Author: Cookie

Beeple, the man who sold one NFT for a staggering $69 million, has long been seen as a symbol of the golden age of NFTs that once was.

Although the glory of NFTs has faded, Beeple and his team have remained active in the NFT circle. At this year's Art Basel, he brought another "golden dog" to the currently quiet NFT market—Regular Animals.

Yesterday, multiple Regular Animals sold for over 10 ETH (approximately $35,000) on OpenSea, and these works were given away for free at Art Basel, with a total of 256 pieces. At this price, Beeple essentially gave away nearly ten million dollars worth of NFTs at Art Basel.

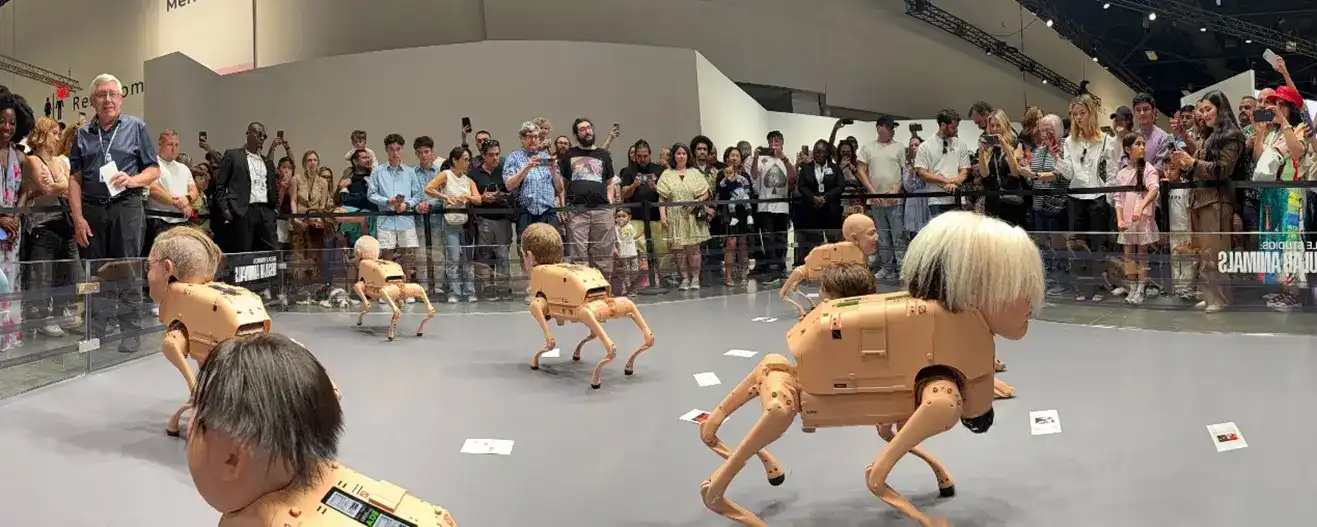

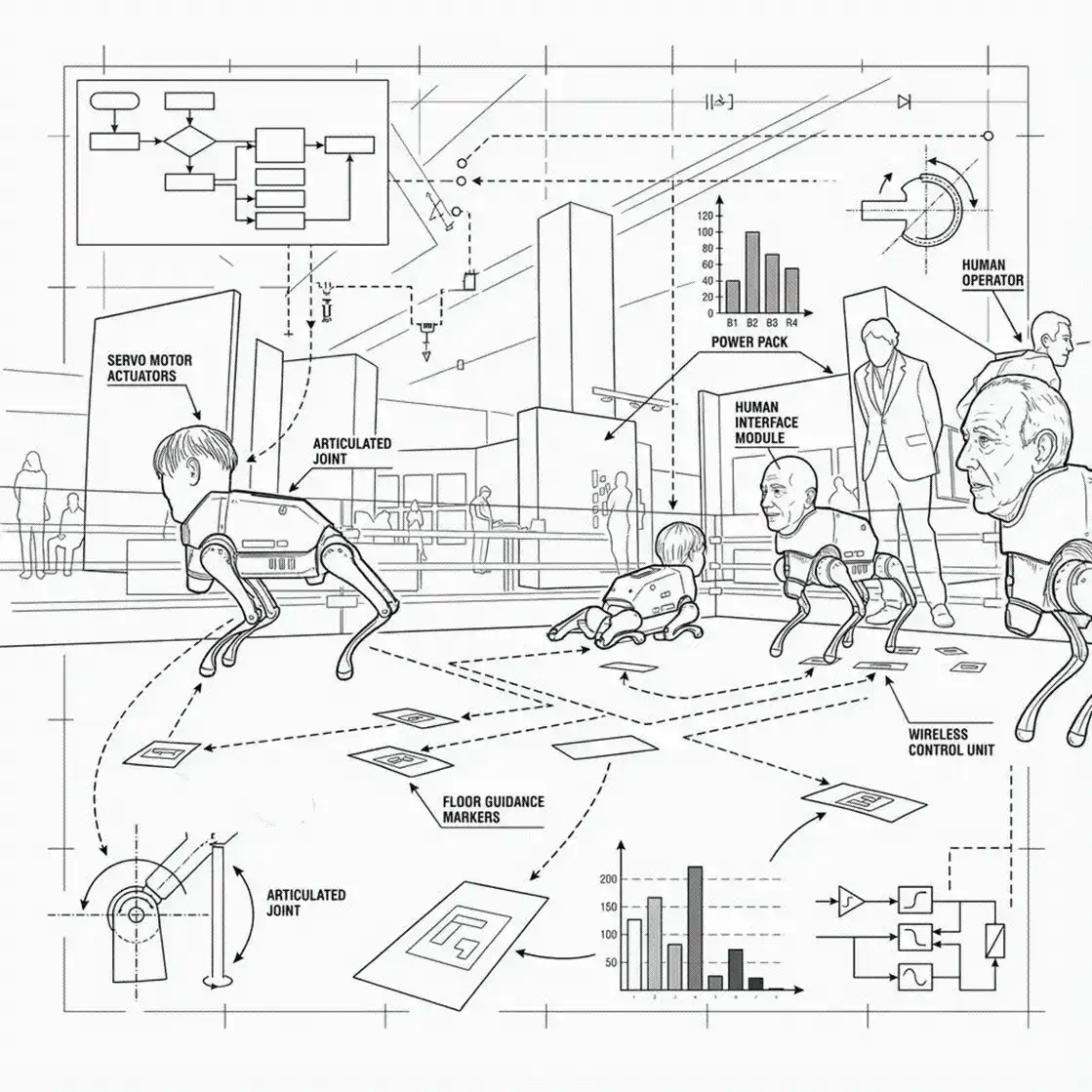

The project that Beeple and his team brought to this Art Basel is precisely Regular Animals. These are a bunch of robot dogs, as shown in the image below. They look a bit eerie because these robot dogs have human faces, and they are faces of well-known figures like Musk, Andy Warhol, Zuckerberg, Picasso, and even Beeple himself.

Of course, it's not just the eerie visual effect; these robot dogs use the cameras on their heads to observe their surroundings and employ an evolving visual algorithm to create artworks.

The celebrities these robot dogs portray were not chosen arbitrarily. The reason for selecting the aforementioned figures is that they have influenced how humans view the world, whether through algorithms, art, or politics. As humans, we observe