Author: Zuoye Waiboshan

Ethereum is shifting towards L1 scaling and privacy, while the U.S. stock market's backend engine DTCC, holding $100 trillion, is beginning to migrate on-chain. It seems a beautiful new wave of crypto is about to arrive.

But the profit logic for institutions and retail investors is completely different.

Institutions possess extreme tolerance in terms of time and space; a ten-year investment cycle and leveraged arbitrage with tiny spreads are far more reliable than the retail fantasy of a thousandfold return in a year. In the upcoming cycle, it is highly likely we will witness the peculiar spectacle of on-chain prosperity, institutional influx, and retail pressure simultaneously.

Please don't be surprised; BTC's spot ETF and DAT, the complete disappearance of BTC's four-year cycle and altseason, and Koreans "abandoning coins for stocks" have repeatedly validated this logic.

After 10/11, CEX, the last barrier for project teams, VCs, and market makers, has officially entered garbage time. The greater its influence on the market, the more it leads to a conservative approach, which will subsequently erode capital efficiency.

Altcoins having no value and editors posting Memes are just episodes of a predetermined path collapsing under its own weight. Migrating on-chain is a move made out of helplessness, but it will differ slightly from the free and prosperous world we imagined.

We originally hoped to use the wealth effect to compensate for the numbness after the loss of belief in decentralization. Let's hope we don't lose both freedom and prosperity.

Today will be the last time I talk about concepts like decentralization and cypherpunk. The old tales of freedom and its betrayal can no longer keep up with the rolling wheels of the times.

Decentralization: The Birth of the Pocket Computer

DeFi is not built on the ideas and entity of Bitcoin; it never was.

Nick Szabo, creator of "smart contracts" (1994) and Bit Gold (first proposed in 1998, refined in 2005), and the inspiration behind core concepts like Bitcoin's Proof of Work (PoW) and timestamping.

Once affectionately called Bitcoin a pocket computer and Ethereum a general-purpose computer. But after the 2016 The DAO incident, where the decision was made to roll back the transaction history, Nick Szabo became a critic of Ethereum.

During the 2017-2021 ETH bull run, Nick Szabo was seen as an outdated stubborn old man.

On one hand, Nick Szabo once genuinely believed Ethereum surpassed Bitcoin, achieving better disintermediation, as Ethereum at that time fully implemented PoW and smart contracts.

On the other hand, Nick Szabo believed Ethereum reformed the governance system from a trust-minimization perspective, with the DAO mechanism achieving efficient interaction and collaboration among strangers globally for the first time.

