Author:Poopman

Compiled by: Deep Tide TechFlow

Ansem announced the market peak, and CT called this cycle "criminal."

Projects with high FDV (Fully Diluted Valuation) but no real applications have squeezed the last penny out of the crypto space. Memecoin pump-and-dump schemes have tarnished the industry's reputation in the public eye.

To make matters worse, almost no funds have been reinvested into the ecosystem.

On the other hand, almost all airdrops have turned into "pump-and-dump" scams. The sole purpose of Token Generation Events (TGE) seems to be providing exit liquidity for early participants and teams.

Dedicated holders and long-term investors are suffering heavy losses, and most altcoins have never recovered.

The bubble is bursting, token prices are crashing, and people are furious.

Does This Mean It's All Over?

Tough times create strong players.

To be fair, 2025 wasn't a bad year.

We witnessed the birth of many excellent projects. Projects like Hyperliquid, MetaDAO, Pump.fun, Pendle, and FomoApp have all proven that there are still genuine builders in this space working hard to push development in the right way.

This is a necessary "purification" to weed out bad actors.

We are reflecting and will continue to improve.

Now, to attract more capital inflow and users, we need to demonstrate more practical applications, real business models, and revenue that can bring actual value to tokens. I believe this is the direction the industry should move in for 2026.

2025: The Year of Stablecoins, PerpDex, and DATs

Stablecoins Mature

In July 2025, the Genius Act was officially signed, marking the first regulatory framework for payment stablecoins, requiring them to be 100% backed by cash or short-term Treasury bonds.

Since then, traditional finance (TradFi) interest in the stablecoin space has grown daily, with net inflows into stablecoins exceeding $100 billion this year alone, making it the strongest year in stablecoin history.

RWA.xyz

Institutions favor stablecoins and see great potential in replacing traditional payment systems for reasons including:

-

Lower cost and more efficient cross-border transactions

-

Instant settlement

-

Low transaction fees

-

24/7 availability

-

Hedging against local currency volatility

-

On-chain transparency

We witnessed major M&A moves by tech giants (like Stripe acquiring Bridge and Privy), Circle's IPO being oversubscribed, and multiple top banks collectively expressing interest in launching their own stablecoins.

All this indicates that stablecoins have indeed been maturing over the past year.

