Author: Felix, PANews

2025 was a milestone year for BNB Chain. Amidst multi-chain competition and the diversion of users and capital, BNB Chain, with its low fees, high throughput, and EVM compatibility, became one of the fastest-growing networks in the Web3 space in 2025; it further solidified its position as a multi-chain infrastructure through dedicated agendas, ecosystem project showcases, and partner interactions at the "2025 Binance Blockchain Week" event.

Looking back at the data, BNB Chain achieved multiple records in 2025: daily active users (DAU) peaked at over 5 million, cumulative DEX trading volume exceeded $2 trillion, stablecoin supply surged to $14 billion, the RWA project ecosystem took initial shape, and Meme coins drove community vitality through viral spread. This year, BNB Chain was not just a "number factory" for trading volume but evolved into an ecosystem integrating DeFi, AI, RWA, and Meme culture, attracting hundreds of millions of users and developers globally.

DEX Daily Active Users Rank First

The BNB Chain ecosystem has expanded from a single chain in 2020 to a multi-layered global network, and data can直观地反映 the real growth of the ecosystem. Currently, BNB Chain's DAU is stable at around 3.7 million, with a peak of 5 million, ranking first among all L1 blockchains, with a market share of 22.6%.

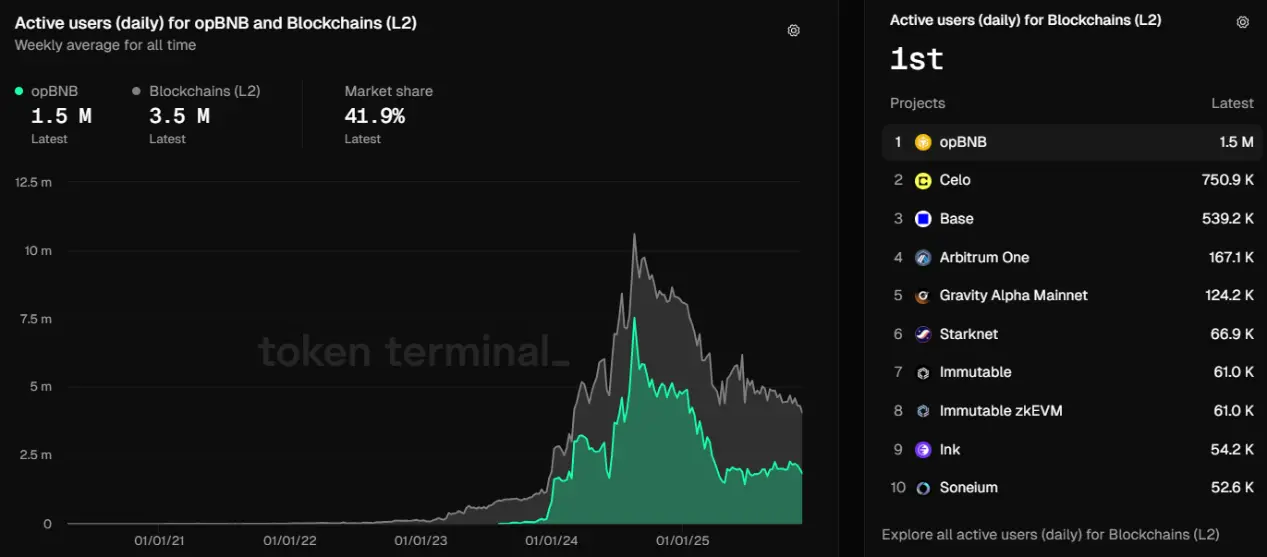

Data source: Token Terminal

opBNB's daily active user count also ranks first among all L2 blockchains, stable at around 1.5 million, with a market share of 41.9%.