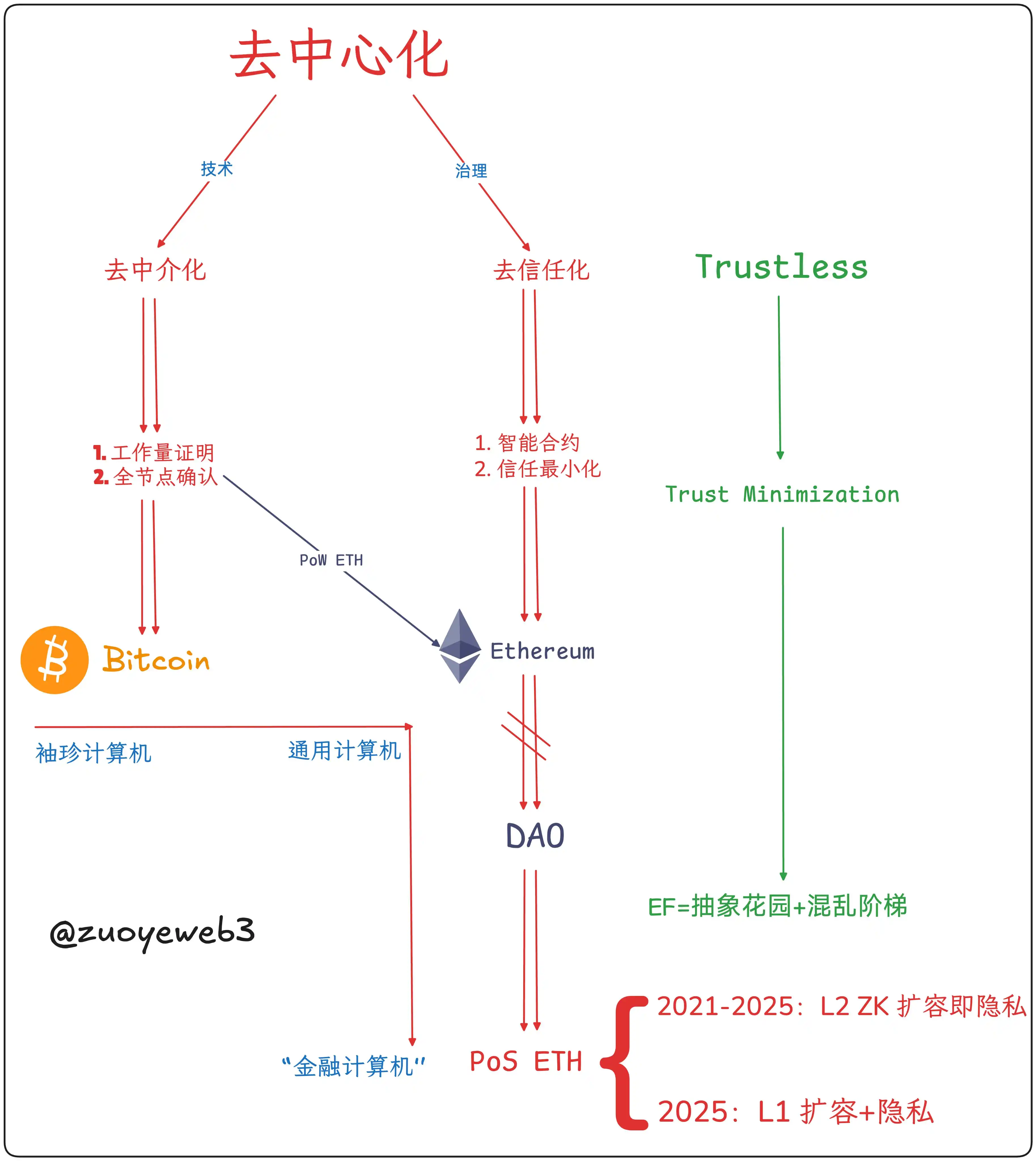

This outlines what decentralization actually refers to: Disintermediation at the technical level -> Pricing cost + Transaction consensus; Detrustification at the governance level -> Trust minimization.

Image Caption: Composition of Decentralization; Image Source: @zuoyeweb3

- Disintermediation: No need to rely on gold or governments, but instead use computational work as proof of individual participation in Bitcoin production;

- Detrustification: No need to rely on human social relationships, but open up under the principle of trust minimization to create network effects.

Although Satoshi Nakamoto was influenced by Bit Gold, he was noncommittal about smart contracts. Under the principle of simplicity, while retaining the possibility of opcode combinations for complex operations, the practice was overall centered around peer-to-peer payments.

This is also why Nick Szabo saw hope in PoW ETH—complete smart contracts and "self-limitation." Of course, Ethereum encountered L1 scaling obstacles similar to Bitcoin. Vitalik ultimately chose L2 scaling to reduce harm to the L1本体 (mainnet).

This "harm" mainly refers to the full node size crisis. After losing Satoshi's optimizations, Bitcoin raced down the path of no return with mining rigs and hashrate competitions, effectively excluding individuals from the production process.