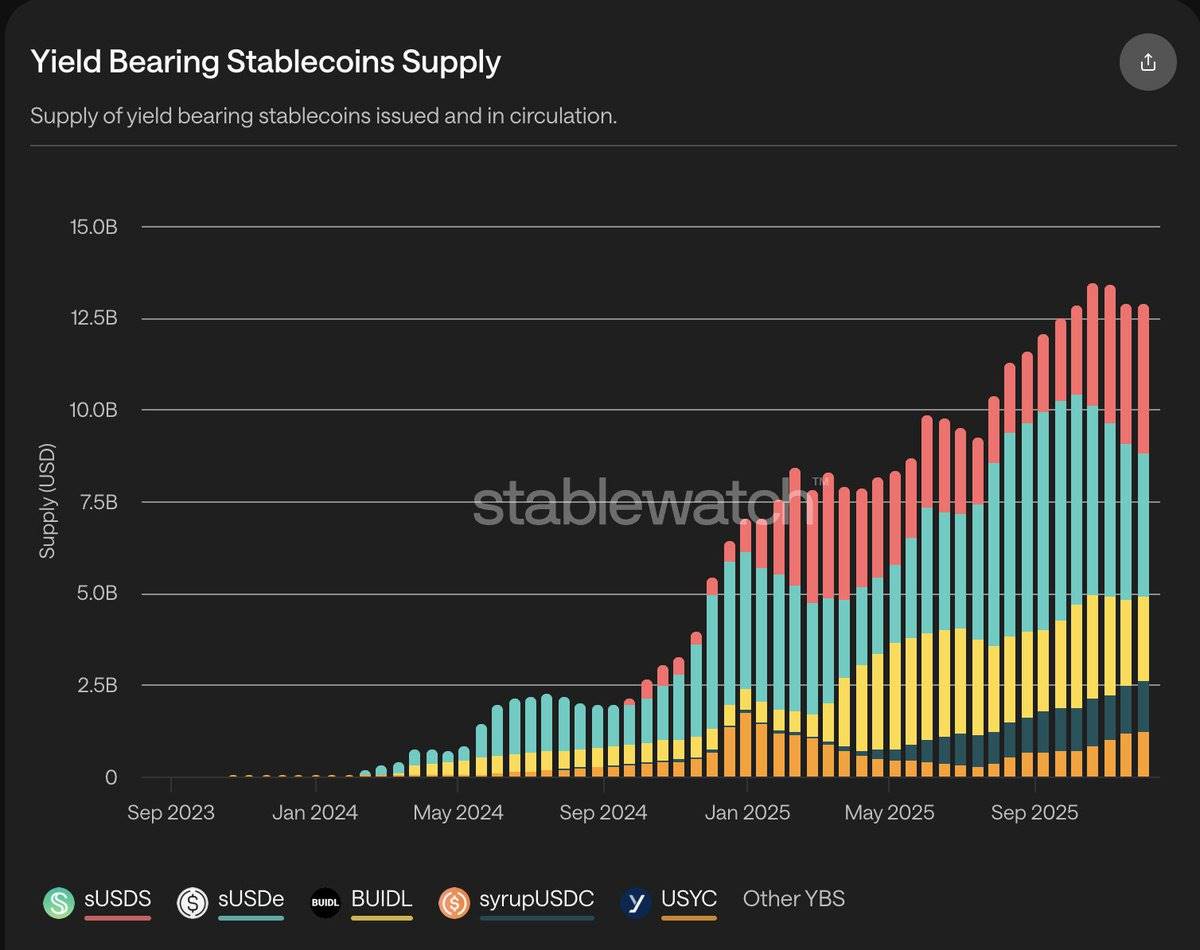

Stablewatch

Beyond payments, another major application for stablecoins is earning permissionless yield, which we call Yield Bearing Stablecoins (YBS).

This year, the total supply of YBS actually doubled, reaching $12.5 billion, driven primarily by yield providers like BlackRock BUIDL, Ethena, and sUSDs.

Despite the rapid growth, recent events like the Stream Finance incident and broader weak crypto market performance have dampened sentiment and reduced yields on these products.

Nonetheless, stablecoins remain one of the few truly sustainable and growing businesses in crypto.

PerpDex (Perpetual Decentralized Exchanges):

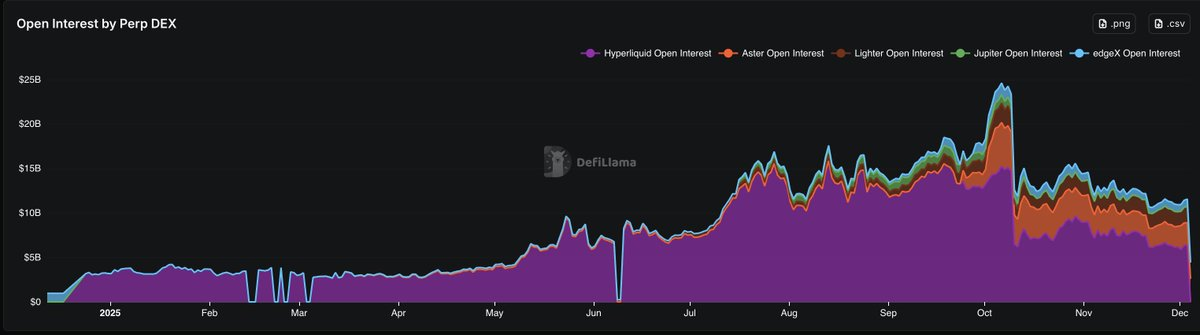

PerpDex was another star this year.

According to DeFiLlama, PerpDex open interest (OI) grew on average 3–4x, from $3 billion to $11 billion, and even peaked at $23 billion.

Perpetual trading volume also surged massively, skyrocketing 4x since the start of the year from an astonishing $80 billion weekly volume to over $300 billion weekly volume (partly fueled by points farming), making it one of the fastest-growing sectors in crypto.

