Author: Viee | Biteye Content Team

In early February 2026, the winter in Hong Kong's Victoria Harbour was livelier than usual, as the Hong Kong Consensus Conference, a focal point of Asia's crypto narrative, was held once again.

Recently, the price of Bitcoin once fell below the $70,000 mark, trading volume was sluggish, and investors were panicked. In this bear market, what choices will these behemoth exchanges make to cope with the cold wave? For ordinary retail investors, perhaps the question is not when the bull market will come, but whether they can survive this bear market. Platforms are adjusting their positions, institutions are building their bases, and how should we allocate funds and protect our principal?

This article will start with Binance's statements at the Consensus Conference, analyze the underlying logic behind institutions' purchases of Bitcoin, and discuss how retail and institutional investors can prepare together for the industry's cold winter by combining recent exchange wealth management activities.

I. Binance's Voice at the Consensus Conference

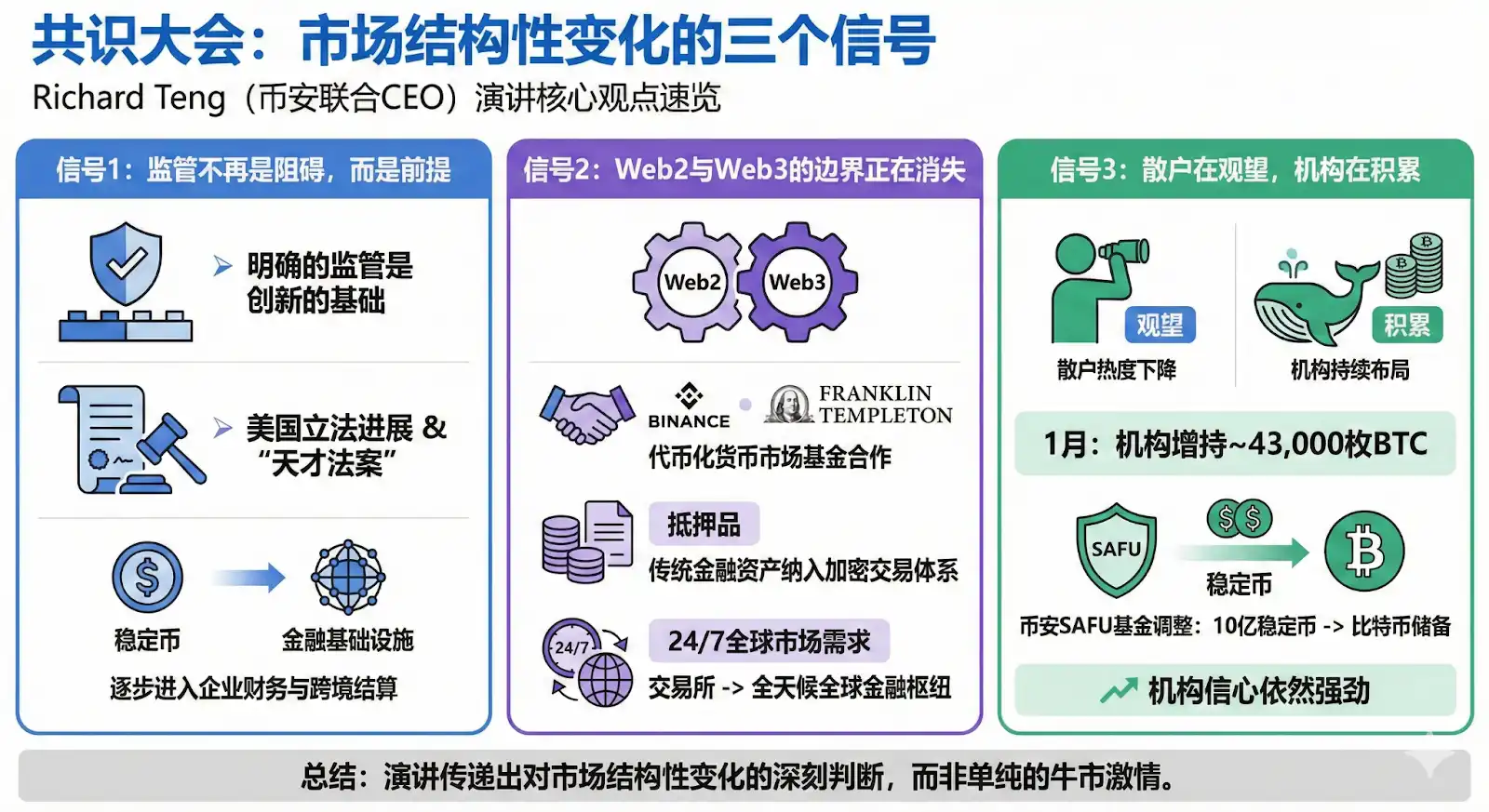

Amid price volatility and low sentiment, the speeches at this Consensus Conference were different from the passionate expressions during the bull market of previous years, and more like conveying a structural change in the market. Among them, the speech by Binance's co-CEO Richard Teng was quite representative, and several very clear signals could be captured throughout the presentation, regarding regulation, institutions, and infrastructure.

First, regulation is no longer an obstacle but a prerequisite.

Richard emphasized that "clear regulation is the foundation of innovation." He specifically mentioned recent legislative progress in the United States and the confidence boost brought to the stablecoin industry by the "Genius Act." Stablecoins, once a liquidity tool within crypto, are gradually entering corporate finance and cross-border settlement systems, which means crypto assets are migrating towards financial infrastructure.

Second, the boundary between Web2 and Web3 is disappearing.

