Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

This column aims to cover low-risk yield strategies in the current market, primarily involving stablecoins (and their derivative tokens) (Odaily Note: code risk can never be eliminated), to help users who wish to gradually grow their capital through U-based wealth management find relatively ideal interest-earning opportunities.

- Odaily Note: For past records, please refer to "Lazy Person's Wealth Management Restart|Ethereal Earns 27% APR While Farming Points; Huma Opens New 28% APY God Pool (January 6)".

Exchange Wealth Management

The previous issue mentioned Binance's USD1 deposit event and OKX Pay's USDG holding interest event. The former is about to end, while the latter has relatively limited capacity (capped at 10,000 USDG).

For friends who still wish to manage wealth directly on exchanges, consider Bitget's collaboration with Arbitrum Morpho for the on-chain earn event. With platform subsidies, the flexible APY for USDC and USDT can reach 9.2%. The advantage of this event is its large capacity (single account, single currency up to $400,000, with deposits and withdrawals at any time). The drawback is the additional layer of security risk from on-chain protocols. Participate based on your risk tolerance.

Another popular wealth management opportunity is various deposit events in the Binance Wallet, such as yesterday's Unitas (real-time APY 37.04%). However, these usually have limits, and slots are highly competitive. It is recommended to keep an eye on announcements and set reminders to participate.

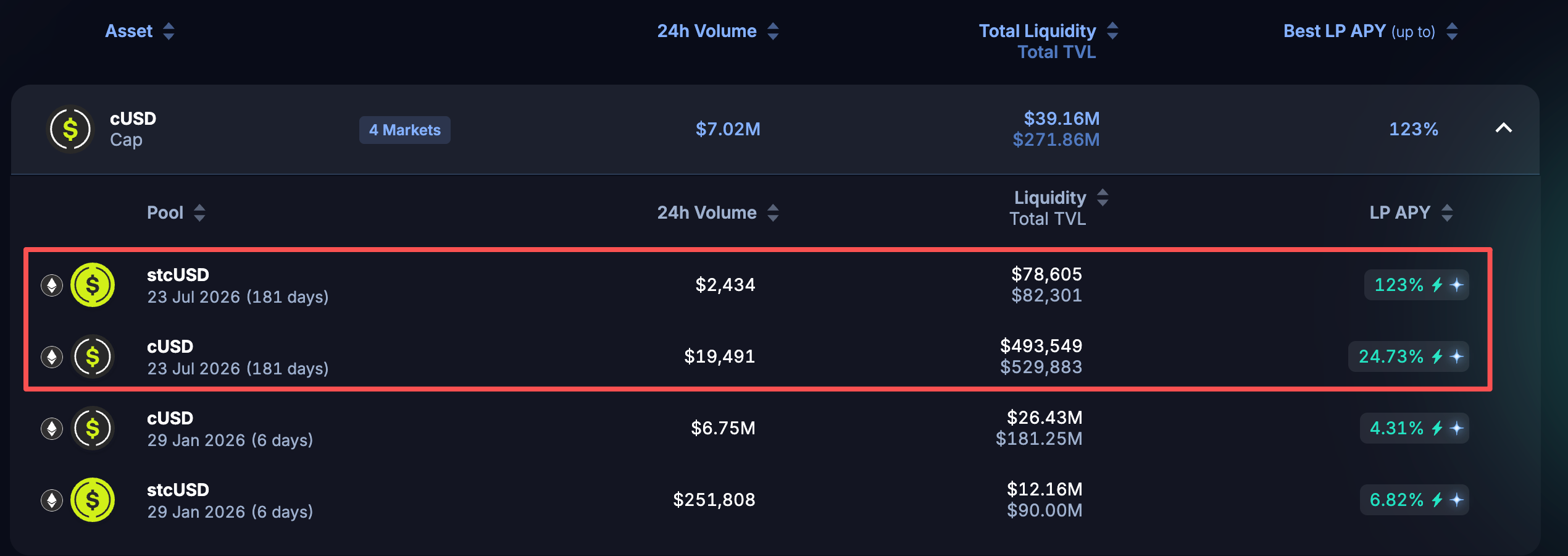

On-Chain Strategy One: Pendle Cap LP (Up to 123% APY + Points)

On January 19, the stablecoin project Cap announced its 1CO and Stabledrop plan. The so-called Stabledrop means Cap will airdrop users who participated in the first season points event, Frontier, in the form of the stablecoin cUSD.

At the same time, Cap also announced that the Frontier program will end on January 29, followed immediately by the launch of the next season points program, Homestead. The relevant liquidity pools for the Homestead program have already been deployed on Pendle and will continue to accumulate first-season points (Caps) rewards until Frontier ends.

Stimulated by the innovative mechanism of the stablecoin airdrop, the current yields for the Homestead-related liquidity pools on Pendle are very attractive. Among them, the base APY for the cUSD LP is 11.33%, which can be amplified to 24.73% with sufficient PENDLE staking, along with a 20x points efficiency multiplier; the base APY for the stcUSD LP is 52.9%, which can be amplified to 123% with sufficient PENDLE staking (the pool is new and small, so the yield is expected to decay quickly), along with a 5x points efficiency multiplier.