Data source: Token Terminal

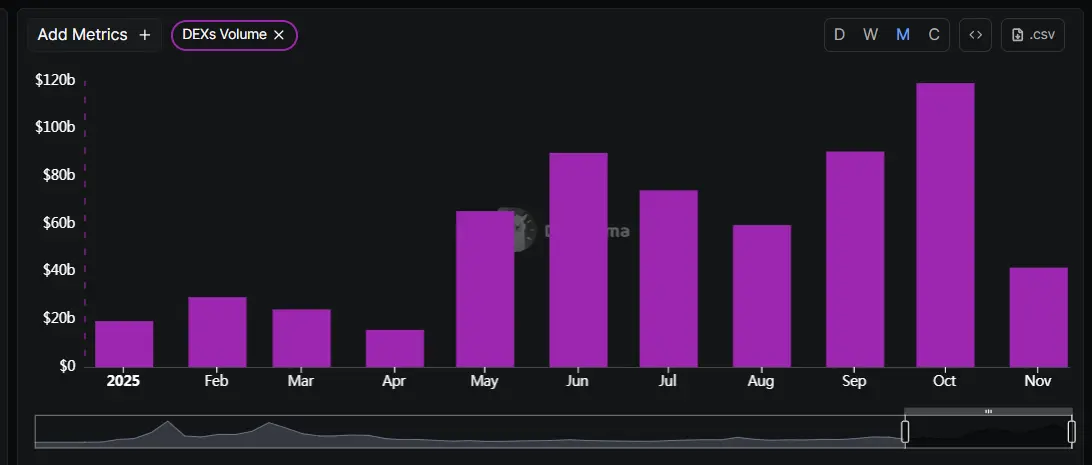

Furthermore, as of December 8th, the cumulative DEX trading volume exceeded $2 trillion, with the trading volume for 2025 year-to-date reaching approximately $680 billion, and the monthly peak hitting $119.2 billion in October.

Data source: DeFiLlama

Meme Narrative as the Year's "Traffic King"

Meme coins, as catalysts for user acquisition, community interaction, and trading frequency, were the undisputed "Traffic King" this year. This year, the BNB Chain Meme ecosystem evolved from an infrastructure explosion (Four.meme) to community狂欢 (CZ effect), transitioning from a "casino" to a "semi-ecosystem," becoming one of the most active narratives on-chain. In the first half of the year, BNB Chain's Meme coin trading volume一度 surpassed that of Solana and Ethereum. In June alone, it accounted for about 45% of the total Meme coin DEX trading volume.

The rise of the Meme ecosystem is inseparable from the solidification of its infrastructure. As a "killer app" for promoting the Meme narrative on BNB Chain, the token launch platform Four.Meme underwent product upgrades, standardized contract addresses (all ending with "4444"), implemented the PancakeSwap V2 liquidity addition scheme, and同步 burned LP tokens. Additionally, the "0 Fee Carnival" activity (zero Gas transfer incentives) reduced minting costs, further triggering a "全民铸币" (nationwide minting) frenzy.

The protagonists of the Meme frenzy were not only English-speaking communities; the waning influence of the Chinese community "stood out" in October,上演了一场压轴戏 (staging a grand finale). The hottest was the self-deprecating representative project $币安人生 (Binance Life), whose name seems to summarize a Binance user's life: from depositing funds to going all-in and finally getting liquidated to zero. $币安人生's market cap surged twice after its October launch, first peaking at around $458 million early in the month, then rising again to over $400 million on October 21st.

Currently, although the Meme frenzy has subsided and most tokens have fallen significantly, this狂欢 has left a浓墨重彩的一笔 (bold and colorful stroke) in the history of cryptocurrency in 2025.

