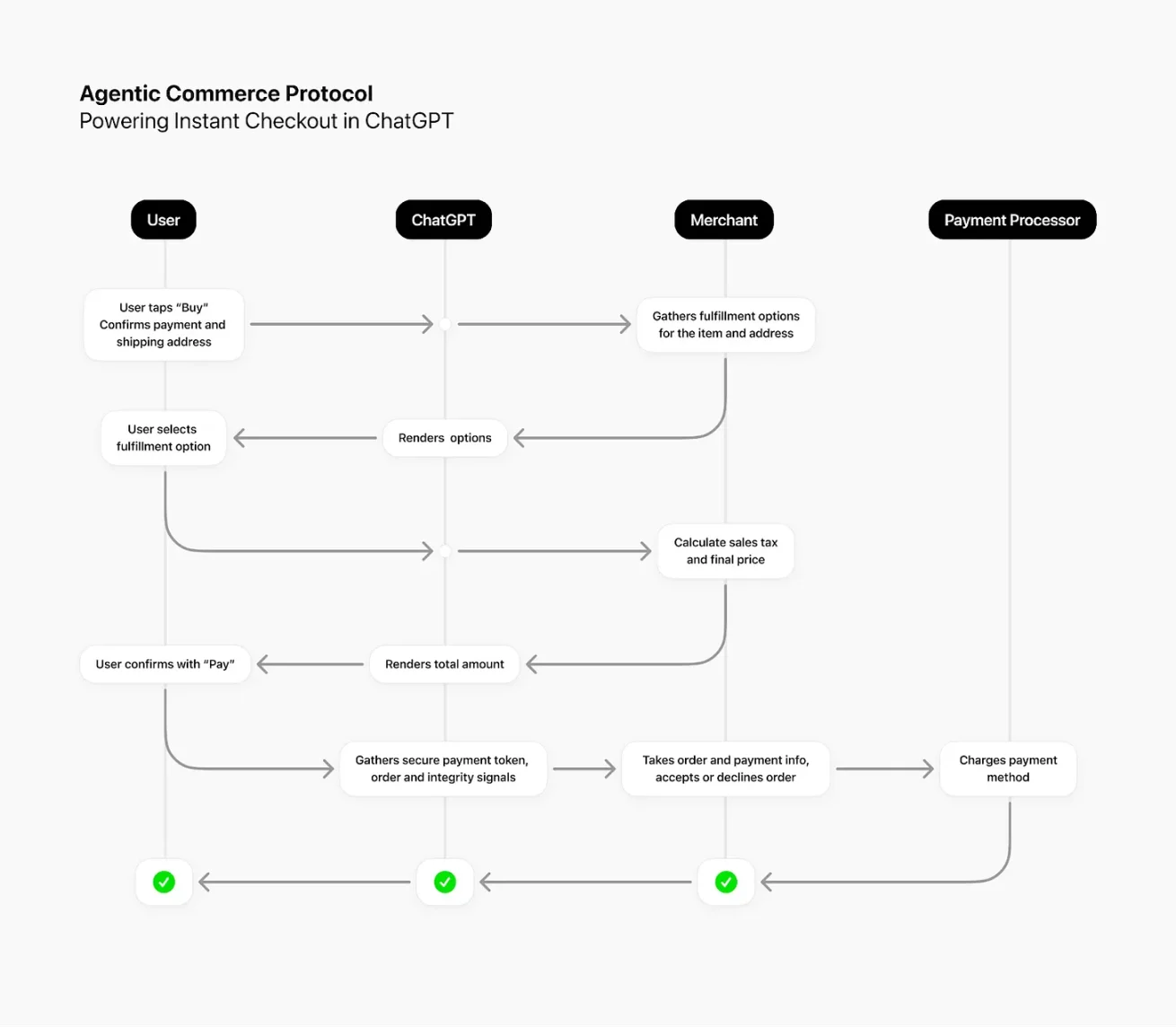

ChatGPT has 700 million active users, all trying to obtain information or services through AI. Although we are not yet directly buying and selling goods through agent interfaces, it is common to use it to "discover" goods. Whether buying running shoes or finding a hotel in El Calafate, I use AI for price comparison. It would be much more convenient to be able to purchase directly within the same interface. This is precisely the purpose of OpenAI's collaboration with Stripe to launch the Autonomous Commercial Protocol (ACP).

Source: OpenAI

This is currently the most direct way for agents to handle funds: the user is in control throughout. After the user places an order, ChatGPT sends the necessary information to the merchant's backend via ACP. The merchant then decides to accept or reject the order, processes the payment through their existing payment service provider, and handles shipping and customer service as usual.

Think of ACP commerce like this: you authorize an intern with a fixed budget, but you have the final say on which product/service to choose, from which merchant, and complete the payment.