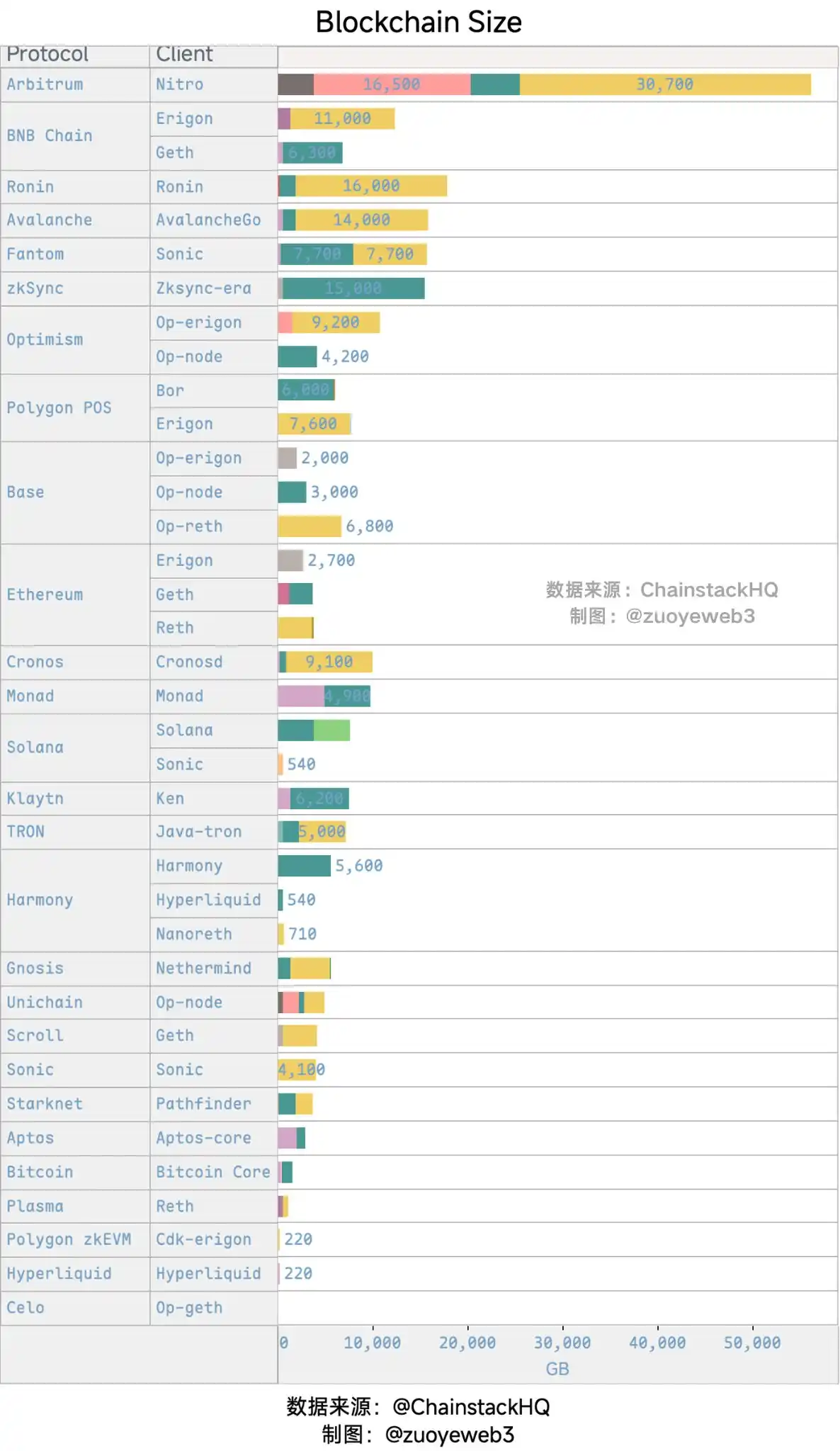

Image Caption: Blockchain Node Sizes; Source: @zuoyeweb3

Vitalik at least resisted. Before surrendering to the data center chain model in 2025, even after switching to PoS, he tried to preserve the existence of individual nodes as much as possible.