Stablecoin Monthly Active Addresses Steadily Rank First

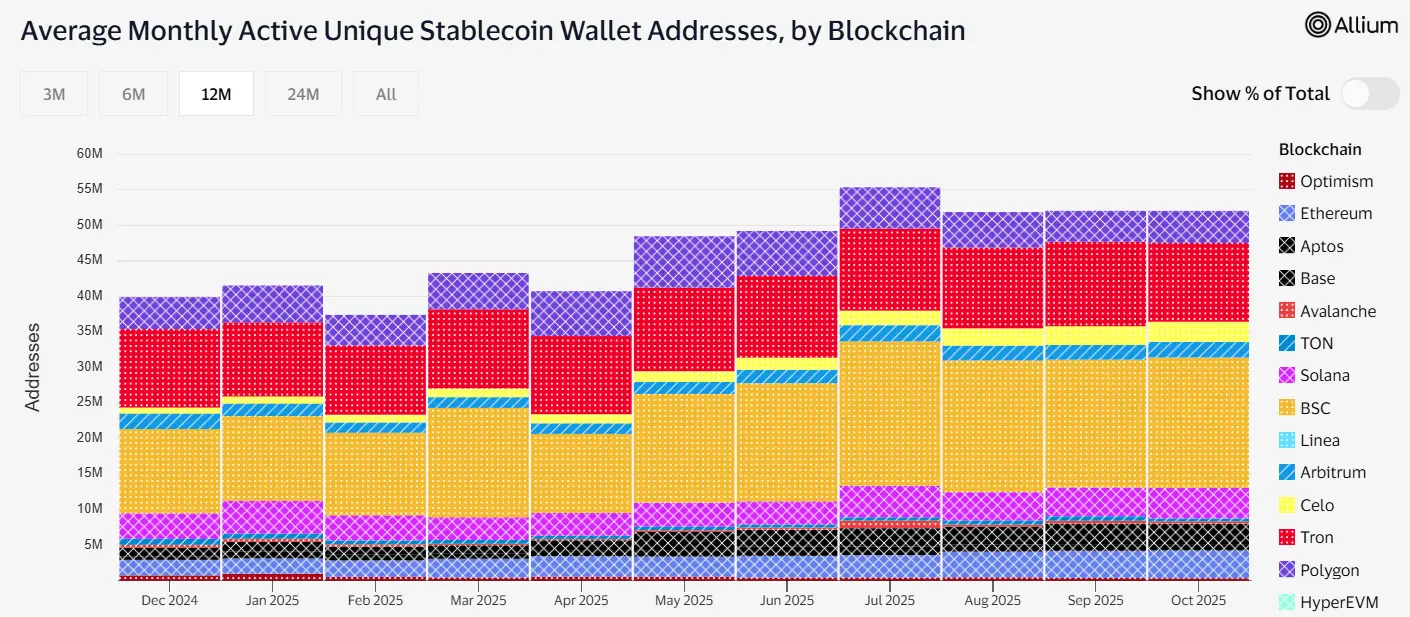

BNB Chain (BSC + opBNB) performed particularly impressively in the stablecoin领域, securing a spot among the top three blockchains in the stablecoin space凭借 low costs, deep integration with the Binance ecosystem, and a series of incentive activities.