OpenAI and Stripe have ACP, while Google has introduced the Agent Payment Protocol (AP2). Before diving into AP2, let's take a step back. Google wants to solve the "interoperability" problem. Currently, AI agents operate in silos: Gemini doesn't talk to Claude, and ChatGPT doesn't know what's happening in Perplexity.

Ideally, when tasks become complex and require collaboration, we want these agents to communicate using a common language. To this end, Google developed A2A (Agent-to-Agent Protocol), allowing different agents to communicate and coordinate.

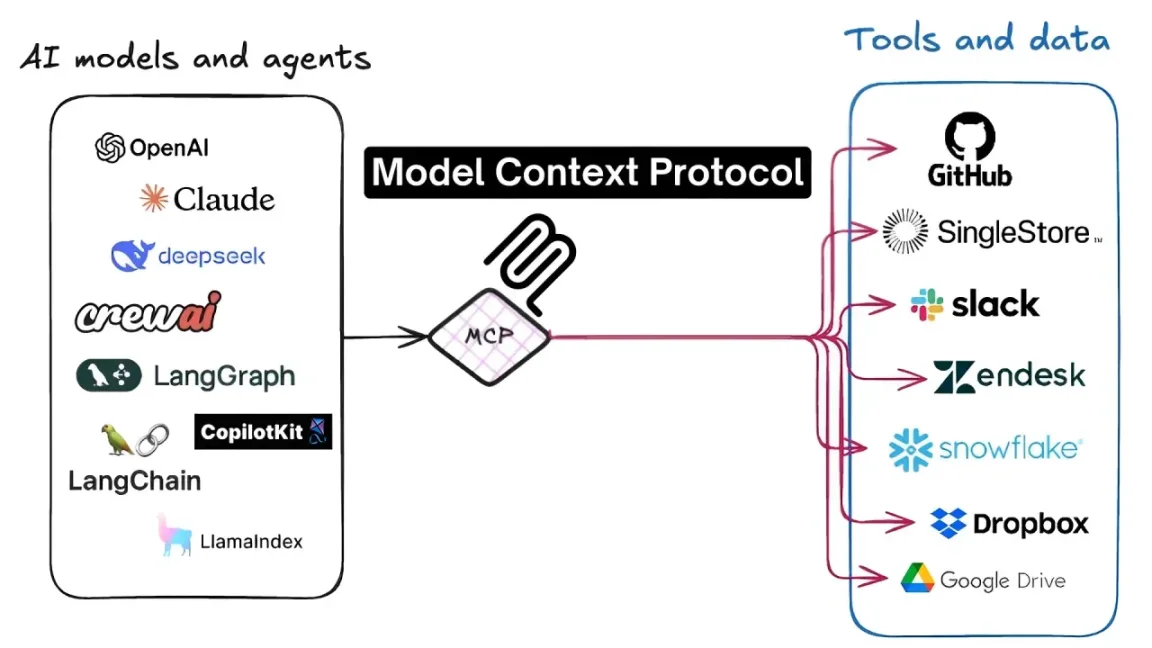

But being able to talk is not enough. Agents also need to be able to use tools, access APIs, and services. The Model Context Protocol (MCP) allows agents to use tools like Google Calendar, Notion, Figma, etc.

Source: Level Up Coding

MCP defines a universal language. As long as they all "speak" MCP, agents can use any tool without additional custom code. The protocol was created by Anthropic, but the specification is open and is being rapidly adopted by various companies. An MCP server is essentially a translation layer placed in front of a company's existing API, exposing the service in a standardized format to any MCP-compatible agent.

Back to AP2, it can be simply understood as: MCP gives agents the ability to obtain data, files, and tools; A2A gives them a voice to talk to each other; and AP2 gives them a wallet, allowing them to spend money safely.

All these protocols place the user at the control center, with agents having limited spending permissions. This solves the distribution and process problems, but none have yet solved: what to do when the agent makes a mistake?

Seller

The story isn't just happening on the buyer's side. New standards are also emerging on the seller's side, focusing on how machines pay for access to APIs, data, and content.

