Bitcoin started the week attempting to reclaim the $92,000 level, a move that hints at early signs of recovery after weeks of volatility and uncertainty. This renewed strength arrives at a critical moment for global markets, as investors turn their attention to one event: the upcoming FOMC meeting. According to a new CryptoQuant report by XWIN Research Japan, the central question is whether the Federal Reserve will finally begin cutting interest rates—a decision that could reshape market expectations heading into 2026.

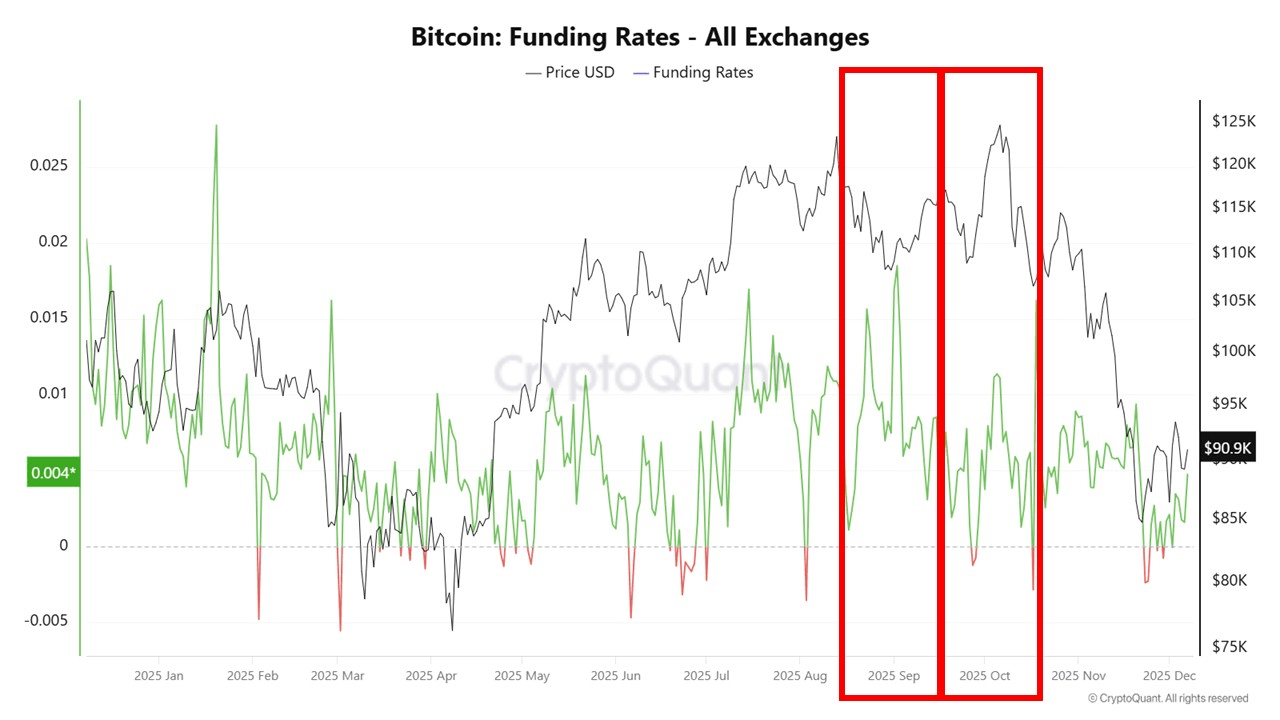

Historical data provides an important context. During the last two rate-cut announcements on September 17 and October 29, Bitcoin followed a strikingly similar pattern. Prices climbed in the days leading up to each meeting, reflecting optimism and speculation.

Immediately after the announcements, the market experienced a brief bounce, only to fall sharply soon after. This behavior highlights a common reaction in macro-driven markets: although rate cuts are usually seen as bullish, they often fuel a “buy the rumor, sell the news” dynamic in the short term as traders lock in profits.

With Bitcoin hovering below major resistance and macro uncertainty rising again, the coming days may determine whether this attempted recovery evolves into momentum—or fades into another corrective swing.

Market Positioning Meets Macro Reality

Rather than simply repeating past rate-cut reactions, the current setup requires placing Bitcoin’s behavior in the broader macroeconomic landscape—a landscape that looks very different from previous cycles. While XWIN Research highlights the historical “up first, down later” pattern around FOMC cuts, the real story lies in how today’s liquidity conditions interact with on-chain signals.

Stablecoin exchange reserves now reflect not just crypto sentiment but the macro backdrop. With the US nearing the end of quantitative tightening and global liquidity subtly improving, rising stablecoin reserves would confirm that investors are preparing to deploy capital into risk assets.

If reserves remain flat or decline, it may indicate hesitation tied to uncertainty over inflation persistence or concerns about policy missteps.

Funding rates, meanwhile, must be interpreted through the lens of a market recalibrating after a 36% correction while still operating in a high-rate environment. Excessive long leverage during a macro turning point—especially if the Fed cuts earlier than expected—creates the perfect setup for volatility spikes.

Neutral or mildly positive funding, however, would suggest traders are not overextended, allowing Bitcoin to absorb macro news more smoothly.

Ultimately, Bitcoin’s reaction to the FOMC will depend on the interplay between improving macro liquidity conditions and the internal positioning of the market. This cycle’s environment is more complex—and potentially more supportive—than prior rate-cut events, making risk-managed positioning more crucial than prediction.