However, both metrics have started to show signs of slowing down since the market correction on October 10th and the subsequent market downturn.

PerpDex Open Interest (OI), Data Source: DeFiLlama

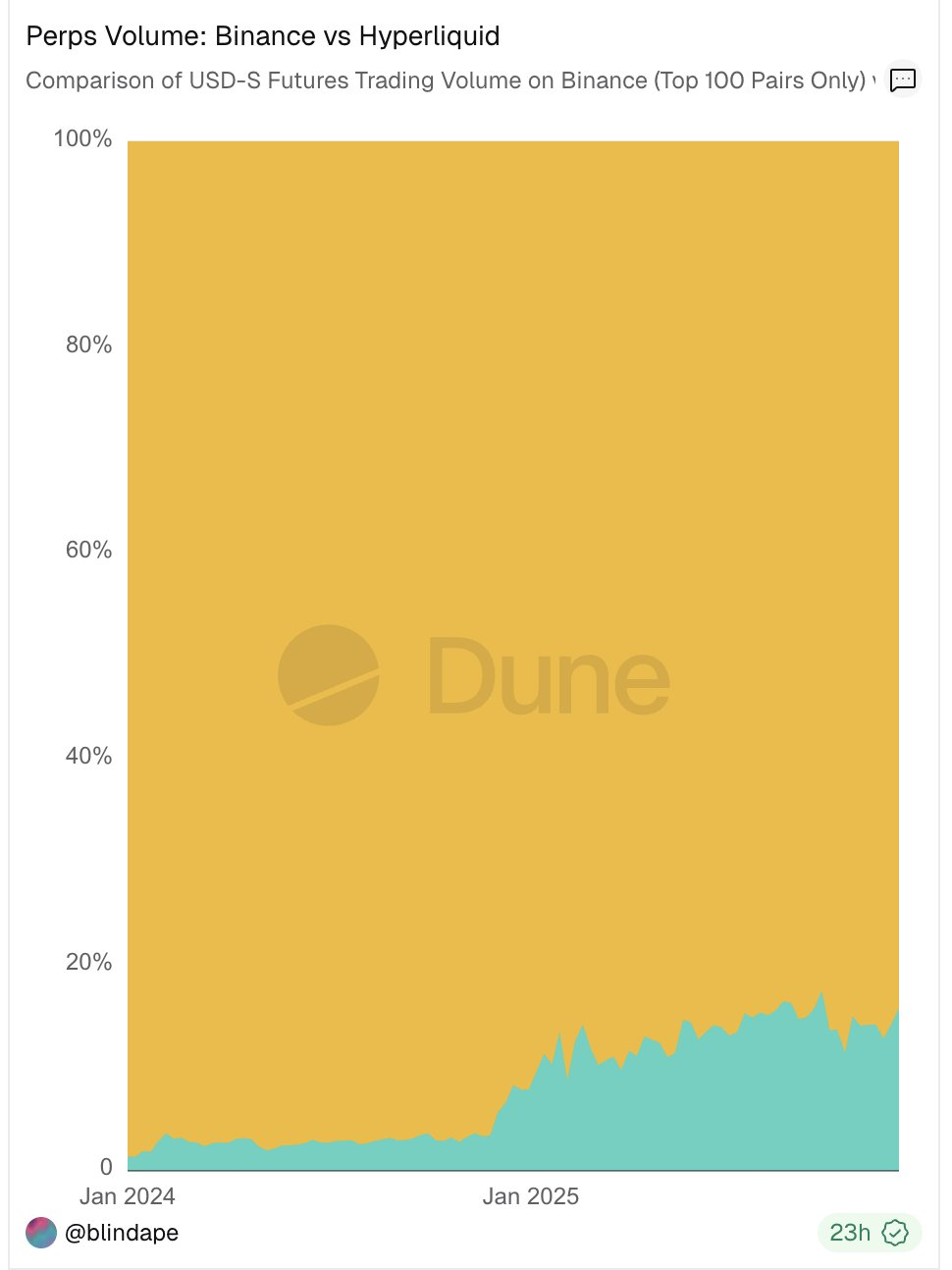

The rapid growth of Perpetual Decentralized Exchanges (PerpDex) poses a real threat to the dominance of Centralized Exchanges (CEX).