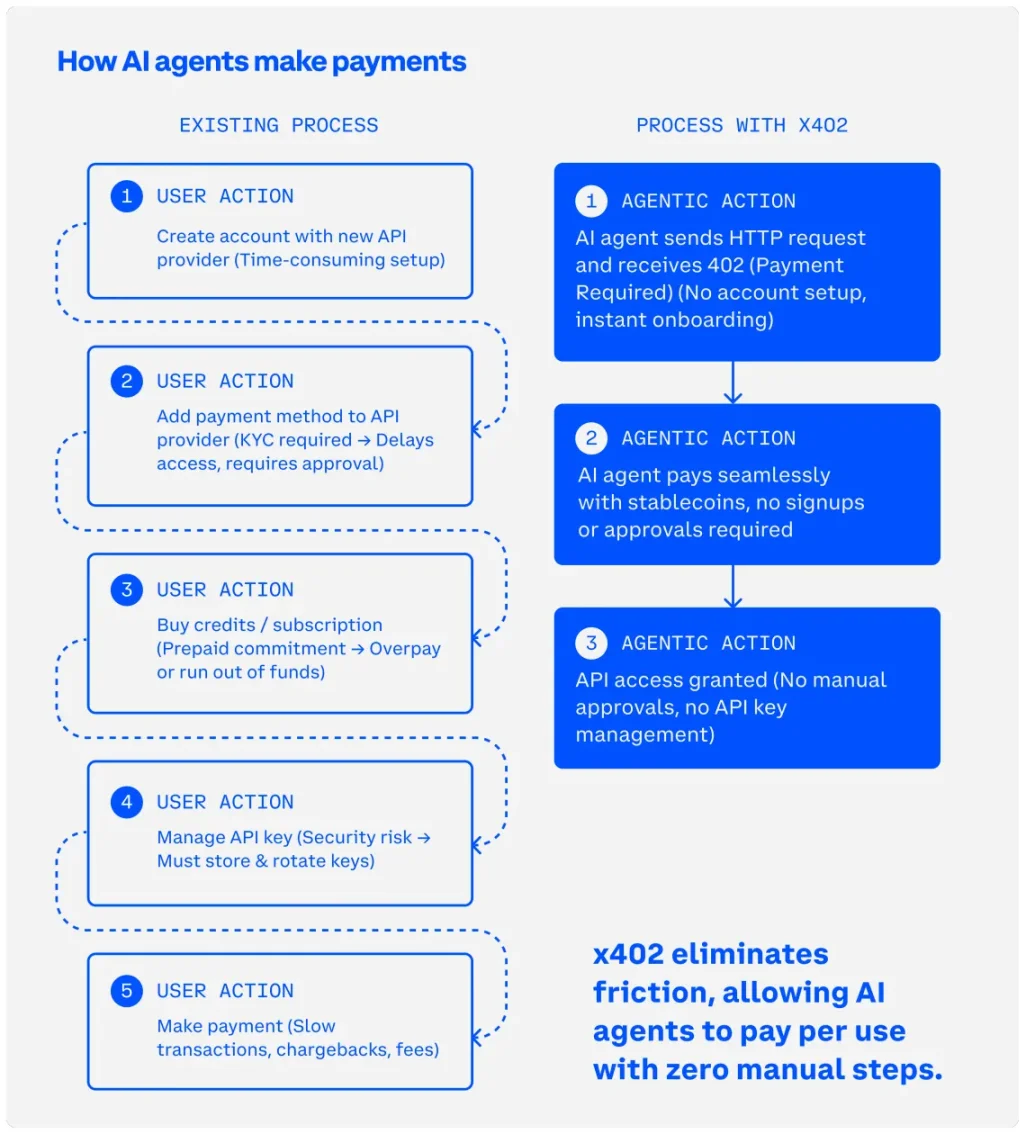

Currently, the most talked about is the x402 standard, an open protocol developed by Coinbase. It revives the HTTP status code 402—"Payment Required"—which was defined as early as 1997 but never used. x402 brings this status code back to life by combining it with stablecoin payments, making micropayments economically viable to settle.

x402 turns HTTP requests into paid requests. Whenever payment is required, the server makes the request. Since the agent has a preset budget, it pays the server and obtains the data within the same flow. This makes "pay-per-request" or "pay-per-call" feasible in machine-to-machine transactions.

With x402, agents can pay precisely for what they need at the moment. For example, spending 2 cents to read a paid article, or paying a fraction of a cent for an API call. Transactions settle on-chain in seconds, without the need to establish long-term relationships.

Source: Coinbase's x402 Paper

Cloudflare has borrowed this concept to build a more specific "Pay for Crawl" system. It also uses HTTP 402 underneath, but the key is Cloudflare's market dominance, with 20% of global web traffic passing through its network, giving it significant influence.

"Pay for Crawl" leverages Cloudflare's edge network to require payment before providing content to AI crawlers. This turns access to content into enforced metering. Publishers are facing plummeting traffic because people no longer click through to websites from search engines but instead read AI-generated summaries. Through this system, publishers can charge AI labs directly each time a crawler accesses their content.

Card networks are also trying to extend existing payment channels to handle agent transactions. Visa has launched an MCP server and an Agent Acceptance Toolkit. Mastercard has a project called "Agent Payments." Both are in early pilot stages, but they are important because Visa and Mastercard already have global distribution networks, issuer relationships, and extensive merchant acceptance networks. The basic idea is: register the agent, set spending controls, and allow the agent to initiate transactions on the existing human credit card payment network.

