Unusual activity has been detected in Dogecoin (DOGE) on-chain data—a key indicator that previously signaled trend reversals has recently surged significantly. As the price once again stabilizes and rebounds near a critical support level, the market is left wondering:

Is DOGE about to start a new upward trend?

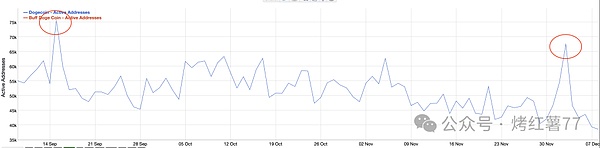

According to data, on December 3, the number of daily active addresses (DAA) for Dogecoin surged to 67,511, marking the second-highest level in nearly three months. It is worth noting that when this indicator peaked on September 15 this year, the price of DOGE was hitting a local high of $0.30, after which it entered a correction. Historical data shows that a sharp increase in DAA is often accompanied by intense battles between bulls and bears in high price ranges.

Currently, DOGE has retraced about 50% from its high, and the recent rise in active addresses may indicate that the market is re-entering a dense trading zone at the current level. Meanwhile, DOGE has risen 3.5% in the past 24 hours and is now trading at $0.14. This price level has been validated as a key support recently, having successfully halted declines and rebounded three times.

Accompanying the price increase, DOGE's trading volume has doubled, showing clear signs of buying activity. The combination of increased on-chain activity and amplified trading volume—could this be a signal of a trend reversal?

Key Technical Levels and Outlook

If DOGE can hold the $0.14 support and further break through the $0.16 resistance, it could confirm a short-term trend reversal, breaking the recent downward structure. After a breakout, the first target could be near the 200-day Exponential Moving Average (EMA), a level typically associated with strong technical significance and trading density.

If the medium-term trend reverses, DOGE may challenge the highs seen in September this year, which also corresponds to the period of recent peak active addresses.

Macro Environment and Market Opportunities

This week's Federal Reserve interest rate meeting will be a key variable affecting market sentiment. If signals of interest rate cuts are released, it could inject liquidity expectations into the cryptocurrency market, helping asset prices rebound toward recent highs. Under the dual influence of macro trends and on-chain data, whether Dogecoin can sustain a rebound is worth close attention.

Note: An increase in on-chain active addresses often reflects rising user participation and can serve as a reference for sentiment and network health. However, investment decisions should still consider technical patterns, market environment, and risk management.