Take Hyperliquid, for example; its perpetual trading volume has reached 10% of Binance's, and the trend continues. This is not surprising, as traders can find advantages on PerpDex that CEX perpetuals cannot offer:

-

No KYC (Know Your Customer)

-

Decent liquidity, sometimes comparable to CEX

-

Airdrop speculation opportunities

The valuation game is another key point.

Hyperliquid demonstrated that Perpetual DEXs (PerpDex) can achieve extremely high valuation caps, attracting a wave of new competitors into the arena.

Some new competitors are backed by large VCs or CEXs (like Lighter, Aster, etc.), while others try to differentiate through native mobile apps, loss compensation mechanisms (like Egdex, Variational, etc.).

Retail investors had high expectations for the high FDV at the launch of these projects, coupled with anticipation for airdrop rewards, leading to the "POINTS WAR" we see today.

Although PerpDex can be highly profitable, Hyperliquid chose to buy back $HYPE through an "Assistance Fund," reinjecting profits back into the token (accumulating to 3.6% of the total supply).

This buyback mechanism, by providing actual value flowback, became a major driver of the token's success and effectively pioneered the "buyback meta" trend—prompting investors to demand stronger value anchors, not high-FDV governance tokens with no real utility.

DAT (Digital Asset Trusts):

Due to Trump's pro-crypto stance, we saw massive institutional and Wall Street capital flowing into crypto.

DATs, inspired by MicroStrategy's strategy, have become a primary way for TradFi to gain indirect exposure to crypto assets.