An Urgent Need to Fill the Trust Gap

All the above standards assume that payments will proceed smoothly and the results will meet expectations. ACP and AP2 involve humans at the checkout stage, providing some security. The x402 variants handle machine-to-machine data access, where risks are typically lower. Card networks extend their familiar protection mechanisms, but at the cost of slow settlement and high fees.

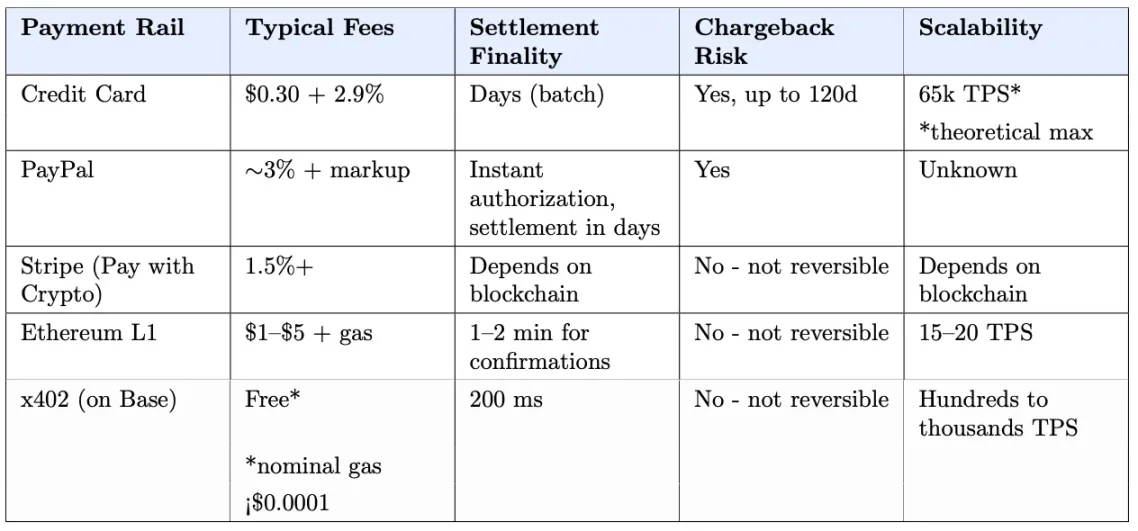

Achieving large-scale micropayments requires speed as the primary goal. Card payment networks take days to settle, and merchants pay a few percent of the transaction amount in fees. Cryptocurrency channels settle in seconds, costing less than a cent. But this efficiency comes with irreversibility; cryptocurrency payments cannot be reversed once completed.

Traditional commerce has built an entire infrastructure around "things that can go wrong." When something goes wrong with a credit card purchase, you have a process to follow: contact the bank, initiate a dispute, the card network investigates and temporarily withholds funds, and finally rules for a refund or supports the merchant. In 2025, there were 261 million disputed transactions, totaling $34 billion.

However, agents running on stablecoin channels have none of these protections.

The problem becomes more complex when agents start collaborating. When hundreds or thousands of multi-agent workflows intertwine, clarifying responsibility can become a nightmare.

Card networks will not take on this risk, at least not under their current profit model. Visa and Mastercard's agent projects still charge standard interchange fees, and settlement still takes days. They could move to instant stablecoin settlement, but that would mean abandoning the dispute handling system that forms the basis of their fees.

The dispute resolution mechanism in traditional finance was not inherent. The first credit card (Diners Club) appeared around 1950, but consumers waited another 24 years to gain the right to dispute transactions. The modern infrastructure we take for granted today was built gradually as problems emerged.

Autonomous agent commerce does not have this much time to waste. API requests already account for 60% of the dynamic HTTP traffic handled by Cloudflare. Bots and automated traffic already account for nearly half of web traffic. ChatGPT's 700 million users can already checkout directly on Etsy through ACP, and Shopify integration is coming soon. The transaction volume already exists, users have the potential need to handle tasks through agents, and it's only a matter of time before agents are used for commercial activities.

Therefore, we face a choice: do we let traditional financial infrastructure continue its slow settlement, or do we consciously build trust infrastructure to match fast blockchain settlement? The former will limit the potential of agents, while the latter is an opportunity and an inevitable extension of the development of autonomous agent commerce.

So, how exactly should it be done?