Another noteworthy part of the speech was Binance's cooperation with Franklin Templeton on tokenized money market funds. Using tokenized funds as institutional collateral also means that traditional financial assets are being incorporated into the crypto trading system.

At the same time, the growth in trading volume of precious metal derivatives reflects the real demand of institutions for 24/7 global markets. When money market funds, gold derivatives, and stablecoins begin to form a closed loop on the same platform, the role of exchanges is no longer just about facilitating trades but more like an all-weather global financial hub.

Third, retail investors are watching, while institutions are accumulating.

A key number given by Richard is that institutional investors increased their holdings by approximately 43,000 Bitcoins in January.

The meaning behind this number is not that prices will rise immediately, but that the market structure is changing. Retail users in Asia-Pacific and Latin America are still active, but overall trading enthusiasm is indeed lower than in a bull market. In contrast, institutional funds are continuously positioning themselves in low-volatility intervals. Combined with Binance's announcement on January 29, 2026, regarding the strategic adjustment of the SAFU fund, which will convert $1 billion of stablecoin reserves in the SAFU fund into Bitcoin reserves within 30 days, it shows that institutional confidence remains strong.

In other words, while retail investors are waiting for clear bottom signals, institutions are already making allocation decisions. Smart money may not have left the market.

So the question is, when institutions are buying and platforms are adjusting their asset structures, how can retail investors gain a deeper understanding of the meaning behind these actions?

II. The Market Is Still Sluggish, Why Are Institutions Already Acting?

Regarding the institutional buying mentioned earlier, let's first review how Bitcoin has attracted a large amount of institutional capital allocation in recent years, especially since the approval of spot Bitcoin ETFs in 2024, which has significantly increased institutional buying.