Although PoW is equated with hashrate and power consumption, determining its basic production cost, in the early days of the cypherpunk movement, Proof of Work combined with timestamping was meant to confirm transaction times, forming an overall consensus and enabling mutual recognition based on that.

Therefore, Ethereum's shift to PoS fundamentally removes individual nodes from the production system. Coupled with the "costless" ETH accumulated from the ICO era and nearly $10 billion from VCs invested in EVM+ZK/OP L2 ecosystems, an immense institutional cost has无形中 (intangiblely) accumulated. One could completely view ETH DAT as a form of institutional OTC exit.

After the failure of disintermediation at the technical level, although node explosion was controlled, it moved towards mining pool clusters and hashrate competitions. Ethereum went through several iterations from L1 (sharding, sidechains) -> L2 (OP/ZK) -> L1,最终 (finally) embracing large nodes in practice.

It must be objectively stated: Bitcoin lost smart contracts and the "individualization" of hashrate; Ethereum lost node "individualization" but retained smart contracts and ETH's value capture ability.

And a subjective evaluation: Bitcoin achieved governance minimization but highly relies on the "good conscience" of a few developers to maintain consensus. Ethereum ultimately abandoned the DAO model, turning towards a centralized governance model (theoretically not, but practically Vitalik can control the Ethereum Foundation, and the Ethereum Foundation can guide the direction of the Ethereum ecosystem).

There is no private intention here to贬低 (belittle) ETH and elevate BTC. From the wealth effect of token price, early investors of both were successful. But from the practice of decentralization, the possibility of either changing course is no longer visible.

Bitcoin will almost certainly not support smart contracts; the Lightning Network and BTCFi are still focused on payments. Ethereum retained smart contracts but abandoned the pricing benchmark of PoW and, beyond detrustification/trust minimization, chose the historical regression of building a centralized governance system.

Successes and failures, right and wrong, will be left for future generations to judge.

The Middleman Economy: The Fall of the World Computer

Where there is organization, there will inevitably be internal strife; where unity is emphasized, centralization必然 (inevitably) follows, and then bureaucracy自生 (spontaneously arises).

In terms of token pricing mechanisms, there are two types: narrative and demand. For example, Bitcoin's narrative is application-oriented—peer-to-peer electronic cash—but people's demand for Bitcoin is as digital gold. Ethereum's narrative is the "World Computer," but people's demand for ETH is application-oriented—Gas Fee.

The wealth effect is more friendly to the PoS mechanism. Participating in Ethereum staking first requires ETH, using Ethereum's DeFi also requires ETH. ETH's value capture ability in turn enhances the rationality of PoS. Ethereum, driven by real-world demand, was correct to abandon PoW.

But on the narrative level, the model of transaction volume * Gas Fee is highly similar to SaaS and Fintech, unable to match the grand narrative of "computing everything." When users who don't use DeFi leave, ETH's value cannot be sustainably supported.

In the end, no one uses Bitcoin for transactions, but there will always be those who want to use Ethereum to compute everything.