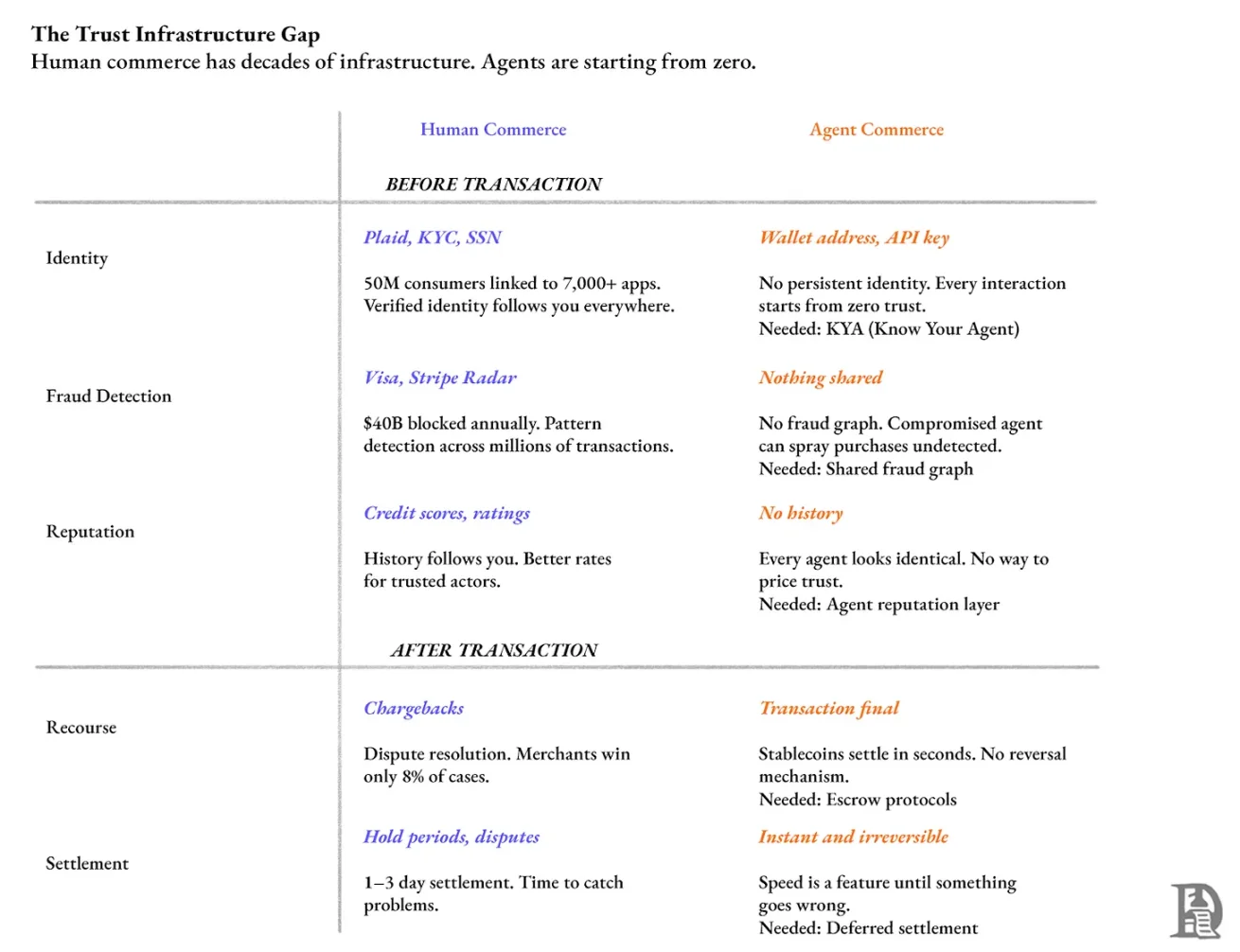

Unsurprisingly, this involves both pre-transaction and post-transaction parts.

Pre-Transaction: Should the agent transaction be allowed?

This depends on three points: identifying the counterparty, fraud detection, and using reputation scores to determine pricing and access permissions.

In the US, Plaid connects nearly half of all bank accounts, processing millions of account verifications daily. When you verify your identity on Venmo, you are using Plaid.

Currently, any agent interacting with APIs, scraping web pages, or initiating payments lacks equivalent identity verification. The server sees only a vague ID (like a wallet address or API key), not knowing who the caller is. Without a universal identity across services, there is no way to accumulate reputation, and every interaction starts from "zero trust."

In 2024, US adults lost approximately $47 billion due to identity fraud.

We need a "Know Your Agent" (KYA) layer, similar to how Plaid provides identity infrastructure for fintech. It should issue persistent and revocable credentials, binding the agent to the human or organization behind it.

Card networks spent decades building systems that can identify suspicious patterns from millions of transactions. They understand normal human consumption behavior and can flag anomalies in real-time. If an agent is compromised and makes unauthorized purchases from multiple merchants, there is currently no shared fraud graph to detect it.

Visa claims that after investing $11 billion in security between 2019-24, its systems prevented $40 billion in fraud attempts. Stripe processes over $1.4 trillion in payments annually and uses this to train its Radar anti-fraud system. During Black Friday and Cyber Monday 2024, Radar prevented 20.9 million fraudulent transactions worth $917 million.

Agent transactions currently lack such a fraud detection layer. When an agent makes an x402 payment, there is no shared system to flag abnormal behavior, such as a surge in spending or abnormal frequency.