the world through these perspectives, and so do these robot dogs. At Art Basel, these robot dogs and humans observed each other, and the moments of observation became the artworks created by these robot dogs—artworks that also serve as autobiographies for these machines.

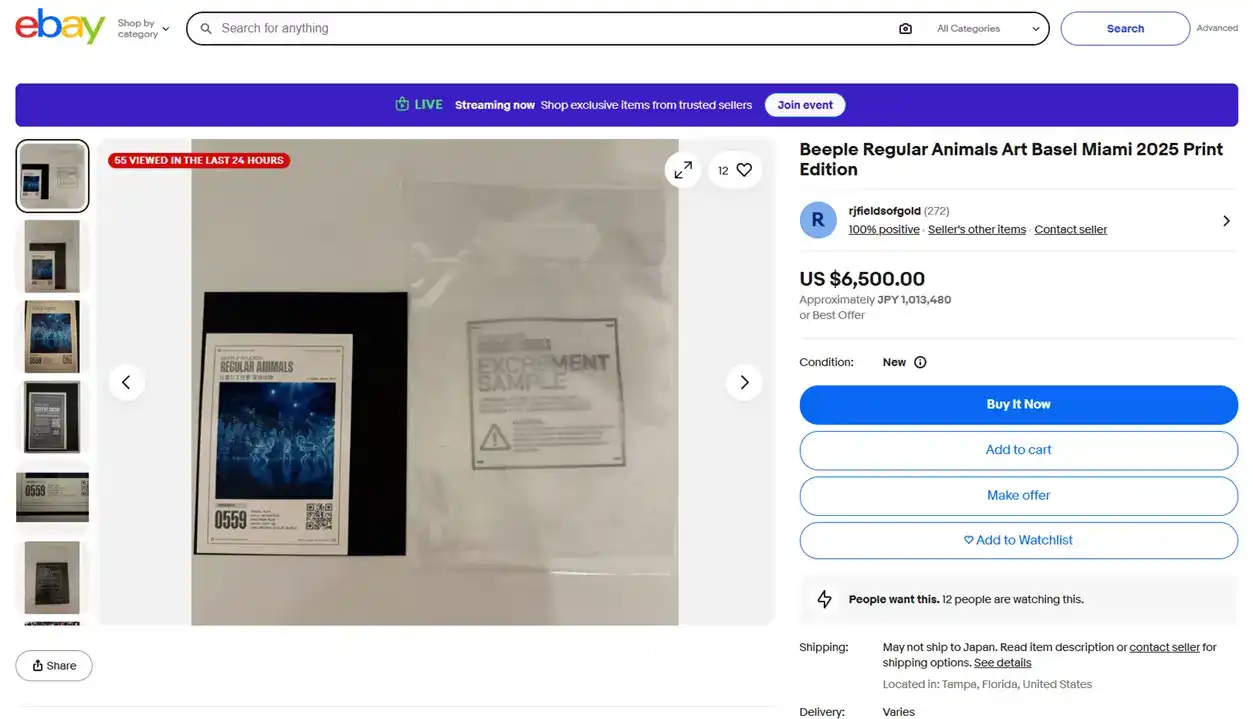

Interestingly, Regular Animals also has a physical series, with a total of 1,024 pieces. On eBay, someone has already listed one for sale at a fixed price of $6,500. The market's valuation suggests that NFTs are far more valuable than physical paintings, reminiscent of Damien Hirst's "The Currency" series years ago, which forced owners to choose between the physical and the NFT.

Before achieving great success in the NFT field, Beeple had been creating art every day since 2007 but had never sold anything for more than $100. After achieving fame and fortune, Beeple did not splurge like some artists or crypto project teams. He acquired a studio/gallery of about 460 square meters, assembled a team of dozens of 3D artists, engineers, and researchers (even including a former Boeing engineer), invited Carolyn Christov-Bakargiev, the former director of the Castello di Rivoli Museum of Contemporary Art, as an advisor, continuously exhibited at art shows around the globe, and created new artworks.

This exhibition of Beeple's robot dogs has not only gained attention in the crypto circle due to its price but has also been covered by traditional media like the WSJ.