1. Analysis of Institutional Buying Trends

Today, institutional buying enters the market mainly through ETFs, investment funds, corporations, governments, and other forms. The following points reflect the current institutional layout trends:

-

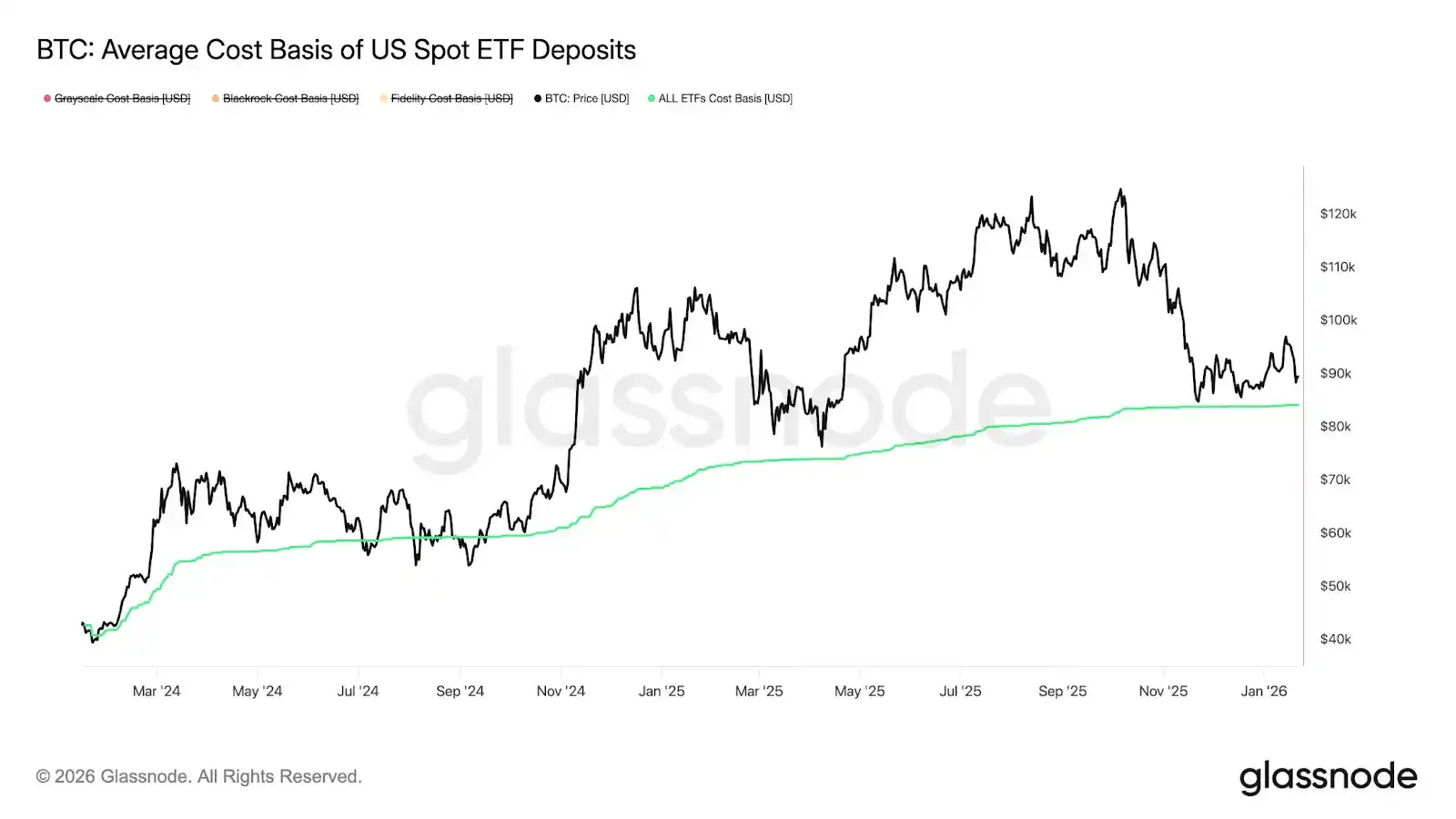

Spot ETFs Attract Massive Inflows: Institutions accessing the Bitcoin market through spot ETFs has become a primary method, and ETF data is also a means to gauge market heat. For example, according to SoSoValue data, U.S. spot Bitcoin ETFs saw their largest weekly outflow since last November in late January (approximately $1.22 billion). Historical experience shows that large-scale redemptions often occur near阶段性 bottoms in prices, so Bitcoin may be接近 a local low. The data in the chart below indicates that the average holding cost of ETF investors is about $84,099, a price range that has formed key support levels multiple times in the past. If historical patterns repeat, this round of capital outflows may mean that short-term downward momentum is nearing its end, and a market rebound is possible.