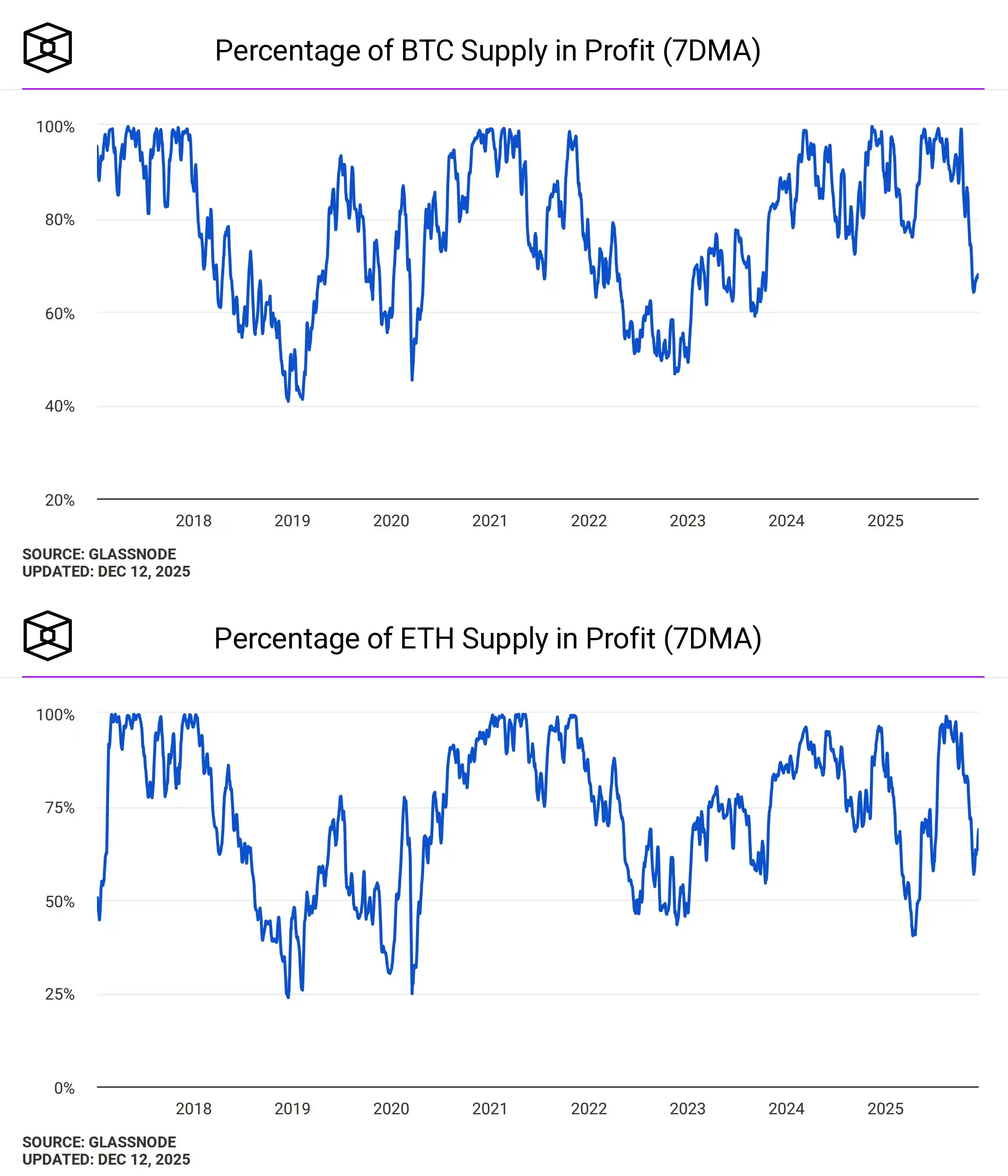

Image Caption: BTC and ETH Address Profitability; Source: @TheBlock__

Decentralization ≠ Wealth Effect. But after Ethereum transitioned to PoS, it默认 (defaulted) to accepting ETH's capital value as its sole pursuit. Price fluctuations will be excessively scrutinized by the market, further interrogating the gap between its vision and reality.

In contrast, the price fluctuations of gold and Bitcoin are highly equated with the market's basic sentiment changes. People worry about world局势 (situations) when gold soars, but no one doubts Bitcoin's fundamental value when its price falls.

It's hard to say that Vitalik and the EF caused Ethereum's "de"-decentralization, but it must be admitted that the Ethereum system is increasingly middleman-ized.

In 2023/24, it became fashionable for Ethereum Foundation members to serve as advisors for projects, like Dankrad Feist for EigenLayer. But few remember the unclear connections between The DAO and multiple core Ethereum members.

This situation only subsided after Vitalik officially announced he would no longer invest in any L2 projects, but the systemic "bureaucratization" of the entire Ethereum ecosystem was already inevitable.