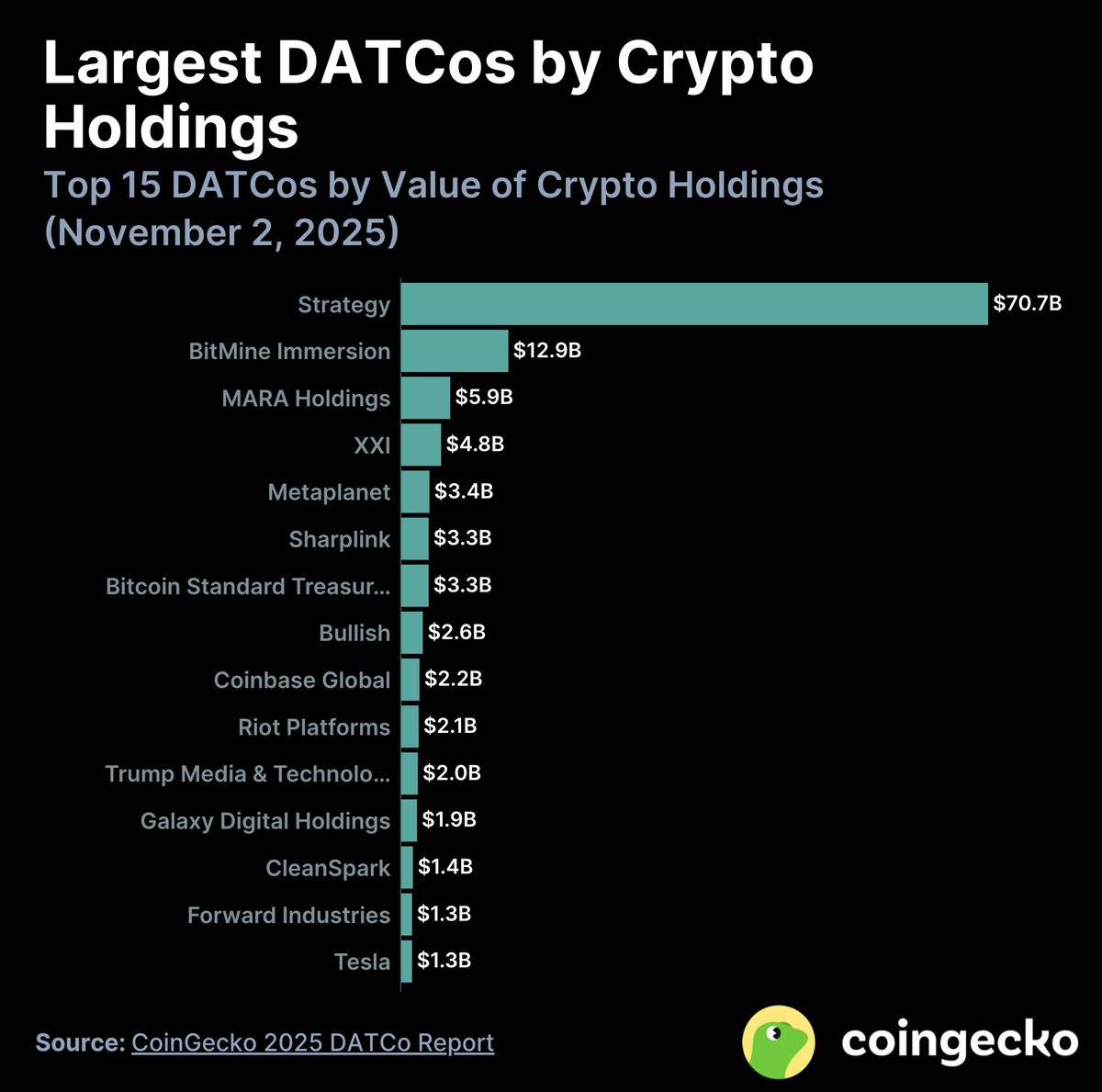

Over the past year, approximately 76 new DATs were created. Currently, DAT treasuries hold $137 billion worth of crypto assets. Over 82% is Bitcoin (BTC), about 13% is Ethereum (ETH), and the rest is scattered among various altcoins.

See the chart below:

Bitmine (BMNR)

Bitmine (BMNR), launched by Tom Lee, became an iconic highlight of this DAT frenzy and the largest ETH buyer among all DAT participants.

However, despite early hype, most DAT stocks experienced "pump-and-dump" patterns within the first 10 days. Since October 10th, inflows into DATs plummeted 90% from July levels, and the market NAV (mNAV) for most DATs has fallen below 1, indicating premiums have vanished, and the DAT frenzy is largely over.

In this cycle, we learned the following:

-

Blockchain needs more real-world applications.

-

The primary use cases in crypto remain trading, yield, and payments.

-

People now prefer protocols with fee-generation potential over pure decentralization (Source: @EbisuEthan).

-

Most tokens need stronger value anchors, tied to protocol fundamentals, to protect and reward long-term holders.

-

A more mature regulatory and legislative environment will provide greater confidence for builders and talent to join the space.

-

Information has become a tradable asset on the internet (Source: PM, Kaito).

-

New Layer 1/Layer 2 projects without a clear niche or competitive advantage will fade away.

So, what's next?

2026: The Year of Prediction Markets, More Stablecoins, More Mobile Apps, and More Real Revenue

I believe the crypto space will move in the following four directions in 2026:

-

Prediction Markets

-

More Stablecoin Payment Services

-

Greater Adoption of Mobile DApps

-

More Real Revenue Realization

Still Prediction Markets

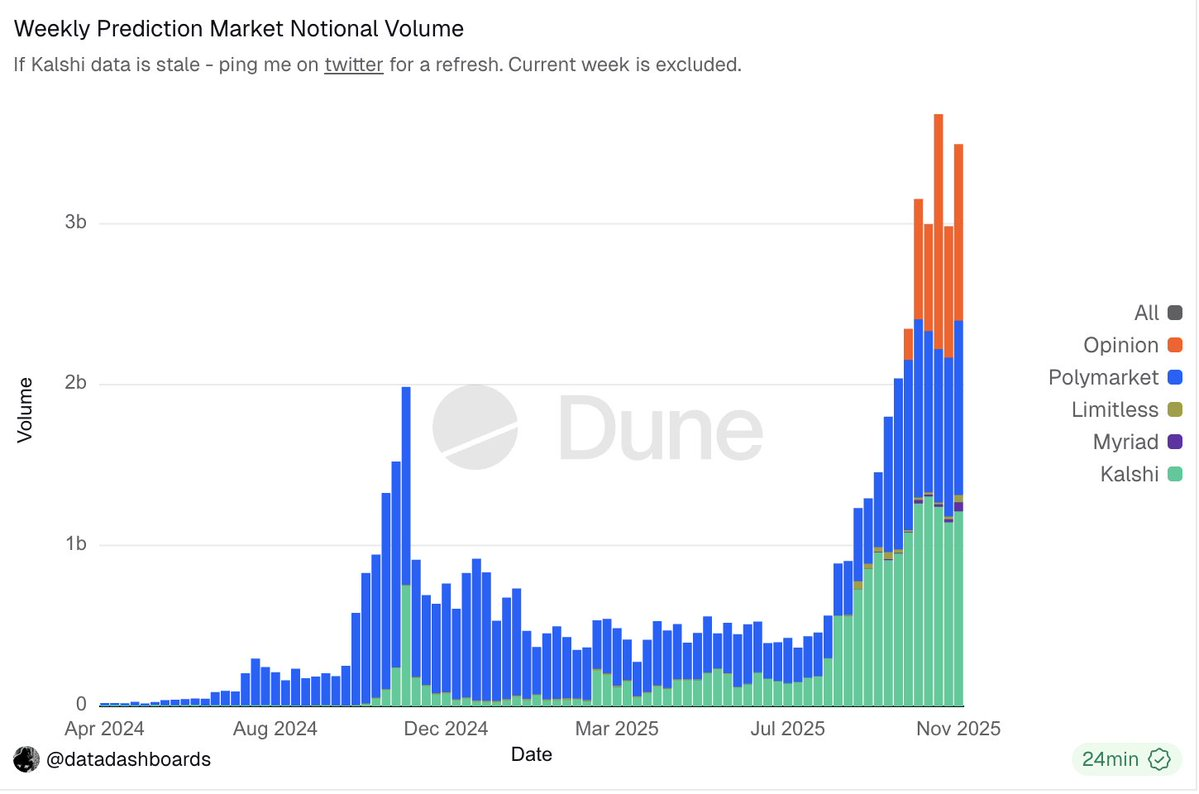

Undoubtedly, prediction markets have become one of the hottest sectors in crypto.

"Bet on anything"

"90% accuracy in predicting real-world outcomes"

"Participants bring their own risk-taking"

These headlines have attracted massive attention, and the fundamentals of prediction markets are equally compelling.

As of writing, the total weekly trading volume of prediction markets has surpassed the peak during the election period (even including wash trading volume back then).

Today, giants like Polymarket and Kalshi completely dominate distribution channels and liquidity, leaving little room for competitors without significant differentiation to gain meaningful market share (Opinion Lab being an exception).

Institutions are also piling in. Polymarket received investment from ICE at an $8 billion valuation, and its secondary market valuation has reached $12–15 billion. Meanwhile, Kalshi completed a Series E round at an $11 billion valuation.

This momentum is unstoppable.

Moreover, with the upcoming $POLY token, impending IPO, and mainstream distribution channels through platforms like Robinhood and Google Search, prediction markets are likely to be one of the major narratives of 2026.

That said, there is still much room for improvement in prediction markets, such as optimizing outcome resolution and dispute mechanisms, developing methods to handle malicious traffic, and maintaining user engagement over long feedback cycles.

Beyond the dominant players, we can also expect new, more personalized prediction markets, such as @BentoDotFun.

Stablecoin Payments Space

Following the enactment of the Genius Act, increased institutional interest and activity in stablecoin payments have been a key driver for their broader adoption.