Without persistent identity and reputation, every agent interaction starts from zero. Reputation is deeply embedded in human commerce: the ads you see are based on browsing history, your Uber rating affects driver acceptance, and your credit score follows you to every financial institution. The same should be true for agents.

Post-Transaction: What to do if something goes wrong?

Chargebacks are how card networks handle disputes: after a customer disputes a transaction through their bank, funds are withdrawn from the merchant. But this is also often abused. In 2023, chargebacks cost merchants approximately $117.47 billion in losses. For every $1 lost to a chargeback, merchants typically bear an additional $3.75-$4.61 in other costs (including fees, loss of goods, and administrative overhead).

Source: Coinbase's x402 Paper

Merchants win only 8.1% of disputes they actively contest. 84% of customers believe it is easier to initiate a chargeback directly with their bank than to seek a refund from the merchant.

Agent-initiated stablecoin transactions settle in seconds and are currently irreversible. Cloudflare has proposed a delayed settlement extension to x402, allowing a "waiting period" to be set before funds are finally transferred.

Developers are already building prototypes of this infrastructure. At the ETHGlobal Buenos Aires hackathon, a team created Private-Escrow x402. Their escrow scheme is: the buyer pre-funds a smart contract, and when paying, signs a "payment intent" off-chain. A coordinator batches hundreds of such signatures into a single settlement transaction, reducing Gas fees by 28 times.

But this is just a basic component; it still needs to be productized.

Who will build all this?

This reminds me of the era when telecom operators dominated the industry. They owned the billing relationship for every mobile user but missed out on the value created by smartphones. App distribution and mobile advertising created hundreds of billions of dollars in revenue, which could have been captured by the operators.

Card networks now face a similar situation. What Visa and Mastercard built over decades is precisely the trust infrastructure lacking in the autonomous agent economy. But their business model relies entirely on interchange fees, and these fees exist precisely because they control the payment channels. They spent huge sums maintaining this facility, funded by a few percent of the transaction volume. Providing consumer protection for stablecoin transactions would mean subsidizing a competitor's payment channel with their own revenue.

If the card networks don't do it, the next candidates are AI labs like OpenAI, Google, and Anthropic. They all want their agents to be widely used. But operating a centralized identity registry means they must take responsibility when agents misbehave. They don't want to become the arbitration court for your "wrong hotel booking."

They would prefer a third party to build the identity and recourse infrastructure for them to plug into directly, just like they plug into payments or search engines today.

Cloudflare is in a unique position. They already handle massive web traffic, already run bot detection, and their "AI Audit" tool allows publishers to track crawler access. The technical leap from "identifying bots" to "verifying agent identity and reputation" is not huge.

But Cloudflare has always positioned itself as neutral infrastructure. Once it starts issuing trust scores or adjudicating disputes, it becomes more like a regulatory body—that's a different business and implies different responsibilities.

