Celestia 是一个专注于数据可用性的模块化区块链项目,近期,其原生代币 TIA 价格走势强劲,据 CoinGecko 数据,截至撰稿前,TIA 价格为 11.5 美元,近一月涨幅为 123.7% ,今日价格有所下降, 24 小时降幅达 4.3% 。TIA 目前市值为 16.77 亿美元,在加密货币中排名第 44 位。

相关阅读:《一文速览模块化区块链 Celestia 的设计优势及 TIA 代币市值潜力》

结合 Celestia 的业务模式,可以发现 TIA 有很多应用场景。用户可以质押 TIA 来参与共识并保护 Celestia,代币越有价值,网络就越安全。除此之外,开发者可以使用 TIA 作为 Gas 启动 Rollup;而 Celestia 作为 Cosmos 生态的主流项目,肯定也不会抛弃质押赚取空投的模式。

随着 Cosmos 生态热度上升,社区中也出现讨论质押 TIA 的声音,并表示 Celestia 生态的项目未来将会给 TIA 质押发放空投。结合 Cosmos 生态传统以及 Celestia 的空投发放方式,或许明年将会有一批项目采取这样的方法发放空投。因此,BlockBeats 整理了 TIA 质押流程供读者参考,以及还为读者梳理了 Celestia 生态中可以质押 TIA 获取潜在空投机会的项目。

如何质押 TIA?