-

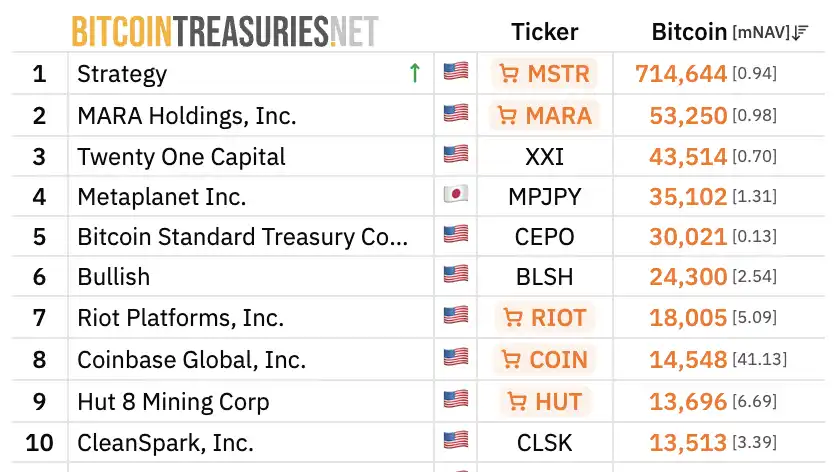

Surge in Total Holdings by Listed Companies: It is reported that in Q4 2025, the total Bitcoin held by global listed companies reached approximately 1.1 million (about $94 billion), with 19 new listed companies purchasing Bitcoin. This indicates that Bitcoin is increasingly being regarded as a strategic asset by enterprises. In addition to the well-known strategic treasury companies, several newly listed companies have also joined the buying camp, further validating the trend of institutional capital inflow. The chart below shows the top 10 Bitcoin treasury data.

-

National Level Initiatives: Some countries are also publicly buying Bitcoin. The government of El Salvador announced in November 2025 that it spent $100 million in a single day to buy approximately 1,090 BTC, bringing its cumulative holdings to over 7,000 coins.

In summary, from 2024 to the present, institutional buying has shown characteristics of explosive ETF inflows and密集建仓 by enterprises and investment funds. As Richard Teng said, this trend is expected to continue in 2026 and continue to provide upward momentum for the market.

2. What Are the Historically Representative Public Bitcoin Purchases?

As of early 2026, historically public purchases of Bitcoin for the purpose of "building the market, stabilizing the ecosystem, or reserve assets" can be divided into 5 major categories. Here are a few representative cases:

From the table above, it can be seen that institutions buying Bitcoin for market building can be roughly divided into three categories. The first is corporate asset allocation, such as MicroStrategy. These companies use shareholder assets as a basis and treat BTC as a long-term value storage tool. The second category is national/DAO purchases and holdings as reserve alternatives. The third category is exchange buying behavior, such as Binance's current SAFU conversion. This approach shifts reserves from stablecoins to Bitcoin, which is more resistant to inflation and censorship and allows for self-custody. In the event of potential future geopolitical systemic shocks, this can enhance asset independence.

The difference lies here: the starting point for the vast majority of enterprises buying BTC is corporate financial decision-making. Binance, however, is using a user protection fund, meaning this is a purchase for risk structure重构.

3. How Does Binance's Approach Differ Fundamentally from Other Institutions?

First, the asset属性 is different.

MicroStrategy uses company assets; ETF institutions' purchases are passive allocations from user subscription funds and do not bear corporate responsibility for price fluctuations. El Salvador's national purchase is more of a policy strategic行为, and its decision-making logic is difficult to replicate. In contrast, Binance is using a user protection fund. Converting the protection fund to BTC本质上 regards Bitcoin as the most reliable long-term asset.

