Bitcoin’s (BTC) price action remained underwhelming this week after another failed attempt to reclaim the monthly volume-weighted average price (VWAP), with BTC consolidating near $90,000 following the Federal Reserve’s 0.25% interest rate cut. The market continued to reject any meaningful push above $93,000, thereby limiting bullish momentum.

Key takeaways:

One Bitcoin analyst said that liquidity contraction is suppressing Bitcoin’s upside, reducing demand relative to sell pressure.

$94,000 to $98,000 remained the critical liquidity pocket, but BTC must avoid forming a bearish break of structure below $88,000.

Liquidity compression dictates Bitcoin’s market behavior

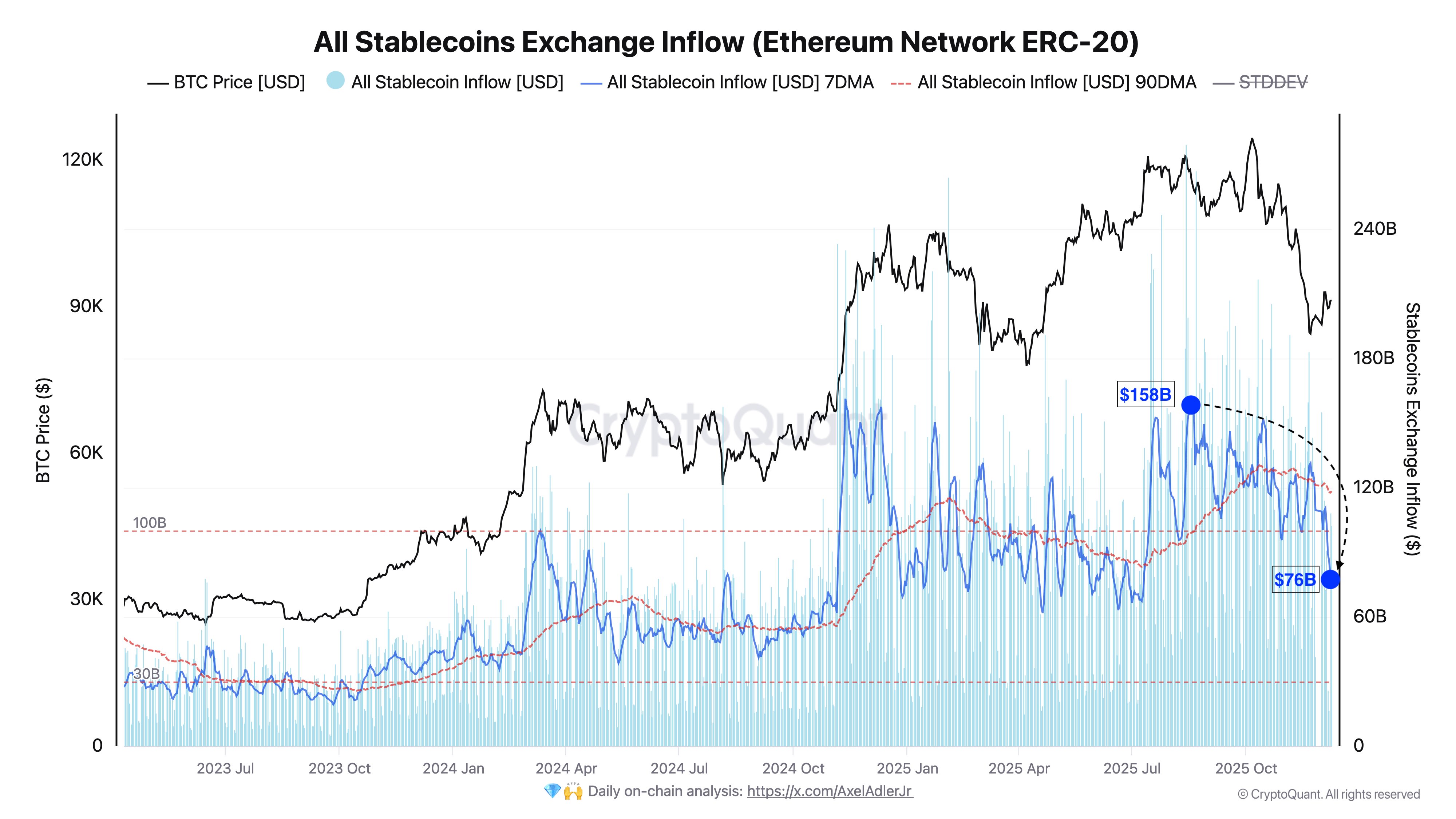

According to crypto analyst Darkfost, Bitcoin’s struggle has little to do with sentiment swings and more to do with declining liquidity, specifically from stablecoins. Stablecoin inflows onto exchanges offer one of the most reliable signals of incoming capital, and right now that signal is flashing red.

