Ripple's Bullish Sentiment Grows: What Will Trigger XRP's Breakthrough to $2.65?

XRP analysts point out that as institutional demand increases and derivative traders turn bullish, XRP is expected to rebound to $2.65.

XRP price has risen 3% in the past 24 hours, climbing 15.5% from the low on November 21, reaching $2.10 on Monday. Multiple fundamental, on-chain data, and technical factors collectively support its potential for further growth.

Key Points:

Driven by increased institutional demand and trader bullish sentiment, XRP is expected to create new historical highs.

XRP price technical analysis, particularly the symmetrical triangle pattern, suggests a potential 27% rise to $2.65.

Investors Pour Heavily into XRP Investment Products

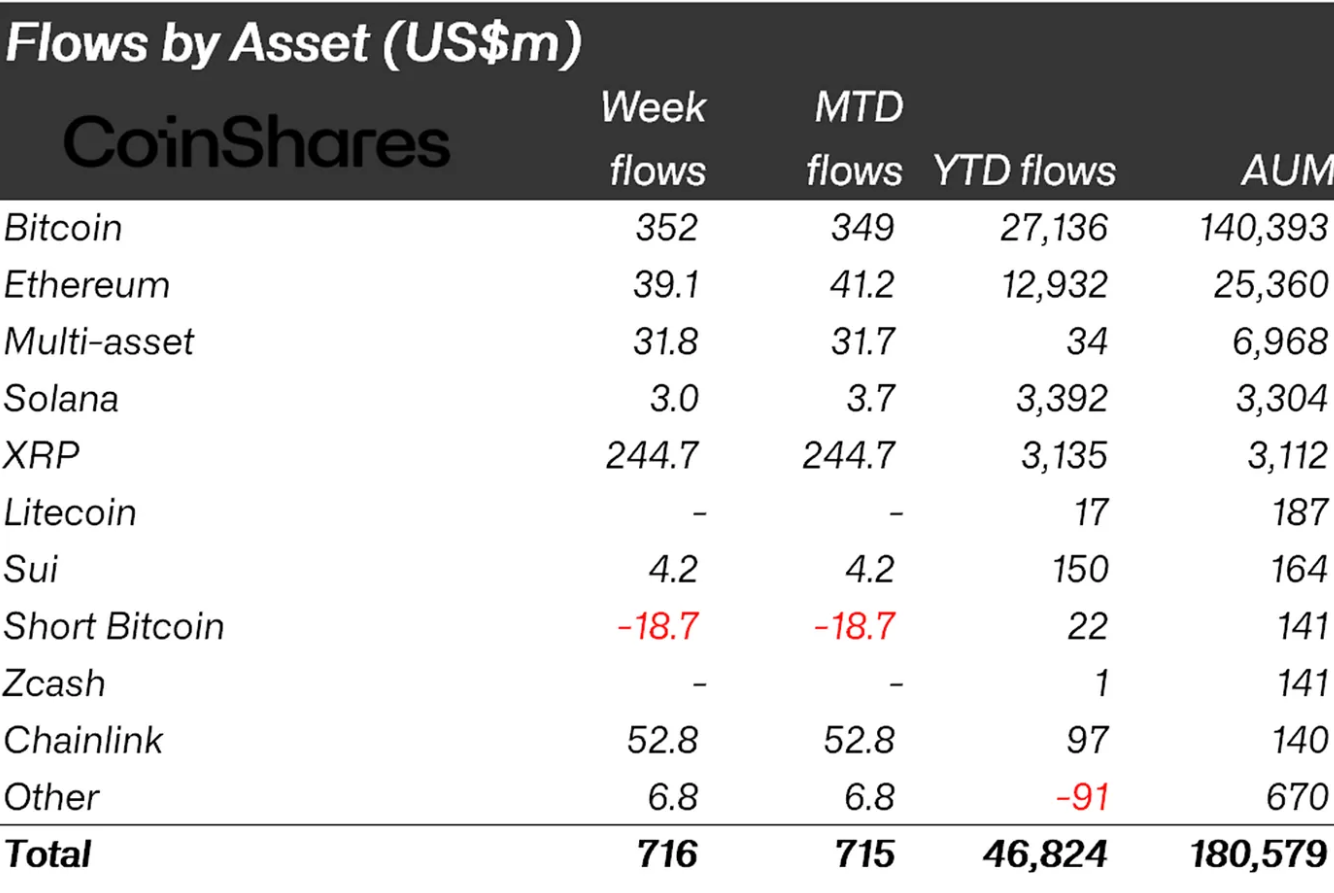

According to CoinShares data, institutional demand for XRP investment products remains strong.