Second, the execution method is different.

The模式 of MicroStrategy, ETFs, and other institutions is closer to trend/bottom adding. Binance, however, buys in phases and has set up a rebalancing mechanism. If the SAFU market value falls below the既定 safety line, it will continue to add positions. This dynamic replenishment mechanism means this is long-term asset structure management.

Third, the market role is different.

Corporate coin buying mainly affects the company's investment structure. The continuous subscription of ETFs represents the持续放量 of institutional compliance channels. Exchange coin buying affects the entire market liquidity and sentiment structure. When the world's largest exchange locks $1 billion worth of BTC as long-term reserves, it can strengthen the expectation that leading platforms are bullish. This is a demonstration effect.

4. What Retail Investors Need to Care About: What Does This Mean for the Market and BTC Price?

In the short term, large-scale public purchases have not caused剧烈上涨, indicating the market may be in a rational digestion stage. But from a structural analysis, we believe there may be several medium to long-term impacts.

First, $1 billion worth of BTC is locked long-term in the insurance fund, equivalent to reducing circulating supply, although the proportion of total circulation is not high (about 0.1%). According to relevant research data, spreading $1 billion over 30 days means buying about $33.33 million daily. In Bitcoin's全网 daily trading volume of $30-50 billion, this only accounts for 0.1%-0.2%, making it difficult to form a significant impact. After using the TWAP algorithm, the buying volume per minute is only about $23,000, which is hardly noticeable in daily fluctuations. Based on this estimate, the price boost is expected to be within 0.5%-1.5%.

Second, as a strategic purchase by the world's largest exchange, it is seen as an endorsement of Bitcoin by an authoritative institution, which may trigger additional confidence premiums. Therefore,综合考虑, under the叠加 of direct buying and market sentiment, the potential price increase for Bitcoin may exceed around 1%, reaching the 2%-5% level.

Finally, the support mechanism. Since Binance承诺 to replenish if it falls below $800 million, this mechanism effectively sets a strong support level. When prices fall significantly, the market will expect Binance to step in and buy, helping to curb the decline.

In summary, Binance's $1 billion phased purchase is expected to only have a mild boosting effect on Bitcoin. It will not violently pump the price in the short term but provides an invisible layer of support for market sentiment and prices, reflecting more long-term bullish confidence in Bitcoin rather than short-term speculation.

III. Retail Investors' Bear Market Survival Rules: Seeking Defensive Yield

When institutions are allocating underlying assets, how should retail investors respond? Since they cannot change the market like large funds, the best way is not to waste bullets.

