Bitcoin’s price is gradually picking up pace following a broader market recovery, allowing the largest cryptocurrency asset to revisit the $92,000 mark on Wednesday. Even though the price is showing strength, key investors are currently moving in the opposite direction of the trend, raising questions about the stability of the recent bounce.

Whales Slams The Brakes On Bullish Bitcoin Bets

Just as the price of Bitcoin staged a slight recovery, the derivatives market has shifted once again as investors make a sudden strategic retreat. On-chain metrics indicate that large BTC holders, also known as whale investors, are stepping back from their bullish positions, a clear sign of growing bearish sentiment.

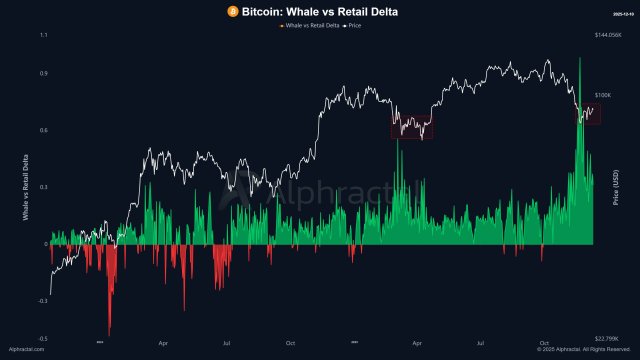

After navigating the key Bitcoin whale vs. Retail Delta metric, Joao Wedson, an author and founder of the Alphractal analytics platform, disclosed that whales have closed their longs. This strategic pullback or shift in sentiment comes after a heavy positioning to the long side by the cohort.

While the retreat marks a notable change in market sentiment, it also suggests that large investors may be locking in profits or preparing for a potential deeper decline in BTC’s price. Wedson highlighted that while large players are currently starting to take some short positions again, retail investors are moving against them, indicating a clear disparity in sentiment between the two groups.

Given that whale behavior has historically served as a leading indication for broader price action, this abrupt reversal raises further concerns about Bitcoin’s short-term trajectory. Following an exuberant surge, there are also concerns about whether the market is getting ready for a cooling phase.

The expert stated that the pattern of this metric against price actions looks somewhat similar to what was observed in February and April 2025. In other words, the price of BTC moving sideways longer than what most traders are anticipating is highly likely at this point.

Traders Calling For A BTC Rally

Overall, market sentiment appears to have recovered as Bitcoin traders become greedy, calling for more upward moves. According to a post from Santiment, a leading on-chain data analytics platform, BTC experienced a much-needed rebound back to the $94,600 price mark on Wednesday, which reinvigorated traders.

Interestingly, the brief bounce caused investors to Fear Of Missing Out (FOMO) back in and look forward to the price of BTC going higher. Santiment’s social data, harvesting X, Reddit, Telegram, and other data, shows that calls for higher and above have increased dramatically.

High bars with blue shades indicate calls for lower or below, which is indicative of Fear Uncertainty and Doubt (FUD). It is worth noting that prices often rise as retailers offload their holdings.

Meanwhile, high bars with red shades represent calls for higher or above, signaling FOMO. When calls for higher moves increase, prices usually correct as retailers attempt to acquire more BTC on the way up. During these kinds of occasions, it is crucial to know that markets move in the opposite direction to the behavior of small traders.