原创 | Odaily星球日报

作者 | 南枳

昨日,Nostr Assets Protocol 宣布了其首次 Fair Mint(NOSTR)的具体细则。本次 Fair Mint 共分为三步:

第一阶段:投入,用户质押 Treat 和 Trick 资产,获得抽奖资格;

第二阶段:抽奖,通过区块哈希值进行奖池抽奖;

第三阶段:申领,从官方界面申领代币。

投入阶段

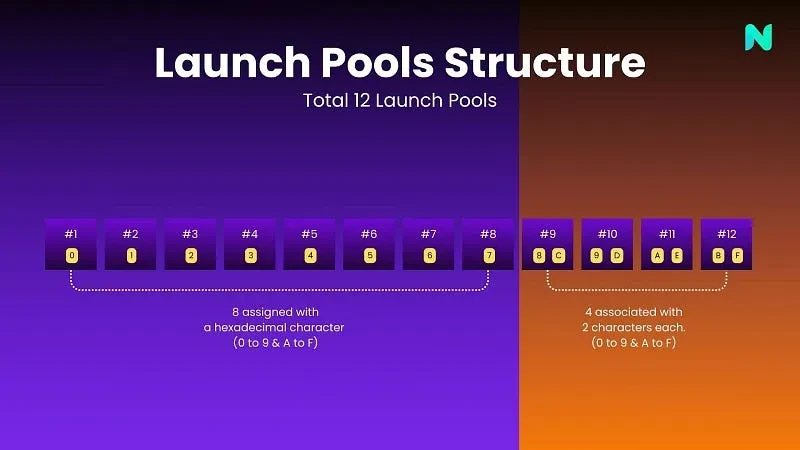

开始时间为 2023 年 12 月 11 日。官方设置了 12 个奖池,后四个奖池获奖概率为前八个奖池的双倍。

用户选择 12 个奖池中的 1 个,投入 Treat 和 Trick 资产,并获得池内排名。

该阶段有以下几个重点:

投入阶段可以持续增加投入资产,排名也是实时的,直至阶段结束。

投入阶段不可退出,一阶段结束时返还 50% ,二阶段(抽奖)结束后返还 50% 。

抽奖阶段

每个区块,按照区块哈希值的十六进制尾号,选择 12 个奖池中的 1 个;

抽中的奖池前 50 名获得一次奖励(再次抽中则为 51-100 名);

共抽取 300 次, 15000 个获奖地址,前 100 次获得 2160 枚 NOSTR, 101-200 名为 1080 枚, 201-300 名为 540 枚。

该阶段有以下几个重点:

如果前 200 个区块没有足够的获胜者,多余的份额将在最后分发,每个人将获得 540 个代币;

每个 Nostr 地址只能投入一个奖池;

每个 Nostr 地址只能获奖 1 次。

代币详情

总量: 21, 000, 000 枚

Fair Mint 量: 18, 900, 000 枚

获奖数: 2160 枚(前 5000 名获奖者), 1080 枚(后 5000 名获奖者), 540 枚 (后 5000 名获奖者)

持续时间: 300 个区块,约 2.1 天(注:比特币网络一个区块约 10 分钟)

产投估算

Treat&Trick 流通量:约8700 万枚(总量 4.2 亿枚)

Treat&Trick 价格: 0.4 USDT(截至 12 月 8 日 13 时)

情况①:假设所有参与人投入数量一致,则单地址投入数量为 8700000/15000 = 5600 枚

情况②:假设所有参与人按照获奖额度决定投入数量,则 15000 地址中,三档投入比例为 4: 2: 1 ,因此最低投入数为 8700000/15000/7* 3 = 2484 枚,最高为 2484 × 6 = 14904 枚。

成本计算

情况①,成本为 5600* 0.4 = 2240 USDT;情况②,最低成本为 993 USDT,最高成本为 2980 USDT。

收益预估

按照每枚 1 USDT 计算,NOSTR 对应的市值为 2100 万美元,接近 Fair Mint 公布前的 Treat&Trick 市值。

情况①下,单号收益约为 18, 900, 000/15000 × 1 = 1260 美元,成本为 2240 美元×预计下跌率,若 Fair Mint 后下跌 56% ,则零收益。

情况②下,最低单号收益约为 540 美元,成本为 993 美元×预计下跌率,若 Fair Mint 后下跌 54 % ,则零收益。

风险提示

因本此 Fair Mint 昨日才公布使用 Treat&Trick 作为投入资产,Treat&Trick 价格短期内上升幅度巨大,存在 Fair Mint 结束后资产大幅折价风险。

比特币生态近期有所退潮,NOSTR 市值预估不明,存在估值不及预期风险。