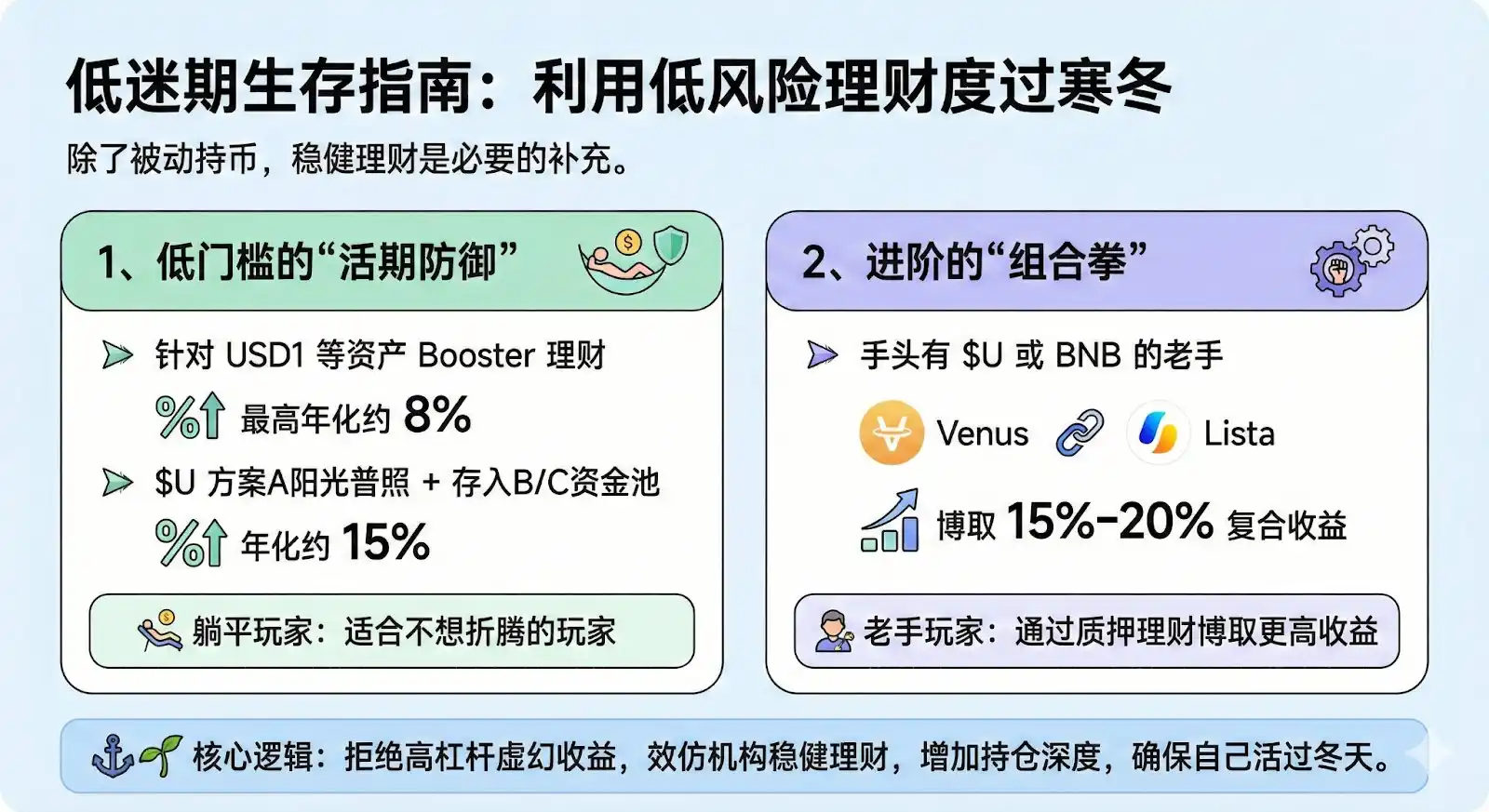

During the current downturn, besides holding coins passively, using platform activities for low-risk wealth management is a necessary supplement to survive the winter. Looking at Binance's recent wealth management actions, the logic is very clear:

1. Low-threshold "Current Defense": Booster wealth management for USD1, with a maximum annualized yield of about 8%. Plan A for $U is sunshine普照 + depositing into pools B/C, with an annualized yield of about 15%.

Suitable for those躺平 players who don't want to折腾.

2. Advanced "Combination Punch": For veterans with $U or BNB, staking for wealth management (such as through Venus or Lista protocols) can aim for复合收益 of 15%-20%.

In short, the core logic is not to chase虚幻收益 with high leverage at this stage but to emulate institutions by increasing holding depth through稳健 wealth management methods to ensure survival through the winter.

IV. Conclusion: Companions in the Winter

The bear market will eventually pass, but only those who survive will be qualified to welcome spring.

At present, this long crypto winter is still testing the patience and will of every market participant. Through the window of the Hong Kong Consensus Conference, we have seen the real choices of leading exchanges.

As the old saying goes, "If winter comes, can spring be far behind?" In a bear market, some are preparing for the worst, which also means the dawn will eventually come. Until then, all we can do is maintain rationality and patience, manage risks well, and cherish the chips in hand.