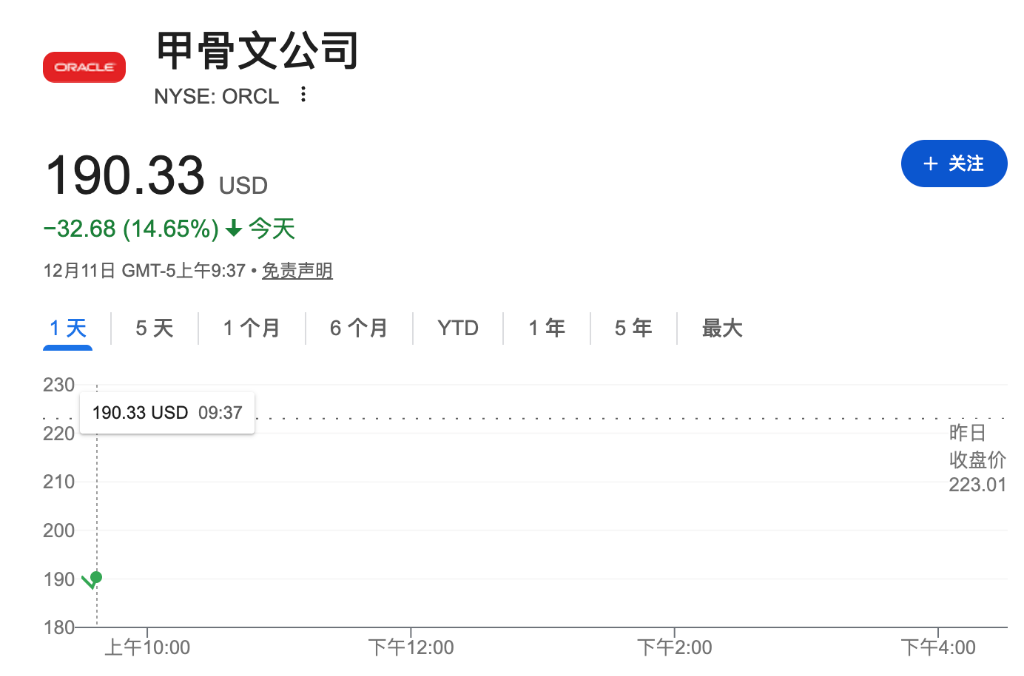

Due to market concerns over Oracle Corporation's plans to heavily invest in artificial intelligence infrastructure, leading to a broad sell-off of risk assets, US stocks declined.

On December 11, US stocks were mixed, European stocks varied, Asian stocks gave up early gains, with most markets moving lower. US Treasury prices rose, and the US dollar saw a slight rebound. Commodities were mixed, with silver and copper rising, while gold and crude oil fell. Cryptocurrencies were under pressure, with Bitcoin briefly falling below $90,000.

Panmure Liberum strategist Susana Cruz said:

"Market caution regarding AI-related spending has significantly increased, contrasting sharply with the situation in mid-2025, when any hint of increased capital expenditure would trigger market excitement. Oracle Corporation has been the weakest link in this chain of events, primarily because a large portion of its investments are debt-financed."

Core market movements are as follows:

- The S&P 500 opened 25.38 points lower, down 0.37%, at 6,861.30 points; the Dow Jones Industrial Average opened 25.15 points higher, up 0.05%, at 48,082.90 points; the Nasdaq Composite opened 144.94 points lower, down 0.61%, at 23,509.22 points.

- Germany's DAX 30 index opened down 0.10%, the UK's FTSE 100 opened down 0.10%, France's CAC 40 opened up 0.21%,

The Euro Stoxx 50 index opened down 0.03%.- Japan's Nikkei 225 index closed down 0.9% at 50,148.82 points, Japan's TOPIX index closed down 0.9%, South Korea's KOSPI closed down 0.66% at 4,107.77 points.

- The 10-year US Treasury yield fell 1 basis point to 4.14%.

- The US Dollar Index was largely flat, the euro rose 0.2% against the dollar to $1.1715.