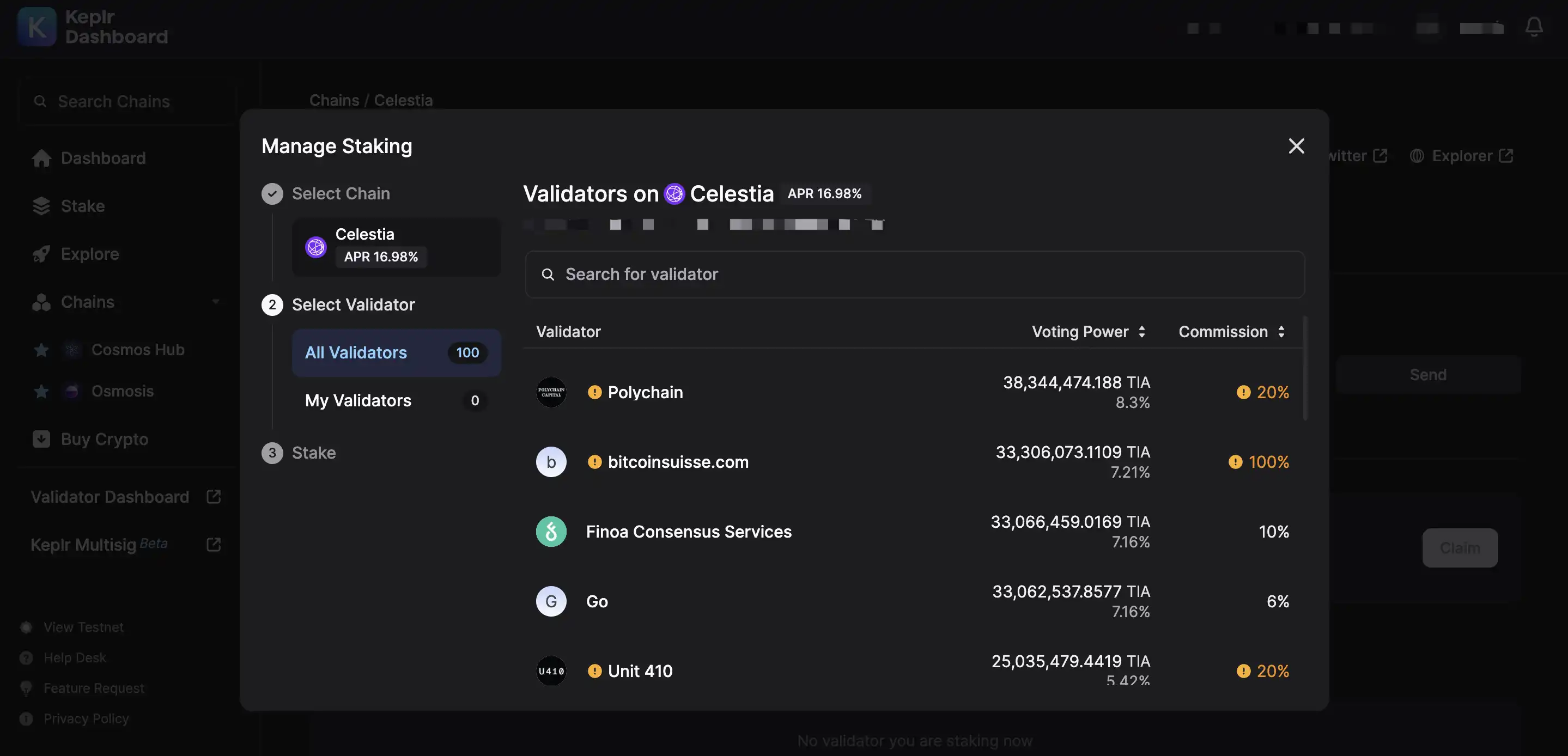

Celestia 官网给出了两种质押 TIA 的方式,分别是 Keplr 钱包通道和 Leap 钱包通道;截至发稿前,两种质押途径的 APR 分别为 16.98% 和 16.13% 。

使用 Keplr 钱包质押 TIA

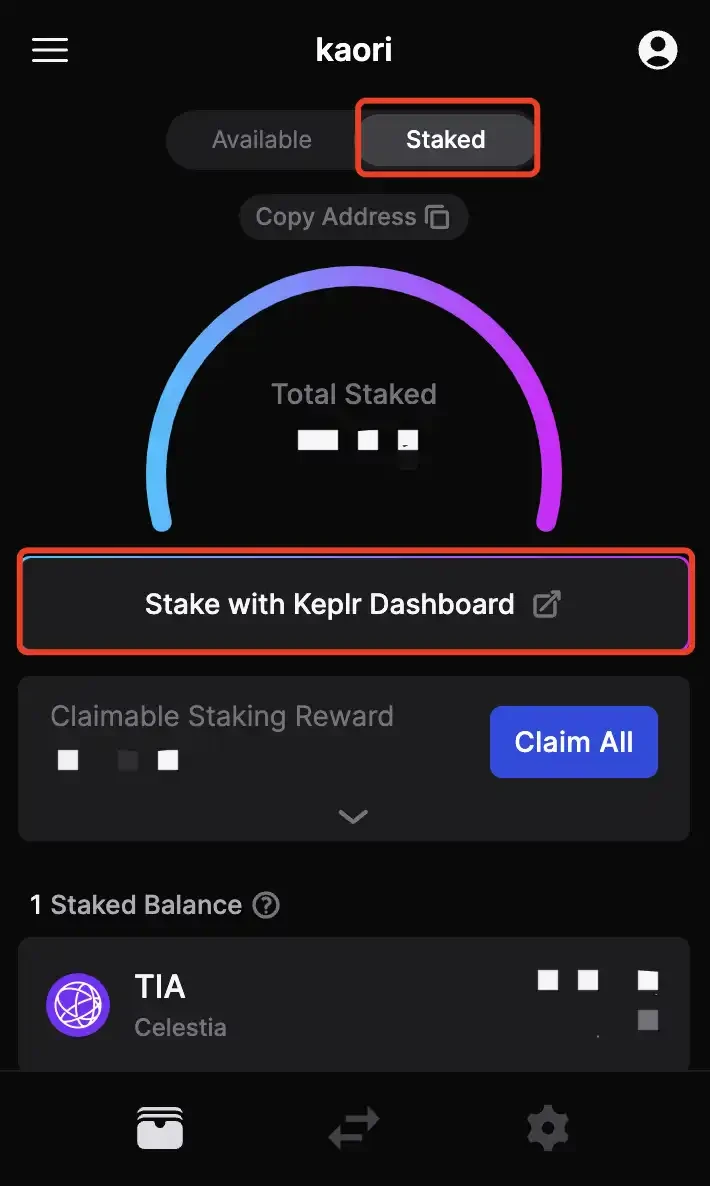

1、打开 Keplr 钱包 Staked 界面,选择 Stake with Keplr Dashboard;