XRP exchange-traded products (ETPs) attracted a total of $245 million in capital inflows in the week ending December 5. James Butterfill, Head of Research at CoinShares, stated in his latest Digital Asset Fund Flows Weekly Report: "This brings the year-to-date inflows to $3.1 billion, far exceeding the $608 million inflows in 2024." He further pointed out:

"ETP investors believe the current negative market sentiment may have bottomed out."

Meanwhile, spot XRP exchange-traded funds (ETFs) continue to maintain their perfect record, recording $10.23 million in capital inflows on Friday, achieving 15 consecutive days of net inflows.

According to SoSoValue data, this continuous inflow trend has pushed the cumulative inflow amount to nearly $900 million, with assets under management (AUM) reaching $861.3 million.

Cryptocurrency investor Giannis Andreou stated in a Monday X platform post: "For 15 consecutive days, every U.S. spot $XRP ETF has shown green capital inflows, pushing total assets close to $900 million." He also noted that these investment products have locked over 4 billion XRP tokens.

Andreou added:

"This accumulation phenomenon usually occurs before a shift in the market narrative."

As reported by Cointelegraph, the continuous spot XRP ETF fund inflows are likely to determine XRP's next phase price trend.

XRP Traders Lean Bullish

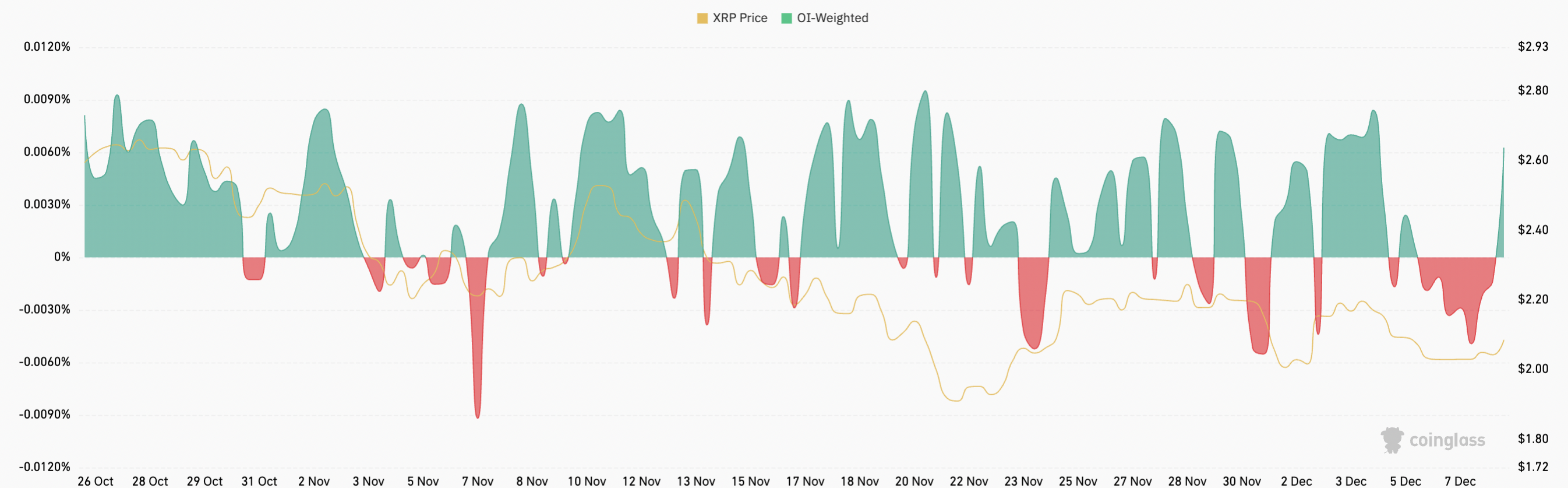

XRP price is expected to rise as leveraged traders steadily increase their interest in establishing new positions, indicating that speculative momentum is strengthening.