Three Entry Points for Startups

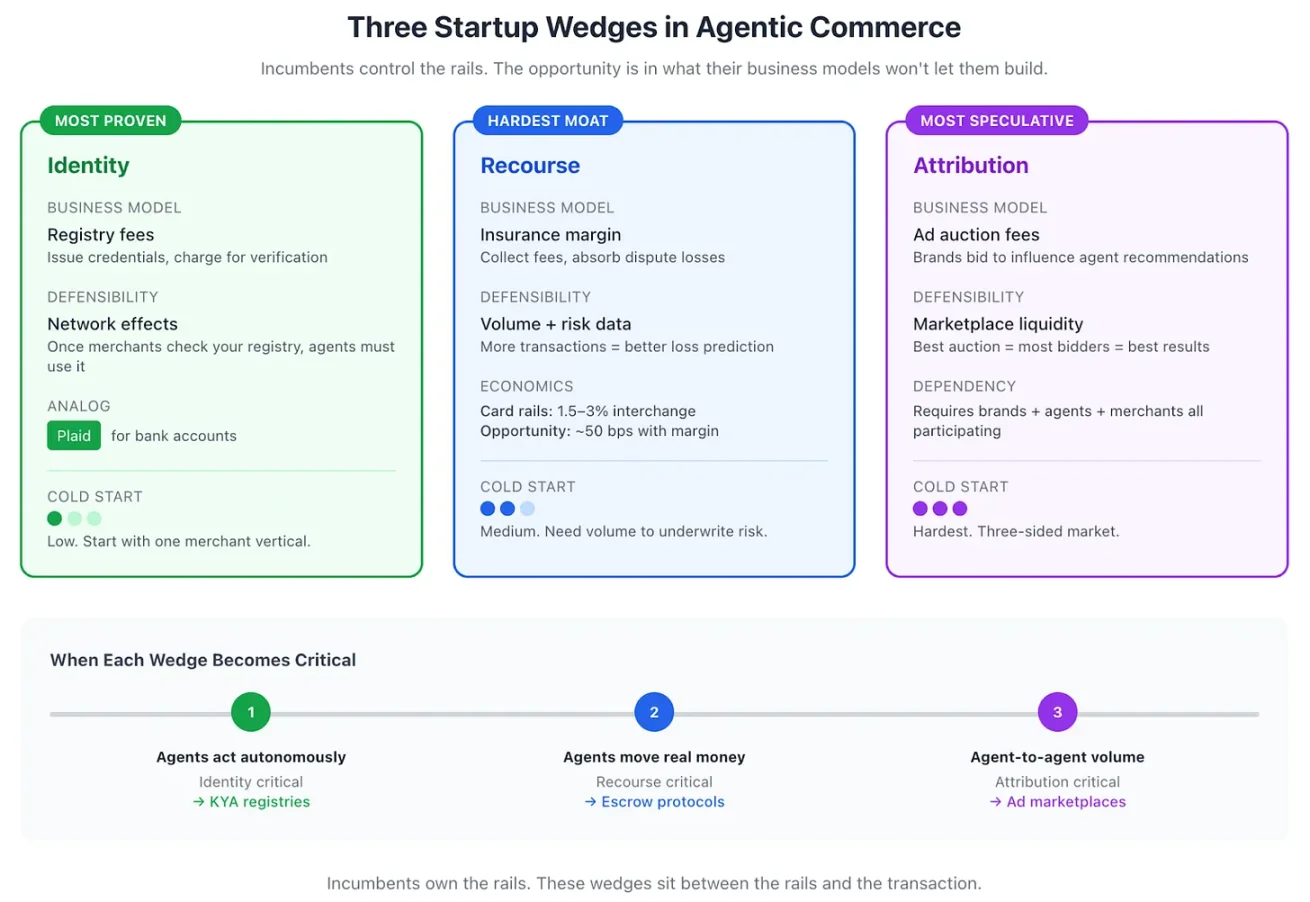

You can't beat OpenAI on model quality, nor can you surpass Cloudflare on traffic. You have to find parts of the tech stack that their business models (at least currently) don't allow them to touch, but where value still exists. I see three entry points: Identity, Recourse, and Attribution.

Agent Identity is the most straightforward. The registry model is proven. Although Plaid is a classic case, it's apt: they did identity verification for bank accounts. A startup could do the same for agents: issue credentials, accumulate reputation, and allow merchants to check reputation scores before accepting payment. Its moat comes from network effects: once enough merchants check through your registry, agents will be forced to maintain a good reputation record.

Recourse Mechanism is harder because it requires taking on risk. Think of it as insurance: charge a small fee per transaction and cover the loss when things go wrong. Scale is key. Card interchange rates are 1.5%-3%, which includes the cost of dispute handling. Stablecoin channel costs are much lower, so a recourse layer could provide comparable protection at a 0.5% fee and still be profitable.

Attribution Mechanism is the most forward-looking but will inevitably emerge. When agents start influencing purchasing decisions, brands will pay to influence the recommended content. Auction mechanisms can be designed. But it has a "cold start" problem, requiring brands, agents, and merchants to participate in a market together for it to work, unlike the first two entry points.

The importance of these three entry points changes with the stage of agent economic development:

-

Identity becomes critical when agents no longer require human approval for each transaction.

-

Recourse is essential when agents start handling real money.

-

Attribution will only start when the volume of transactions between agents is sufficient to support an advertising market.

This leads to the actual development trajectory:

Source—Chart generated using Claude

Startups Will Build Part of the Agent Economy Infrastructure

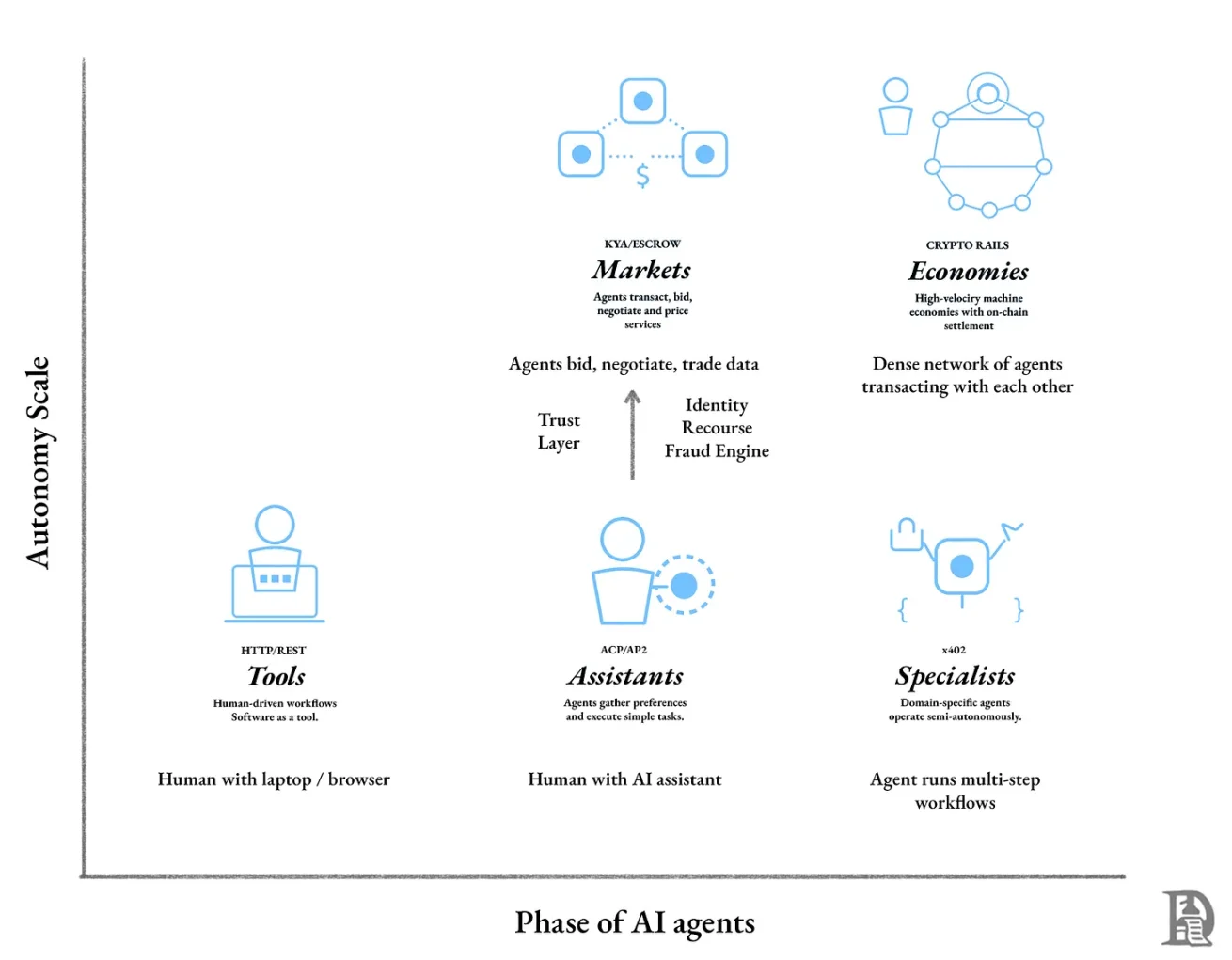

The development of agents can be divided into three stages:

-

As an interaction interface

-

Executing under human supervision

-

Autonomously transacting with each other

We are in the first stage. ChatGPT's Etsy checkout integration is a good example: we browse products in the chat interface (though not exclusively), the agent recommends options, but the human makes the final decision. Trust is entirely borrowed from existing facilities.

This stage belongs to the existing giants because it's a distribution game for争夺 the user entry point. Value accumulates with the players who own the interface where purchase decisions are made.

The second stage is marked by agents gaining more autonomy. Agents no longer just suggest itineraries but directly book flights, rent cars, and reserve hotels. We give goals or constraints, the agent executes, and we accept the results.

At this point, the trust layer becomes indispensable. Without a recourse mechanism, users will not authorize agents; without identity verification, merchants will not accept agent payments.

This is precisely the opportunity for startups. Existing giants may lack sufficient incentive to build trust facilities for stablecoin channels because they already have huge growth potential in the current stage (which they still dominate). OpenAI's revenue this year reached $13 billion. In comparison, Tether's profit in the first ten months of 2025 alone was $10 billion, with even higher annual profit expected.

The identity, recourse, and attribution layers will be built by new companies dedicated to solving the specific problems at the boundary of agent capabilities and user authorization.

The third stage is autonomous agent commerce. Your agent no longer needs to ask for routine decisions; it can negotiate with other agents, bid for computing resources, participate in advertising auctions, and continuously settle thousands of small transactions. Stablecoins, due to the volume, speed, and granularity required for machine-to-machine transactions, will become the default settlement layer.

The competitive focus at this stage will no longer be the best model or the fastest blockchain, but who builds the most trusted infrastructure: the "passport" for agents, the "court" for adjudicating disputes, the "credit system" that allows transactions beyond balances. These institutions for software services will determine which agents can participate in the economy and under what conditions.

Conclusion

We have laid the pipes for agents to "spend money," but we haven't built the mechanisms to verify "whether they should spend." HTTP 402 slept for thirty years and finally woke up because micropayments became feasible. The technical problems are solved. But the trust facilities that underpin human commerce, such as identity verification, fraud detection, and dispute resolution, still lack their agent counterparts. We solved the easy part. It will take time for agents to do business with each other with confidence.