比特币 [BTC] 正在逐步抹去四月的下跌阴影。截至撰写时,BTC已经突破关键短期阻力 $93.1K,并成功站上 $95.3K —— 这是过去五天横盘区间的高点。

尤其是 $93.1K,也是短期持有者的成本线,价格能稳定在这之上,代表市场情绪开始“回血”。多头重新掌握节奏,短期目标价已瞄准 $107.5K 和 $110K 区间。

资深分析师 Willy Woo 近期也发声看多,直言“BTC下一个目标是 $108K”,而从清算热图来看,大额清算区正密集分布在 $100K~$110K 区间,突破可能一触即发。

MVRV 指标“踩线反弹”,比特币成功完成新一轮牛熊轮替

在 Glassnode Insights 最新数据中,MVRV(市值与实现价值比)曾在4月8日测试关键支撑位 1.74,这是此前日元套利交易爆雷时的下探极限。而这次又一次“触底弹起”,如今已回升至 2.14,显示市场已挺过风暴,再次进入强势区。

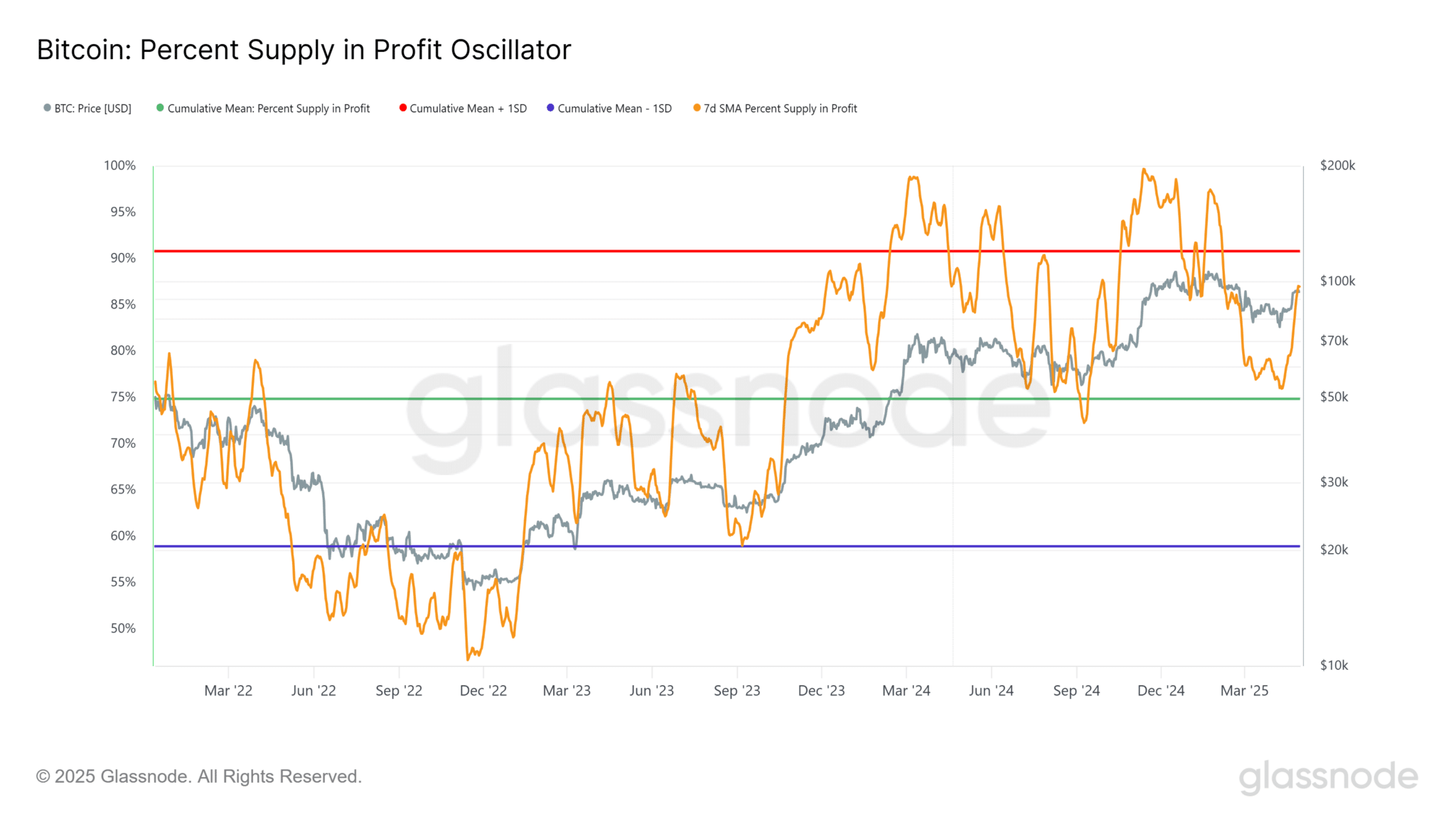

盈利地址回升至 87%,链上信心回暖

另一个重要指标“盈利地址百分比”也给出积极信号。4月初该数据从长期均值74.8%处止跌回升,如今7日均线已达到 87%,表明市场大部分地址又回到盈利状态 —— 和2024年8-9月的反弹节奏如出一辙。

清算热图:上方流动性密集,$100K、$106K、$110K 成磁吸点

根据 Coinglass 的6个月期清算热图,目前下方清算区很稀疏,离当前价格最接近的清算点在 $83K 和 $74.1K。但上方就热闹了:$100K、$106.8K 和 $110.2K 是未来几天最可能“被扫掉”的多头目标。

当前 $96.6K 附近的流动性已经被吃掉,预示短期区间已被打破,市场在寻找新高。

技术面支持继续看涨:短线回踩即买点

1小时K线显示,突破伴随着高交易量。如果回踩 $95.4K 不破,可能是短线进场良机,特别适合追随趋势的交易者。

结语:BTC百K之路,已经重启

链上数据、资金流向、技术结构齐刷刷地指向同一个方向:“比特币重拾牛市节奏”。如果没有突发性黑天鹅事件,下一个重大心理关口 $100K,甚至 $110K,并非梦话。