Ethereum saw a bounce back above the $3,000 price market, with bullish sentiment gaining momentum among investors, especially those on centralized exchanges. Even with the market experiencing sideways movements, the overall supply of ETH on crypto exchanges has fallen sharply, hitting unprecedented levels.

Lowest Supply Of Ethereum On Exchanges

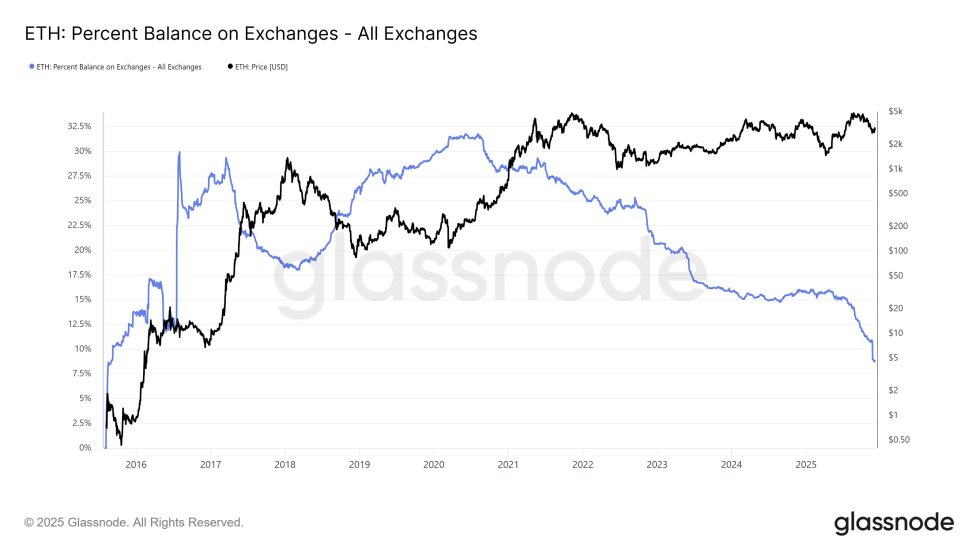

Recent signals from on-chain metrics indicate that the Ethereum market environment is undergoing a quiet yet significant transformation. This unfolding trend is due to the sharp drop in the supply of ETH available on cryptocurrency exchanges.

Related Reading: Ethereum Network Fatigue? Monthly On-Chain Transactions Drops As Activity Slows Down

As reported by Coin Bureau on the social media platform X, ETH supply on centralized exchanges has hit levels not seen in years. With more holders choosing long-term storage, staking, and self-custody over keeping their assets available for trade, this significant supply drain indicates a change in investor behavior.

Data from the ETH Percent Balance on Exchanges metric shows a total of 8.7% of Ethereum supply available on exchanges, marking the lowest level since ETH’s launch in 2015.

As exchange reserves decrease, the structural pressure on ETH’s circulating supply is increasing, which could create a scenario for a more explosive price environment. Coin Bureau stated that several crypto analysts are currently warning that tightening liquidity might trigger a robust rally when demand recovers.

Mid-Size Whale Holders Are Still Existing In The Market

Despite a sharp withdrawal of ETH from exchanges, selling pressure still remains in the market as indicated by the Ethereum Accumulation Heatmap. After examining the metric, Alphractal, an advanced investment and on-chain data analytics platform, uncovered that wallet addresses holding 1,000 ETH to 10,000 ETH, or mid-size whales, are offloading their holdings, signaling weakening sentiment among the group due to ongoing market fluctuations.

According to the metric, these investors carried out heavy distribution just near the price top. The cohort was the one who took advantage of the euphoria to secure profits while others were celebrating at the all-time high.

What’s interesting is that these investors are still selling, mounting heavy bearish pressure on the market, which is likely fueling the current bearish wave. Meanwhile, wallet addresses holding at least 10,000 ETH or mega whale holders continue to be considerably more neutral, with relatively light distribution, demonstrating no panic, no aggressive buying, at least not yet.

Such a trend suggests that supply behavior is not completely aligned with the euphoria of retail investors. These accumulation and distribution patterns are vital to gauge those who are actually driving ETH’s price moves. It also determines those who are quietly heading for the exit, while others are still entering.

At the time of writing, the price of ETH was trading at $3,135, demonstrating a more than 3% rise in the last 24 hours. Bullish sentiment seems to be returning strongly, as evidenced by an over 142% increase in trading volume over the past day.