一份意外疲软的就业报告,正让市场开始热议去年“7月按兵不动、9月大幅降息”的剧本是否会重演,有“新美联储通讯社”之称的Nick Timiraos和知名经济学家El-Erian都点出当前的场景有“似曾相识”之感。

就在本周美联储宣布维持利率不变后,周五公布的7月非农就业数据却显示,美国劳动力市场正在以惊人的速度降温。数据不仅远低于预期,对前两个月就业人数的大幅下修更是揭示了经济潜在的疲弱程度,这让美联储此前的观望立场备受考验。

面对这份疲软的就业报告,贝莱德全球固定收益首席投资官Rick Rieder直言:

今天的报告提供了美联储9月份调整利率所需的证据,因此唯一的问题是调整幅度有多大。

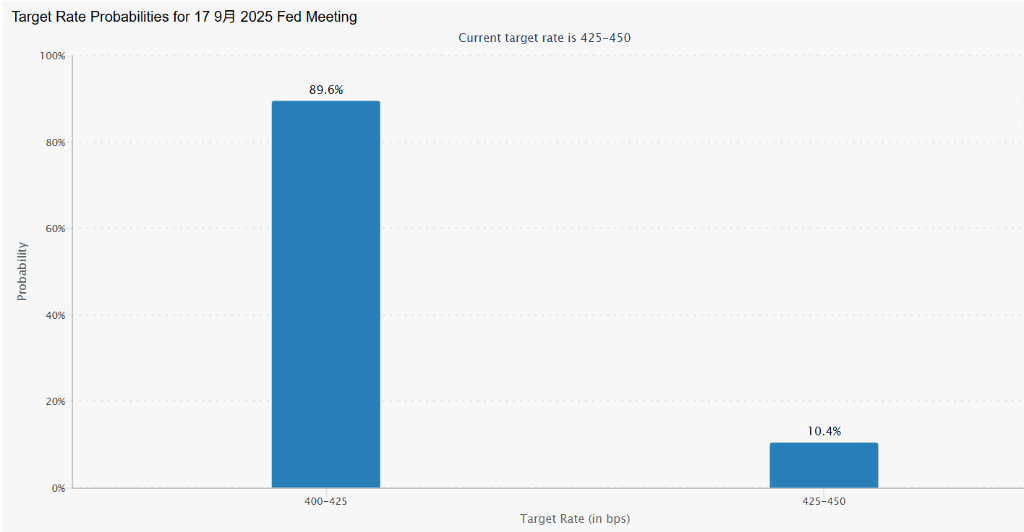

据芝商所数据,美联储在9月会议上降息的概率从周四的不足40%飙升至近90%。

(9月降息25基点概率高达89.6%)

(9月降息25基点概率高达89.6%)

历史重演?市场押注美联储“补救式”降息

就业市场的骤然降温,让市场立即联想到了去年夏天美联储的政策轨迹。

当时,美联储在7月的会议上同样选择不降息,但两天后发布的疲弱就业报告改变了局势。最终,官员们在9月的会议上以降息50个基点(超过常规的25个基点)的方式进行了“补救”。

而在7月美联储利率决议前,知名经济学家El-Erian就曾发帖前瞻美联储的潜在利率路径:

美联储完全重演去年模式的可能性有多大?具体来说,美联储在7月份维持利率不变,然后在9月份大幅降息,尽管在此期间经济状况看似没有变化。

此前据华尔街见闻,知名财经记者Nick Timiraos同样表示当前情景可能让美联储官员产生“似曾相识”之感。

然而,Timiraos指出,两者之间存在一个关键差异:去年,美国通胀正处于持续回落的通道中;而今年,由于春季以来特朗普政府实施的一系列广泛加征关税的举措,美联储官员们反而担心通胀压力可能回升。

因此Timiraos强调美联储面临的关键问题在于:美国经济基本面是否真的在恶化,还是说近期的放缓只是某些政策影响滞后所致、属于暂时现象。

但贝莱德全球固定收益首席投资官Rick Rieder在周五下午给客户的报告中表示:

如果劳动力市场的闲置状况加剧,或者新增就业持续低于10万,预计美联储将开始降息,且9月份降息50个基点是可能的。

值得注意的是,尽管Rieder提出了大幅降息50个基点的可能性,但目前的期货市场价格显示,交易员们认为发生这种情况的概率为零。

在9月会议之前,决策者还将获得一份就业报告和两个月的通胀数据,这些信息将共同决定,美联储是会选择谨慎观望,还是会像去年一样,用一次果断的行动来回应正在变化的经济前景。