AttitudeGirlB9

06/14 04:19

Derivatives data points to weak market conviction

Derivatives data points to weak market conviction

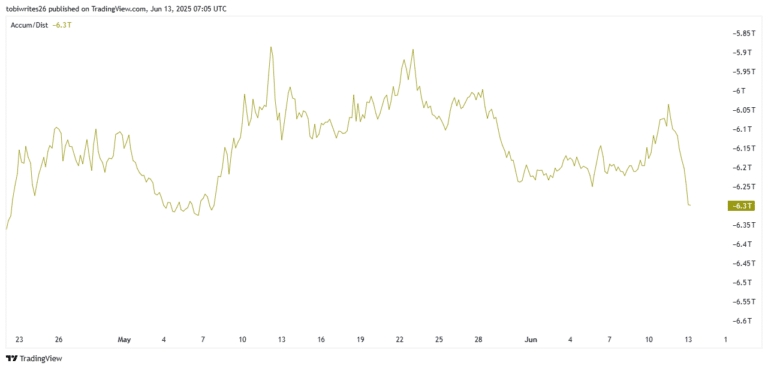

The selling pressure appears broad-based. Accumulation/Distribution (A/D) printed a reading of -6.3 trillion, confirming a dominant exit phase.

Additionally, the Parabolic Stop and Reverse (SAR) aligns with this sentiment, as dots have formed above the current price. If more dots form, it would imply increased selling volume in the market.

Finally, the Moving Average Convergence Divergence (MACD) has confirmed a death cross pattern.

This pattern forms when the MACD blue line crosses below the signal orange line, indicating a likely significant price drop.

#Check In Weekly, Win Prizes Weekly — Join the Fun!#Claim1,200 USDT in the Monthly Creation Challenge#Share Your Thoughts on Popular Assets in June

3Compartir

Todos los comentarios0Lo más recientePopular

No hay registros