The data showed a significant liquidity contraction: ERC-20 stablecoin inflows have declined from $158 billion in August to approximately $76 billion this month, representing a nearly 50% drop. Even the longer-term 90-day average has slipped from $130 billion to $118 billion, confirming that the trend is not temporary but structurally deteriorating.

This decline translated directly into weaker buying power. Darkfost noted that recent rebounds are not driven by strong accumulation but by periods of reduced sell pressure, meaning the market lacks the inflows needed to sustain higher highs or defend key support levels. Until fresh liquidity returns, Bitcoin’s rallies are likely to remain shallow.

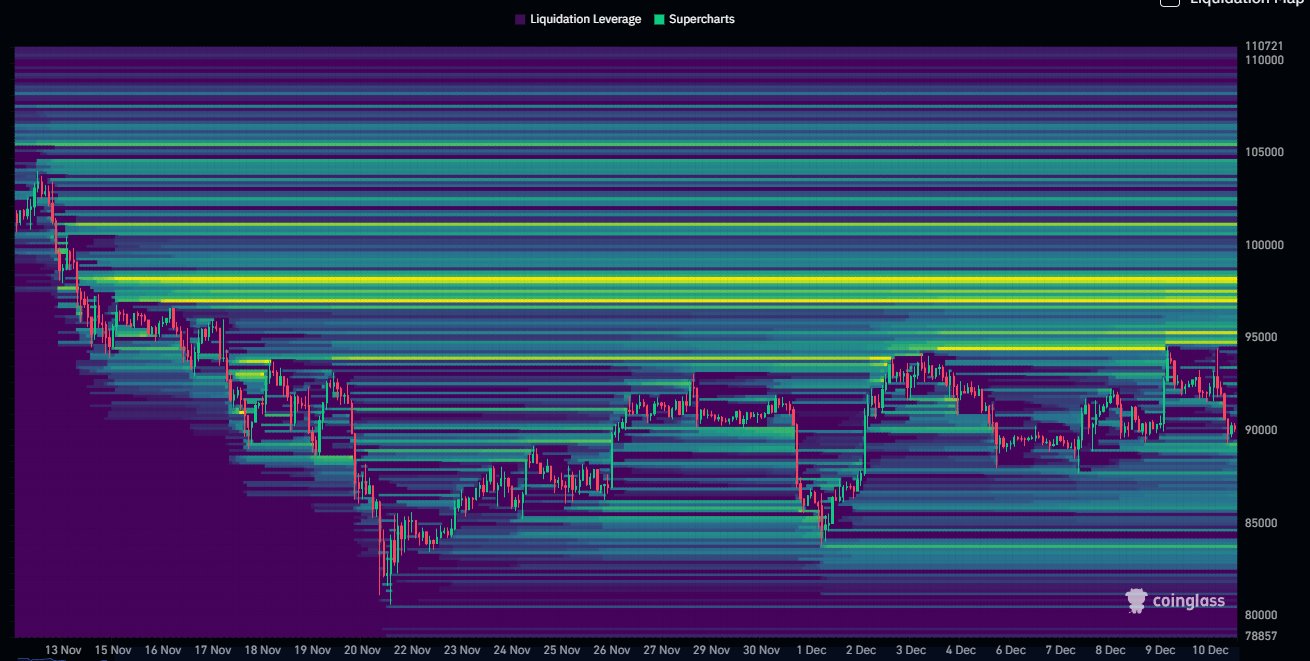

Meanwhile, trader DaanCrypto added that the broader liquidity map still indicated the $97,000–$98,000 region as the next significant magnet for price. But BTC has repeatedly failed to break $94,000, the first barrier that must be overtaken for volatility expansion.

Without that confirmation, the market remains vulnerable to sharp range reversions that continue to trap both longs and shorts.

Related: Prediction markets bet Bitcoin won’t reach $100K before year’s end

BTC nears key breakdown threshold near $90,000

From a structural standpoint, Bitcoin has now failed three consecutive attempts to break the $93,000 level. The latest rejection formed a clean swing failure pattern (SFP) after the FOMC meeting, signaling exhaustion and reinforcing the weakness in trend continuation.

BTC is also nearing confirmation of a bearish rising wedge, which becomes active if the price falls below $88,000 and forms a bearish break of structure (BOS). A breakdown would expose an external liquidity sweep around $84,000, with deeper downside potential toward the $80,600 quarterly lows, a level that aligns with prior inefficiencies on higher-timeframe charts.

Still, bullish traders such as Captain Fabik maintained that BTC is undergoing deliberate shakeouts designed to remove weak hands. For a bullish reclaim, BTC must secure a weekly close above $90,000 and ideally near $93,000, giving bulls the structural foundation required to attack the $96,000 breakout zone, where a momentum expansion could finally unfold.

Related: Bitcoin due 2026 bottom as exchange volumes grind lower: Analysis

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.