In a sense, middleman does not necessarily carry negative connotations like broker; it refers to efficiently matching and撮合 (facilitating) each other's needs. For example, the Solana Foundation, once considered an industry典范 (model), generally promotes project development from the perspective of the market and its own ecosystem's growth.

But for ETH and Ethereum, ETH should become a "middleman" asset, but Ethereum should remain彻底 (thoroughly) open and autonomous, maintaining the technical architecture of a permissionless public chain.

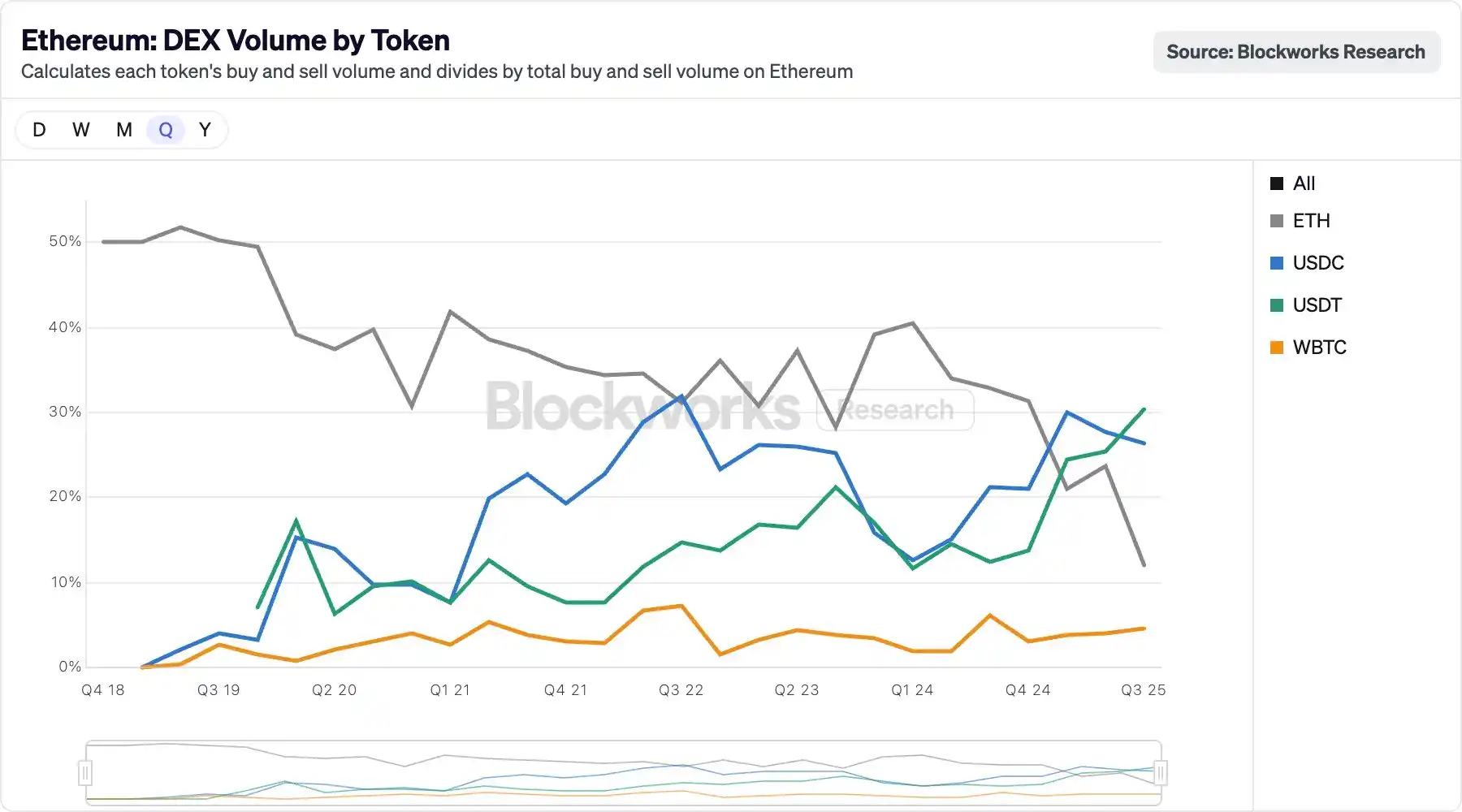

Image Caption: Ethereum DEX Volume by Token; Source: @blockworksres

Within the Ethereum ecosystem, there are signs of stablecoins gradually replacing ETH. As liquidity migrates on-chain with Perp DEX, USDT/USDC is also profoundly changing the old landscape. The story of stablecoins replacing ETH/BTC as the benchmark asset within CEXs will replay on-chain.

And USDT/USDC are precisely centralized assets. If ETH cannot maintain a vast application场景 (scenario) and can only be used as an "asset," then under the背景 (background) of speed increases and fee reductions, Gas Fee consumption must be large enough to sustain ETH's price.

Moreover, if Ethereum is to be completely open, it should allow any asset to act as the intermediary asset, but this would severely harm ETH's value capture ability. Therefore, L1 needs to reclaim power from L2, L1 needs to scale again. Privacy in this context can be interpreted as a necessity for institutions or as a choice不忘初心 (not forgetting the original intention).

There are many stories here, each worth hearing, but you must choose a direction to pursue.

Complete decentralization cannot achieve minimal organization, leading to everyone acting on their own. Under the principle of efficiency, one can only continuously lean towards trust minimization. Minimized trust relies on the order derived from Vitalik, and the extreme freedom Sun Ge gives to black/gray industries—there is no difference.

We either trust @VitalikButerin, or we have to trust Brother Sun @sunyuchentron. Simply put, decentralization cannot establish a self-existent, self-sustaining order. People's hearts desire extreme chaos, but their bodies极端厌恶 (extremely detest) environments without a sense of security.