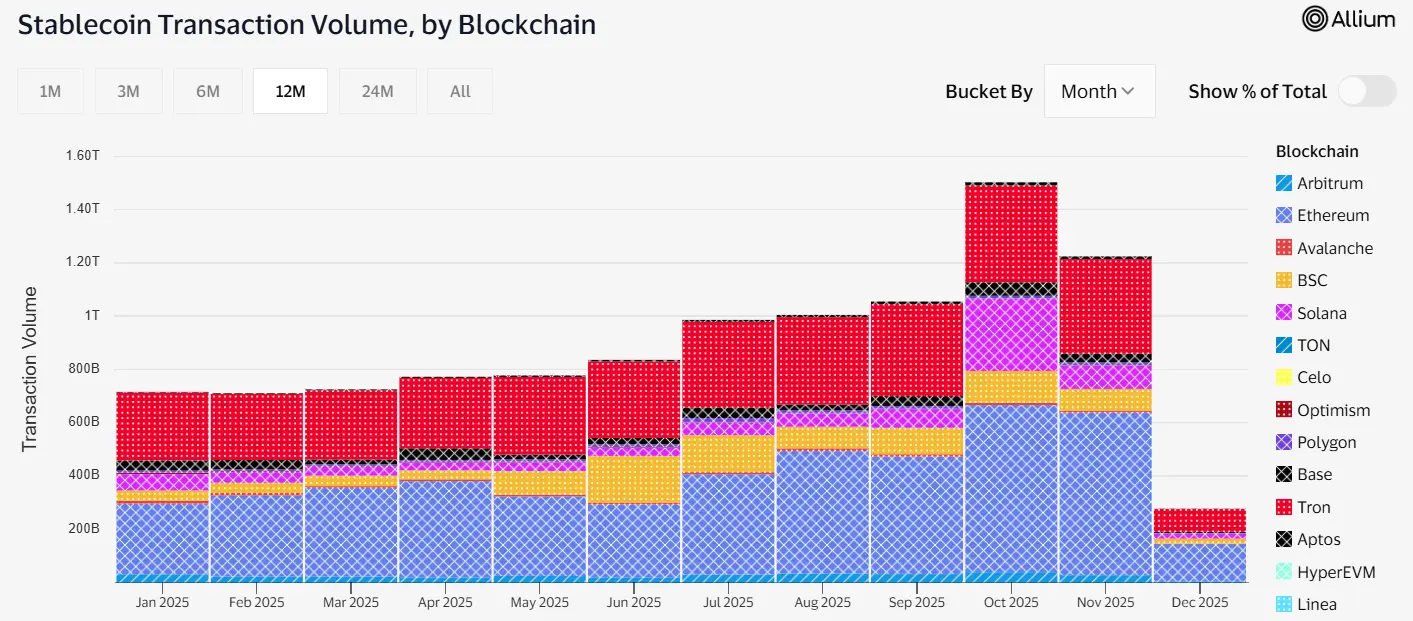

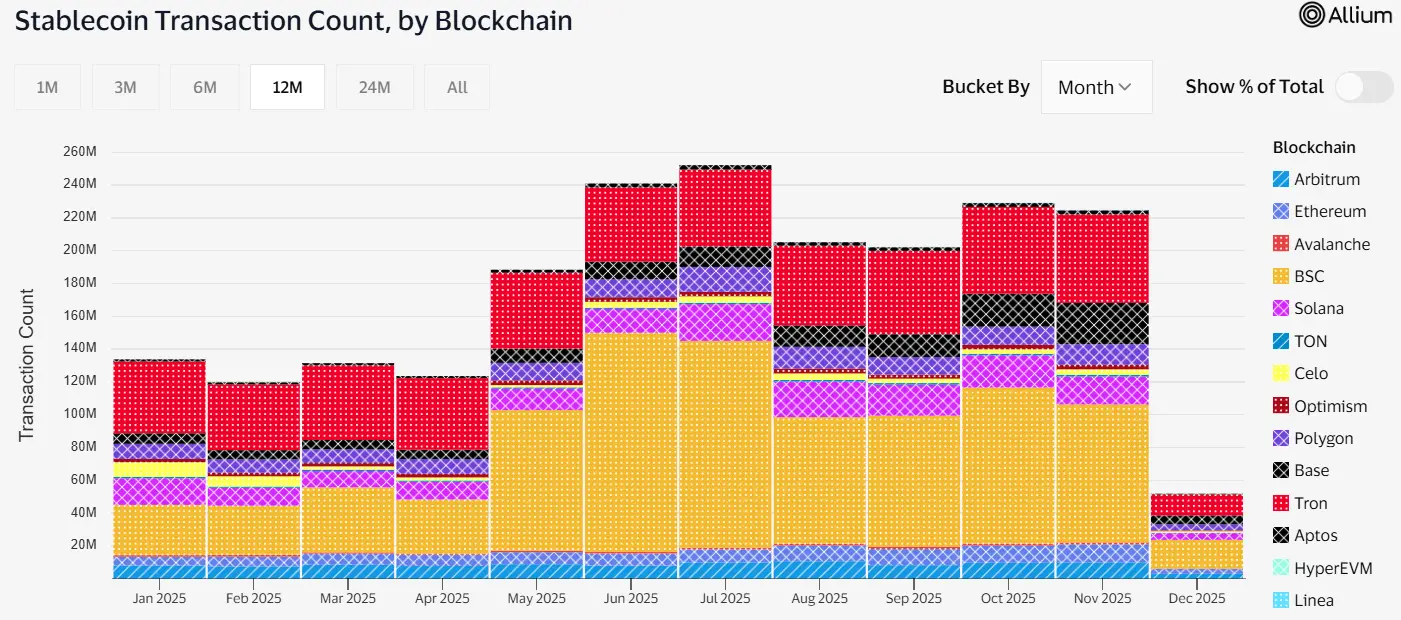

As of December 6th, the total stablecoin circulation on BNB Chain was approximately $14 billion, with the annual supply growing by about 102.9% (from about $6.9 billion at the beginning of the year); the total trading volume reached about $953.8 billion, with a monthly average trading volume from January to November of about $85 billion; the number of transactions has ranked first among all blockchains since May; and the monthly active address count has steadily ranked first among all blockchains this year.

Year-to-date stablecoin supply; Data source: Artemis Terminal

Monthly trading volume; Data source: Visa Onchain Analytics

Monthly transaction count; Data source: Visa Onchain Analytics

Monthly active address count; Data source: Visa Onchain Analytics

The growth in the stablecoin领域 was得益于 the construction of the BNB Chain network itself. First was the "0 Gas Fee Carnival" activity, which was extended multiple times in 2025, covering multiple coins like USDT, USDC, USD1, directly stimulating stablecoin transfers, withdrawals, and bridging, and was also a key reason for the inflow of retail and institutional funds.