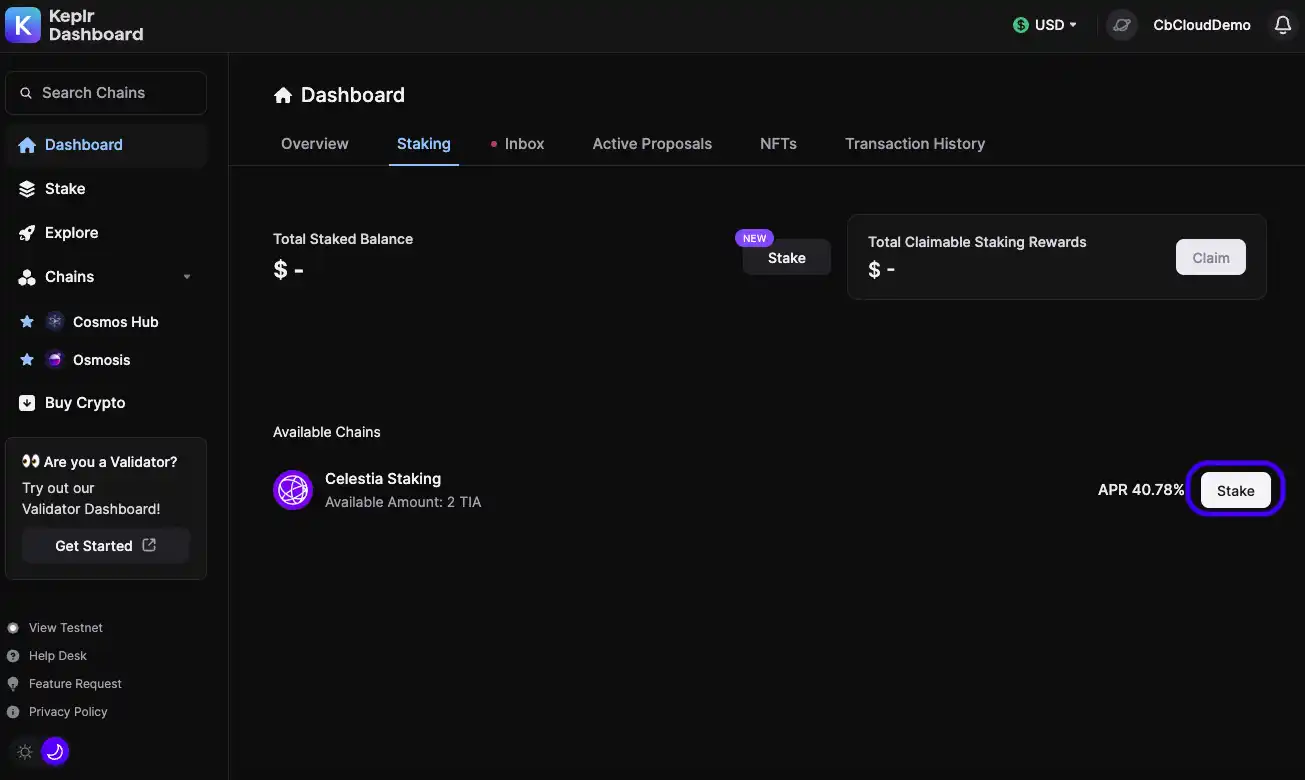

2、如果钱包内有 TIA,就可以看到 Celestia 质押选项,单击「Stake」按钮;

3、选择 Celestia 网络并选择验证器;

4、此处以选择 Coinbase Cloud 作为 Validator 为例,输入想质押的 TIA 代币数量并选择 Stake ;

5、如果一切正常,确认交易后可在 Celestia 质押界面查看领取奖励、取消质押、重新委托或质押额外代币。

使用 Leap 钱包质押 TIA

第二种官方质押方式为使用 Leap 钱包。

1、在 Leap 插件中点击右上角选择 Celestia 网络,并进入 Stake 界面;

2、点击 TIA Stake,并选择验证器,此处还是以 Coinbase Cloud 为例,搜索 Coinbase Cloud 验证器并单击;

3、输入想要质押的 TIA 数量,然后单击「Review」,确认交易。

潜在空投机会有哪些?