XRP's daily funding rate has turned positive at 0.0189% from the previous day's 0.0157%, indicating that the majority of traders are establishing long positions.

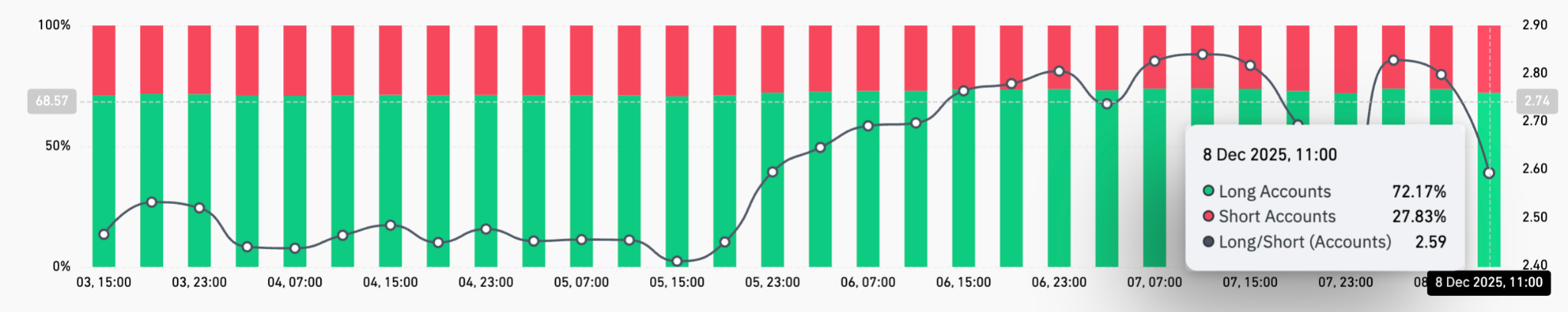

The long/short account ratio on the Binance platform currently favors long positions at 72%. Although this high activity introduces liquidation risks, it also highlights the market's increasing confidence in XRP's upward potential.

Analysts from the trading platform Beacon observed a similar situation, noting that traders on Hyperliquid are leaning bullish on XRP, with longs at 72%, representing $94.5 million worth of XRP, compared to 28% short exposure at $37.6 million.

New week, fresh sentiment.@HyperliquidX traders are leaning bullish with 55.3% longs across the market. $XRP is even stronger: 72% long vs 28% short with $94.5M long exposure against $37.6M short exposure.

— Beacon (@beacontradeio) December 8, 2025

How are you feeling about the market right now? pic.twitter.com/0U6HdvbnTC

XRP Symmetrical Triangle Breakout Targets $2.65

Data from Cointelegraph Markets Pro and TradingView shows, as indicated in the chart below, that XRP's trading price has broken out of a symmetrical triangle pattern on the four-hour timeframe.

The price needs to close above the triangle's upper trendline at $2.15 to continue the upward trajectory, with a measured target of $2.65.

Such a move would represent a total gain of 27% from current levels.

Pseudonymous trader BD stated in a Monday X platform post: "The symmetrical triangle on the 1-hour chart shows XRP is consolidating tightly," and added,

"A breakout here could trigger a rally of up to 16%, pushing the price towards the $2.40 area."

As reported by Cointelegraph, a daily close above $2.30 would confirm the structural breakout and could trigger a move towards $2.58, provided the $2 support level remains stable.

Related Recommendation: VC Financing Review: Capital Volume Remains Huge, But Deal Count Decreases, Crypto Venture Capital is Drying Up

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. Although we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements subject to risks and uncertainties. Cointelegraph is not responsible for any losses or damages resulting from reliance on this information.