Secondly, BNB Chain underwent 3 major technical upgrades in 2025 (primarily in the form of hard forks). These upgrades focused on improving network scalability, transaction speed, and security. The Maxwell upgrade implemented on June 30th shortened the BSC block time from 1.5 seconds to 0.75 seconds, achieving "sub-second" confirmation, with the median Gas fee dropping to $0.01 per transaction, and network efficiency improving by 20%.

Furthermore, deep integration with communities and institutions (like World Liberty Financial) has also shifted BNB Chain from a "trading chain" to a "stablecoin payment hub".

RWA Development Becomes One of the Mainstream Institutional Battlefields

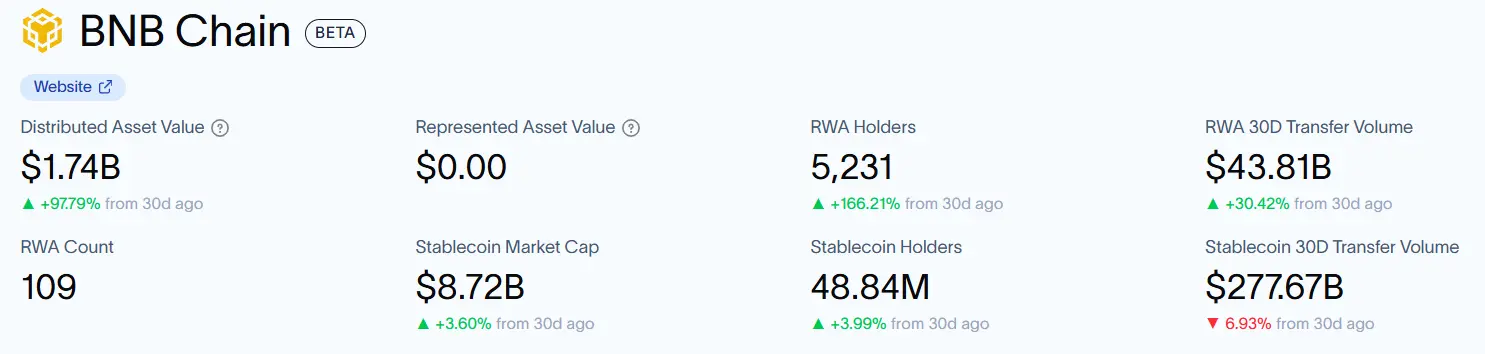

In 2025, BNB Chain became a leading platform in the RWA tokenization领域 through technical upgrades and ecosystem integration. As of December 8th, its total RWA market capitalization had reached $1.74 billion, accounting for approximately 9.46% of the total RWA market; there are over 100 projects; the number of holders has grown significantly since the beginning of the year, reaching 5,231.

