1.When AI meets Web3

In today's digital age, integrating AI with the Web3 economy is becoming a revolutionary innovation movement, changing our understanding and realization of economics, data, and value exchange. Web3, as a decentralized internet paradigm, focuses on decentralization, autonomy, and user sovereignty. Meanwhile, AI enhances the intelligence and automation of the Web3 economy through its learning and prediction capabilities.

At the infrastructure Layer, AI can optimize the performance and security of blockchain networks. For instance, it can improve the efficiency of the network's consensus mechanism through machine learning algorithms, optimizing transaction speeds while enhancing network security. Additionally, AI technology can ensure privacy protection and secure sharing of user data through encryption techniques and zero-knowledge proofs, laying the foundation for the sustainable development of the Web3 economy.

At the execution Layer, the combination of AI with smart contracts allows complex business logic to be automatically executed without the need for human intervention. AI can analyze on-chain data in real-time, dynamically adjust contract parameters to adapt to market changes and user needs. Furthermore, AI continuously improves contract execution efficiency and response speed through self-learning and optimization, enabling more flexible and intelligent transactions and services.

At the application Layer, the integration of AI has driven the development of a range of innovative applications, such as market prediction, decentralized finance (DeFi) platforms, and personalized services. These applications not only enhance the accuracy and efficiency of transactions but also optimize the user experience. For example, AI can provide more precise and personalized product recommendations, helping users discover and access services and content of interest more easily. Additionally, AI can enable real-time customer support and issue resolution, increasing user satisfaction and loyalty.

This article focuses on analyzing the potential of AI and Crypto integrating and provides a simple forecast of the development of Web3 and AI in the future. Additionally, the article will introduce a one-stop-shop Crypto AI hub - ChainGPT

2.ChainGPT: A one-stop-shop Crypto AI hub

2.1 ChainGPT Introduction

ChainGPT is an advanced AI infrastructure that develops AI-powered technologies for the Web3, Blockchain, and Crypto space. ChainGPT aims to improve the Web3 space for retail users & startups by developing AI-powered solutions designed explicitly for Web3. From LLMs to Web3 AI Tools, ChainGPT is the go-to place to boost your Web3 flow with Artificial Intelligence.

Using ChainGPT, users may quickly get whatever knowledge and information they want. With many other unique features designed for individuals, developers, and businesses, ChainGPT is an essential tool for all who are blockchain enthusiasts.

2.2 Team Background

ChainGPT's team is comprised of professionals from different fields and countries, with several core members, including:

• Ilan Rakhmanov, Founder and CEO, has founded multiple companies and has experience in coding, compliance, business, design, marketing, management, and law.

• Ariel Asafov, COO, is an industrial engineer who has managed the Israeli Railways system and has been responsible for product development in other tech companies.

2.3 ChainGPT's Solutions

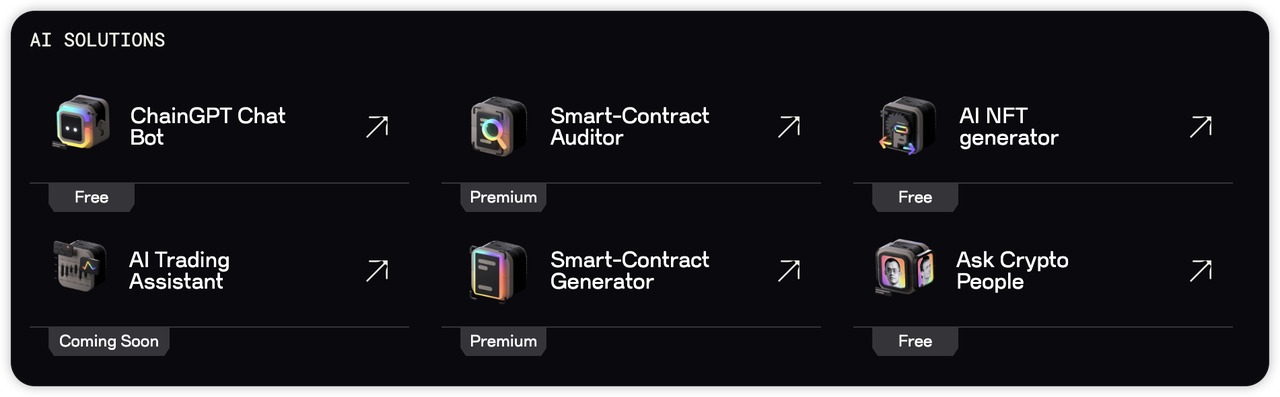

From the versatility presented on ChainGPT's official website, it's evident that it is not just an ordinary tool but a multi-layered, multifunctional platform that offers a wide range of services and features for users. First and foremost, it provides precise data and in-depth insights in the blockchain and cryptocurrency space, helping users gain a better understanding of this rapidly evolving field. Its no-code smart contract generator disrupts traditional programming methods, making it easy for non-professionals to create smart contracts and driving the widespread adoption and application of smart contract technology. Smart contract auditors ensure the security and reliability of contracts, providing users with a secure trading environment.