Berachain

Berachain 是一个基于流动性证明共识构建的高性能 EVM 兼容区块链,通过将 Cosmos 原生共识机制 Tendermint 与其本身的流动性共识证明(Proof of Liquidity)相结合,并采用 Celestia 作为 DA 层,从而能提供较快的交易速度、较低的交易成本和即时的最终确定性。

今年 4 月,Berachain 完成了 4200 万美元的融资,Polychain Capital 领投,Hack VC、dao 5、Tribe Capital、Shima Capital、Robot Ventures、Goldentree Asset Management、OKX Ventures 参投。

Berachain 摒弃传统公链常用的单原生 Token 经济模型,其团队认为每个去中心化经济体都应该具有对运作至关重要的三个主要部分:

其一为定价和执行的媒介(Gas),用来为工作单元定价并以智能合约执行工作;其二为共识和决策的媒介(治理),用以民主功能组织并达成共识和决策;其三为通过共同稳定面额进行交易的媒介(稳定)。

因此,Berachain 使用了对应的 Tri-Token 经济模型:

1. $BERA:Berachain 的 Gas Token。

2. $BGT:Berachain 的治理 Token,可对新的白名单资产进行投票。$BGT 不可转让,只能通过质押 $BERA 获得,这确保了用户的长期一致性。

3. $HONEY:Berachain 的原生超额抵押美元稳定币。$HONEY 是 Berachain 生态系统的 Money,是协议收入被支付给质押者的支付方式。将被超额抵押至少 150% ,以确保与美元挂钩。

这一经济模型被开发团队称为「Tri-Token」,为每个 Token 分配了独特的角色,以鼓励用户长期使用并保持链上流动性的一致。

Manta Pacific

Manta Network 是基于 ZK 应用的模块化区块链,Manta Pacific 是为 EVM 原生 ZK 应用和 dApps 提供的模块化 L2 生态系统,也是 Celestia 设施上最大的生态网络,于今年 9 月 12 日推出其主网 Alpha 版本。

目前,Manta Network 发布的路线图显示,推出主网前将经历四个阶段,分别是 Manta Pacific Alpha 版本,Manta Pacific Alpha II,接入 Celestia DA;Manta Pacific Beta,过渡到 zkEVM;最后对于 Manta Pacific 主网,Manta Pacific 将进一步升级通用电路,以实现更低的 gas 成本。

Eclipse

Eclipse 是一个模块化结算层,可以通过选择所需的共识和 DA 层来创建自定义执行链,Eclipse 在执行环境上支持 EVM 和 SVM,并计划在未来支持更多虚拟机,同时在 DA 层上已经支持 Celestia,未来可能支持 Eigen DA 和 Avail 等协议。

2022 年,Eclipse 完成 1500 万美元 Pre-Seed 轮和种子轮融资,其中早些时候的 600 万美元 Pre-Seed 轮融资由 Polychain 领投, 900 万美元种子轮融资由 Tribe Capital 和 Tabiya 共同领投。

今年 9 月,Eclipse 发布了其主网架构,将利用以太坊作为结算层,运行 Solana 虚拟机(SVM)作为执行环境,将数据发布到 Celestia 实现可扩展 DA,并通过 RISC Zero 完成 ZK 欺诈证明。此外,官方还表示主网预计将在今年年底前上线。

Polymer Labs

Polymer Labs 是一个基于 IBC 构建的模块化网络协议,旨在实现去中心化、安全和无许可的跨链网络。2022 年 3 月,Polymer 宣布完成 360 万美元种子轮融资,Distributed Global 和 North Island Ventures 领投。同年 4 月,Polymer Labs 和 Celestial 达成合作,将 IBC 引入 Optimistic rollups。

除了以上和 Celestia 有紧密联系的生态项目外,还可以在 https://celestia.org/ecosystem/ 查询更多生态项目。