TVL in November broke through $1.005 billion, a monthly increase of 55.1%, and a quarter-on-quarter surge of 1,510%, growing from $75 million to $1.208 billion, the fastest growth rate in the industry; among which USYC reached $903 million and the CASH+ money fund规模 reached $712 million, forming a dual-engine growth.

Data source: Rwa.xyz

The biggest factor promoting BNB Chain's rapid rise in the RWA tokenization领域 is its provision of a one-stop solution, including compliant issuance (KYC/AML tools), secondary liquidity (integration with DEXs like PancakeSwap), and DeFi utility (lending), reducing cross-chain friction.

Additionally, dedicated RWA incentive programs have also been instrumental. BNB Chain established an initial $50 million exclusive RWA incentive fund in January this year, providing personalized support for RWA projects building on or migrating to BNB Chain, including TVL incentives, liquidity subsidies, compliance guidance, etc., becoming the starting point for the全年 RWA爆发 (year-long RWA explosion).

Driven by various factors, positive news kept coming for RWA. First, the xStocks alliance, a joint effort by Kraken and Backed Finance, officially launched the first batch of 60+ tokenized U.S. stocks and ETFs on BNB Chain in July,首次 allowing ordinary users to trade traditional stocks on-chain 24/7. Subsequently, Ondo Finance's "Global Markets" landed on BNB Chain in October,迅速突破 (quickly exceeding) 100 types of tokenized assets, further bringing traditional assets like stocks, ETFs, and commodities into DeFi.

Most notably, on November 14th, BlackRock's BUIDL fund went live on BNB Chain through the security token platform Securitize and the cross-chain protocol Wormhole. This marks the first time the flagship RWA product of the world's largest asset management company has truly landed on BNB Chain. Furthermore, CMB International and Circle also partnered with BNB Chain respectively. CMB International tokenized its $3.8 billion USD money market fund as CMBMINT and CMBIMINT onto BNB Chain, while Circle deployed its tokenized money market fund USYC to BNB Chain. The launch of these assets marks BNB Chain's emergence as one of the mainstream institutional battlefields for RWA.

Aster Rises Rapidly, Perp Gradually Matures

Although Hyperliquid and others still dominate the Perp market, BNB Chain achieved doubled growth this year through flagship projects like Aster. Data shows that as of December 8th, BNB Chain's Perp monthly trading volume基本呈逐月递增模式 (basically showed a month-on-month increasing pattern), peaking in October at approximately $22.483 billion, with its share of the global Perp market significantly increasing from about 1% at the beginning of the year to about 2.05%. Perp became the third largest narrative after Meme and stablecoins.

Data source: DeFiLlama

Multiple protocols focused on perpetual trading emerged on BNB Chain in 2025, with popular projects including Aster, MYX Finance, etc. Aster, as the flagship Perp project on BNB Chain, supports multi-chain unified liquidity, offering hidden orders, stock Perps, and extremely high leverage (up to 1001x). CZ also publicly purchased ASTER,推动其快速崛起 (fueling its rapid rise).

Outlook

2025 was an important year for BNB Chain's transition from high-speed growth to "ecological deepening."凭借 high performance, low fees, and a large user base, it formed a strong barrier to entry, achieved blossoming results in areas like Meme, stablecoins, and RWA, and established its position as a Web3 infrastructure.

However, challenges remain for BNB Chain. It needs to shift from "short-term traffic" to "long-term value," and also face competition between blockchains and macro uncertainty risks. How BNB Chain will better prove that it is more than just a chain, bring the next billion users on-chain, and become the global engine of Web3 remains to be seen.