From a developer's perspective, ChainGPT's code debugger provides programmers with an efficient debugging tool, making it easier for them to pinpoint and resolve issues in their code. Furthermore, its unique code-to-natural-language feature translates code into easily understandable language, facilitating communication not only within the team but also with non-technical individuals. Additionally, the document creator offers users a convenient service for document editing and production, enhancing team collaboration efficiency. The chart analysis and technical analysis features also allow users to gain a better understanding of market trends and investment opportunities, providing robust support for investment decisions.

In terms of security, the AML and blockchain analysis features ensure the legality and privacy of user transactions, providing comprehensive security. Additionally, the real-time on-chain data feature allows users to access the latest blockchain data at any time, offering timely support for decision-making. Lastly, the news source feature not only enriches users' information sources but also provides them with multidimensional and multi-perspective information analysis, aiding in making wiser decisions.

In summary, the versatility of ChainGPT is not just a service but an integration of technology and intelligence, providing users with a comprehensive, efficient, and secure platform, driving the development of the blockchain and crypto space.

3.The Future of "AI+Web3"

The author observed the development of AI. From the application development perspective, AI and Web3 may evolve in the following three directions, leading to the emergence of phenomenal applications.

3.1 Innovative Integration of NFTs and Metaverse

With the support of AIGC's Stable Diffusion model and technologies like Mid-journey, many companies are working on integrating creativity and image generation functionalities related to NFT projects and the metaverse. Currently, this field is experiencing rapid development, although it's not perfect yet. We expect to see a multitude of creativity emerging in the next 6 months. Due to the open-source nature of Stable Diffusion, the Web3 space will witness a variety of PFP and avatar generation models in different styles. Moreover, the quality of images and animations will continue to improve, delivering even more exquisite works to users.

3.2 Development of AI-Assisted Trading Strategies

In the field of AI-assisted trading strategies, some companies have already introduced AI-based trading bots, although most of them are relatively simple. These systems typically require users to input commands and strategies in natural language. Projects like Dune have also introduced what they call "AI queries," which essentially translate natural language into SQL language. We expect that in the next 6 to 12 months, this field will see the emergence of more sophisticated solutions. Therefore, we will closely monitor the development of these quantitative and market-making projects, as their integration could significantly enhance the appeal of our platform to users.

3.3 Web3 domain specific AI Model

In the Web3 space, there is great anticipation for the development of domain specific AI models. While public data in the Web3 domain is relatively limited, with most data being private, some efforts have begun to train models specifically for the cryptocurrency market using Web3-related data, similar to OpenAI's GPT. We expect that in the next 12 months or so, we will see the emergence of "chatGPT models" tailored to the cryptocurrency field. These models will be capable of generating responses related to the cryptocurrency domain and will find applications in scenarios such as post-information retrieval processing, on-chain contract auditing, sentiment analysis, and potentially even coin listing evaluations (although cost-effectiveness considerations will be important). The development in this field is expected to make significant strides in the next 12 months.

4.Conclusion

The integration of AI with Web3 represents a revolution in the digital age, redefining the rules of economics, data, and value exchange. At the infrastructure layer, AI optimizes the performance and security of blockchain networks, laying a solid foundation for the Web3 economy. At the execution layer, combining AI with smart contracts enables the automated execution of business logic, providing more intelligent and more flexible transactions and services. At the application layer, AI brings innovative applications, from market predictions to personalized services, offering users more efficient and personalized experiences.

In this ever-evolving field, ChainGPT, as an all-in-one AI and artificial intelligence platform, provides multi-layered and multi-functional solutions for the Web3, blockchain, and crypto space. Its powerful features, including smart contract generation, auditing, code debugging, document creation, data analysis, and more, offer users comprehensive support and services.

Looking ahead, we can expect deeper integration of AI with NFTs and the metaverse, more innovative developments in trading strategies, and rapid advancements in vertical AI models for the Web3 space. All of this will drive continuous innovation in the digital economy, opening up more possibilities for users. In this dynamic field, ChainGPT will continue to play a leading role in shaping the future of Web3 and AI.