Vitalik is a middleman, ETH is a middleman, and Ethereum will also be the middleman between the traditional world and the链上 (on-chain) world. Ethereum wants a product without a product, but any product inevitably carries elements of marketing, falsehood, and deception. "Just use Aave" has no fundamental difference from UST.

Only by repeating the first failed action can the financial revolution succeed. USDT first failed on the Bitcoin network, UST failed by buying BTC, then came the success of TRC-20 USDT and USDe.

Or perhaps, people suffer from ETH's decline and sideways movement, and also suffer from the膨胀 (bloating) of the Ethereum system, making retail powerless to separate from Wall Street. It should have been Wall Street buying ETH from retail, but people are now tasting the bitter fruit of ETFs and DATs.

Ethereum's limitation is the capital of ETH itself. Production for the sake of production, production for the sake of ETH, are two sides of the same coin, a self-evident truth. East and West not buying from each other, capital and project teams preferring certain ecosystems, certain entrepreneurs—ultimately, none are producing for the token of the project they invested in, but are producing for ETH.

De—->"Centralization": The Future of the Financial Computer

From the Second International to LGBT, from the Black Panther Party to Black Panther, from Bitcoin to Ethereum.

After The DAO incident, Nick Szabo began to detest everything about Ethereum. After all, Satoshi Nakamoto has vanished into obscurity, but Ethereum's performance cannot be said to be poor. I'm not schizophrenic, criticizing Ethereum one moment and then singing V's praises the next.

Compared to next-generation公链 (public chains) like Solana and HyperEVM, Ethereum is still the best player balancing decentralization and wealth effect. Even Bitcoin, its天生 (innate) lack of smart contract support is its biggest flaw.

As a ten-year-old chain, ETH and Ethereum have transformed from the "opposition" to the "official opposition," needing to occasionally summon the spirits of decentralization and cypherpunk, then continue advancing towards the realistic future of the financial computer.

Minerva's owl only takes flight at dusk. The debates over wealth effect and decentralization must be buried in Königsberg. The truly cruel practice of history has long since buried both these narratives together.