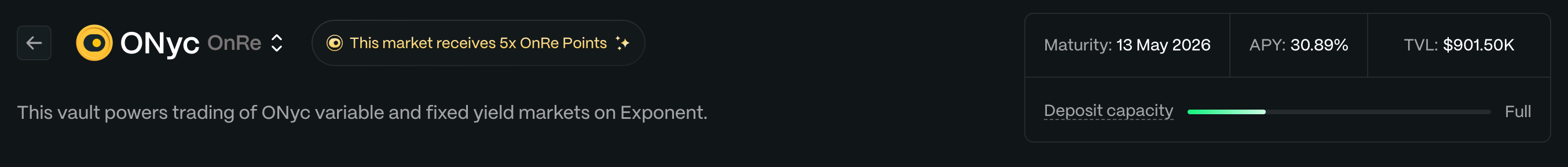

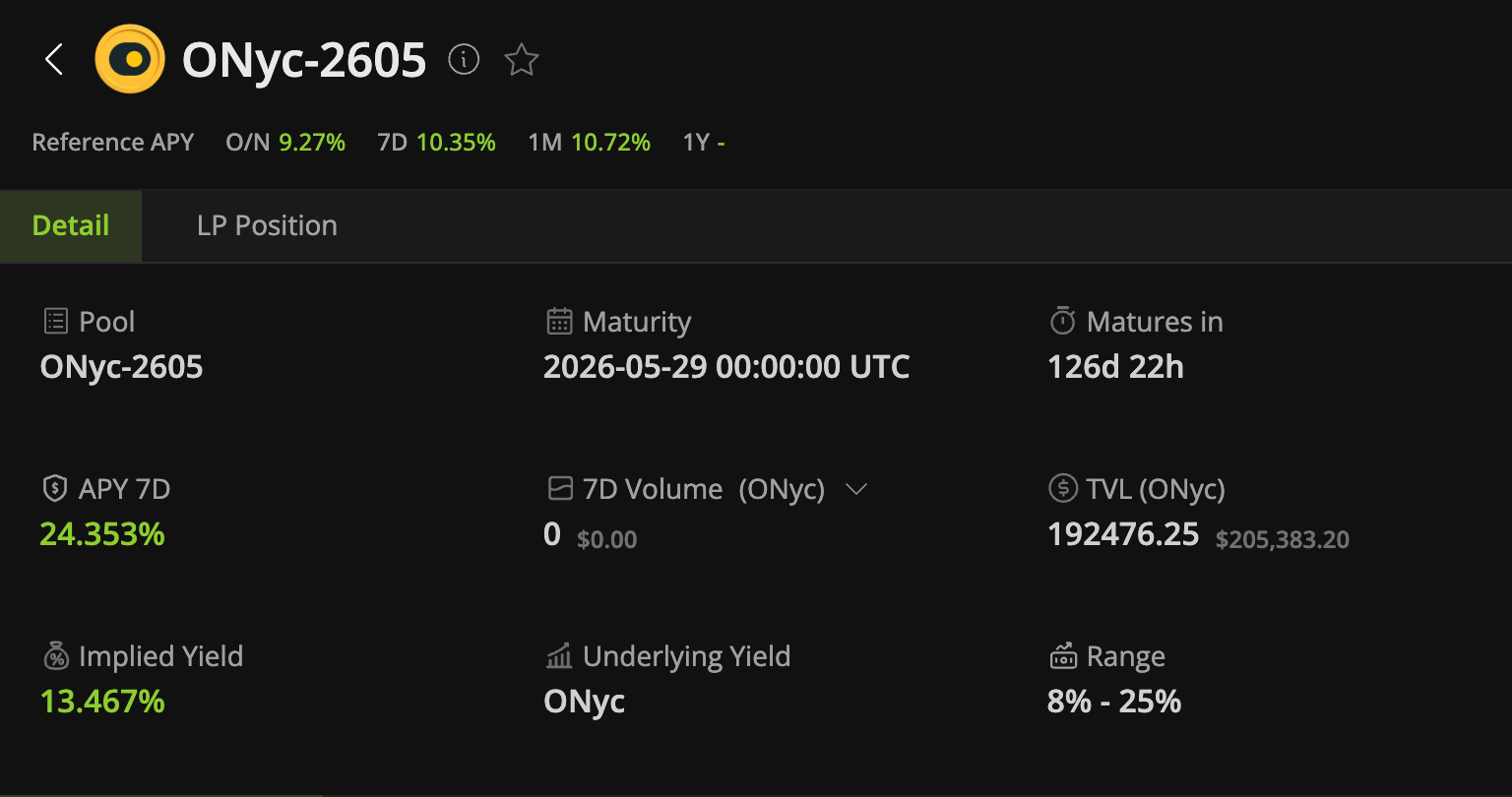

On-Chain Strategy Two: Exponent and RateX ONyc LP (Up to 30.89% APY)

On January 20, Onre, an on-chain reinsurance protocol backed by Solana Ventures and Ethena Labs, renewed the liquidity for ONyc (Onre's yield-bearing stablecoin) expiring in May on Exponent and RateX.