- Spot gold fell 0.3% to $4,215.05 per ounce, spot silver extended gains to 1%, now at $62.541 per ounce, London copper futures rose over 0.5% to $11,618 per ton, Brent crude fell 0.7% to $61.51 per barrel.

- Bitcoin fell 2.3% to $90,224.89, Ethereum fell 4.1% to $3,204.4.

Oracle's weaker-than-expected earnings report ignited market concerns about an AI bubble, leading to a decline in tech stocks. Earlier, the optimistic market sentiment reversed after overnight gains. On one hand, positive factors such as the Fed's interest rate cut, the initiation of a $40 billion monthly Treasury purchase program (seen by the market as "stealth QE"), and dovish remarks had been fully digested. On the other hand, Oracle's sharp post-market decline due to missed revenue expectations, and the performance pressure it exposed as a key AI player, sparked worries about the return on investment in the AI sector.

According to Wall Street News, the market had expected a "hawkish rate cut" from the Fed, but the actual results showed no additional dissenters, no higher dot plot, and the anticipated strong stance from Chairman Powell did not materialize. Wall Street analysts expect the actual rate cuts next year could exceed the 25 basis points indicated by the dot plot. Leadership changes and policy uncertainty are potential drivers of market volatility in 2026.

Oracle's stock plunged 16% after hours. According to Wall Street News, the company reported its Q2 FY2026 results after the market closed on Wednesday, with both revenue and cloud business income falling short of analyst expectations. Quarterly free cash flow (FCF) was -$10 billion, and annual capital expenditures are expected to be approximately $15 billion higher than previously anticipated.

Emarketer analyst Jacob Bourne stated, Against the backdrop of ongoing uncertainty in AI spending prospects, Oracle is facing increasing scrutiny due to its debt-driven data center expansion and customer concentration risks. This revenue miss is likely to heighten concerns among already cautious investors regarding its OpenAI partnership and aggressive AI spending strategy.

Alberto Torchio, portfolio manager at Kairos Partners, said:

"Oracle's impact even surpassed the Fed's. That says it all, because we've consistently seen highly concentrated markets, with the AI theme leading the way. This doesn't mean AI is obsolete or in a bubble, but we need to look at this issue from a broader perspective."

As risk assets like global stocks fell broadly, macro risk-off sentiment dominated the market, causing oil prices to give up early gains. Previously, concerns over oil supply risks and escalating geopolitical conflicts, triggered by the US seizure of a sanctioned Venezuelan oil tanker, had pushed oil prices higher.

According to Wall Street News, the crude oil market is experiencing an unprecedented surplus. However, Brent oil prices remain stable between $61-66, primarily because the market finds it difficult to judge whether crude oil from sanctioned countries like Russia and Iran (accounting for 15% of global supply) should be counted as effective supply. Analysis suggests that sanctions make market direction unpredictable, and once floating storage moves onshore, oil prices could fall sharply.

London copper futures pared some gains, now up nearly 0.5% to $11,610.5 per ton. Earlier, buoyed by the Fed's rate cut, London copper approached record highs. So far this year, copper prices have accumulated gains of over 30%. Besides liquidity expectations, a series of mine shutdowns, concerns about overseas supply shortages, and traders rushing to buy in the US market ahead of potential tariffs have all provided upward momentum for copper prices.

Oracle's disappointing earnings report dealt a blow to market sentiment, causing Bitcoin to fall sharply, once breaking below the $90,000 mark. Tony Sycamore, market analyst at IG in Sydney, said: "The cryptocurrency space really needs to see stronger evidence that the sell-off on October 10th has completely ended, but currently, such evidence does not seem to exist."

Standard Chartered significantly lowered its year-end 2025 Bitcoin forecast from $200,000 to $100,000. Geoff Kendrick, head of global digital assets research at Standard Chartered, said: "We believe the buying activity by Bitcoin digital asset fund companies may have concluded. Therefore, we now believe that future Bitcoin price increases will essentially be driven by just one factor—ETF purchases."