Ari Emanuel is working on a memoir, Page Six hears.

We’re told the famed agency head and fight mogul is shopping the book around, and editors are said to be drooling at the prospect.

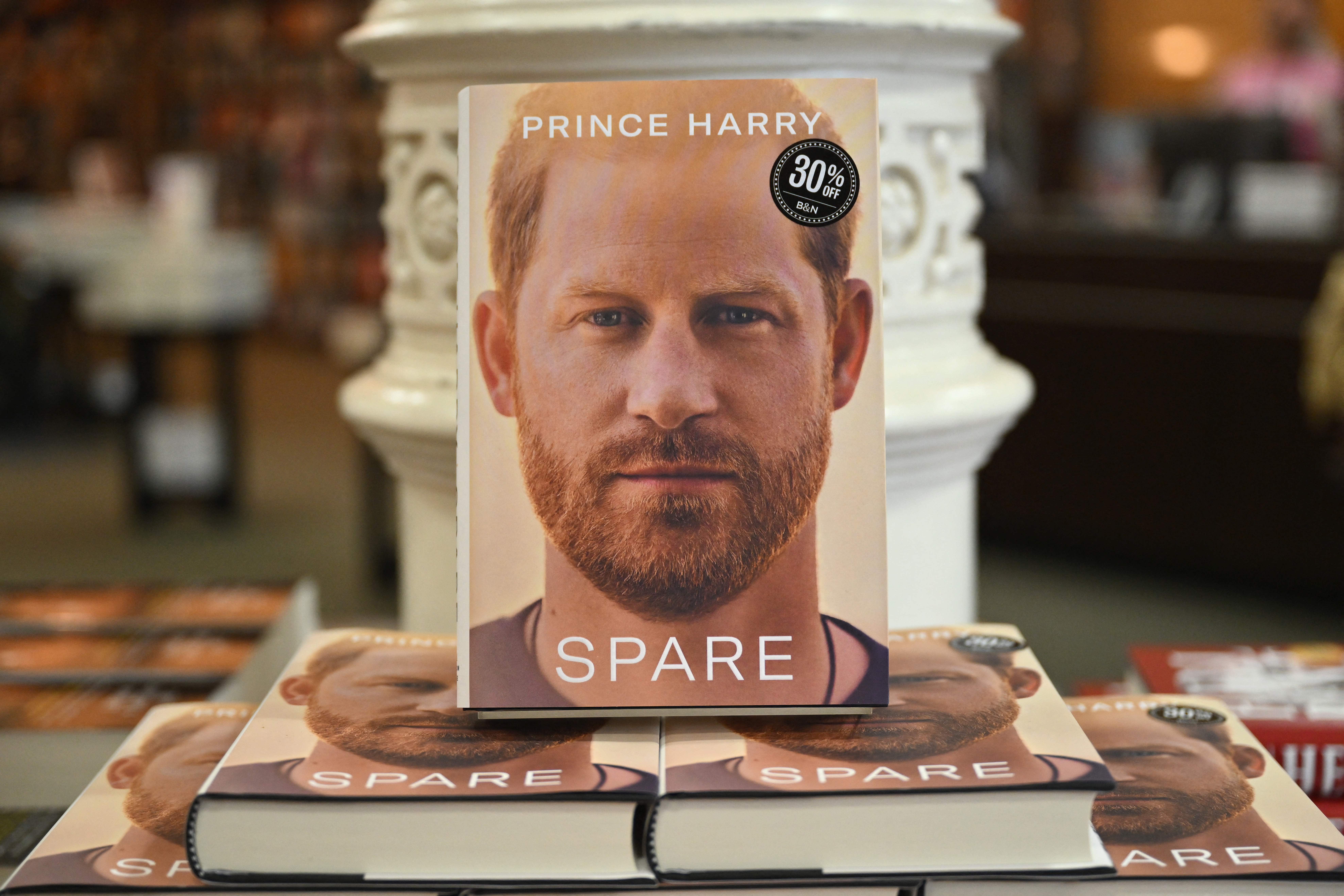

“Think of it as Ari’s ‘Shoe Dog’ or ‘Spare,’ ” said an insider, referring to the blockbuster 2016 memoir by Nike co-founder Phil Knight and the even-more-blockbuster 2023 memoir by Prince Harry.

It’ll no doubt be lapped up by business types hoping to learn from Emanuel’s stratospheric success as the founder of the Endeavor talent agency, which merged with the William Morris Agency in 2009 to create a Hollywood megalith, as well as his time as the head of TKO Group Holdings, which owns both the UFC mixed martial arts championship and the WWE wrestling brand — two of the biggest sports franchises on earth.

(Needless to say, the book is being repped by William Morris Endeavor).

WME’s failed initial public offering in 2019 was a major business saga, and an inside look at that debacle would also likely be a draw for the Forbes-reading crowd.

But Emanuel also has an intriguing personal life, since he’s the brother of Rahm Emanuel, former Obama chief of staff, mayor of Chicago and representative.

It seems the book is expected to make some serious cash.

We’re told he’s working with Pulitzer Prize winner JR Moehringer, who, we’re told, doesn’t sharpen his pencil for less than $1 million.

Moehringer worked on both the Knight and Harry books, as well as Andre Agassi’s book, “Open: An Autobiography,” which was also a runaway bestseller.

Ari and Rahm’s older brother, Zeke, wrote a memoir about the extraordinary family in 2013: “Brothers Emanuel: A Memoir of an American Family.”

Reps for Ari didn’t get back to us.