Currently, with additional incentives from Onre, the real-time APY for providing ONyc LP on Exponent is as high as 30.89% — the total pool quota is $3.5 million, which is not very large. Only 25.76% is currently deposited, and the overall APY is expected to dilute to around 20% once full (currently, 14.44% of the yield comes from additional incentives, which will be significantly affected by dilution). In addition to the yield, LPs can also receive 8x Onre points rewards until January 31, after which it will drop to the regular 5x multiplier.

The ONyc LP pool on RateX does not have Onre incentives, but RateX itself subsidizes RTX incentives, with an overall APY of around 25%. The Onre points are the same as on Exponent, but it also earn 8x RateX points.

The project is relatively niche, so it is recommended to participate with small amounts.

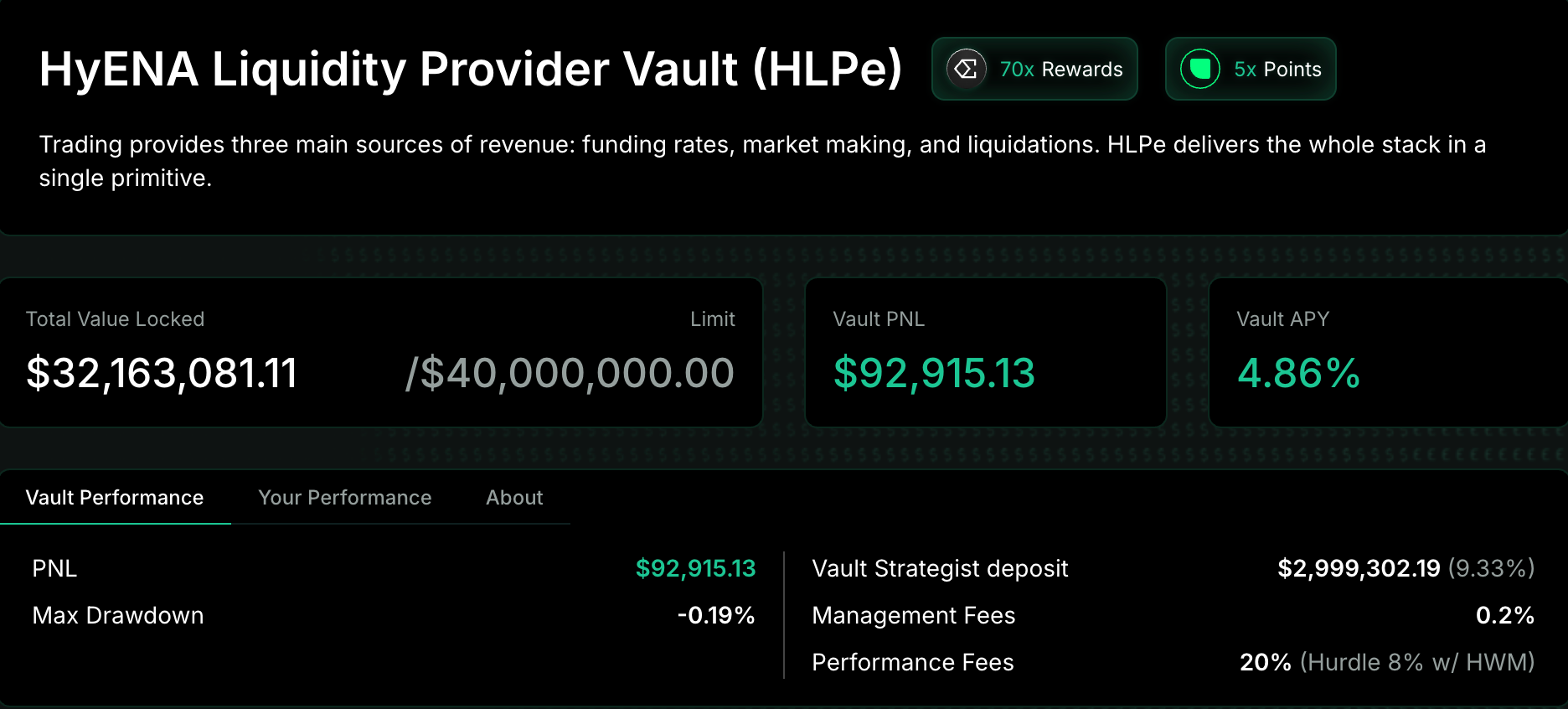

On-Chain Strategy Three: hyENA LP (4.86% APY + 70x Ethena Points Multiplier)

hyENA, the decentralized contract exchange and "son" of Ethena, recently increased the LP deposit limit again. The current quota is $40 million, with about $8 million space remaining.

Currently, the LP APY for hyENA is about 4.86%. The base yield is not ideal, but it also offers a 70x Ethena points multiplier (currently the most efficient points channel besides YT) and a 5x Upshift points multiplier. Consider participating if you are optimistic about Ethena's future development.