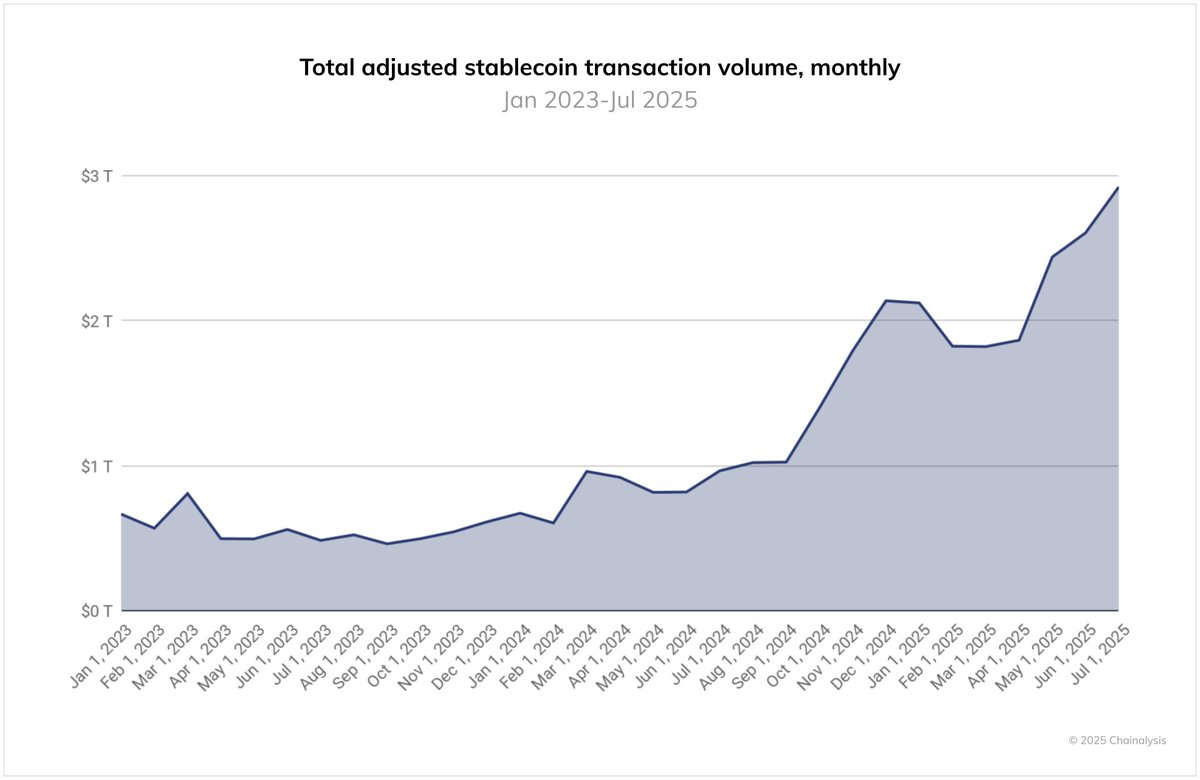

Over the past year, monthly stablecoin transaction volume has climbed to nearly $3 trillion, and the adoption rate is accelerating rapidly. While this may not be a perfect metric, it clearly shows significant growth in stablecoin usage post-Genius Act and the European MiCA framework.

On the other hand, Visa, Mastercard, and Stripe are actively embracing stablecoin payments, whether by supporting stablecoin spending through traditional payment networks or partnering with CEXs (like Mastercard with OKX Pay). Merchants can now choose to accept stablecoin payments regardless of the customer's payment method, demonstrating the confidence and flexibility of Web2 giants in this asset class.

Meanwhile, crypto neo-banks like Etherfi and Argent (now rebranded as Ready) have started offering card products, allowing users to spend stablecoins directly.

Take Etherfi, for example; its daily spending has steadily grown to over $1 million, with no signs of slowing down.

Etherfi

That said, we cannot ignore the challenges still faced by crypto neo-banks, such as high user acquisition costs (CAC) and the difficulty of profiting from deposited funds due to user self-custody.

Some potential solutions include offering in-app token swaps or repackaging yield products as financial services sold to users.

With payment-focused chains like @tempo and @Plasma gearing up, I expect significant growth in the payments sector, especially driven by the distribution power and brand influence brought by Stripe and Paradigm.

Adoption of Mobile Applications

Smartphones are becoming increasingly ubiquitous globally, and younger generations are driving the shift towards digital payments.

To date, nearly 10% of daily global transactions are conducted via mobile devices. Southeast Asia leads this trend due to its "mobile-first" culture.

Payment Method Rankings by Country

This represents a fundamental behavioral shift in traditional payment networks. I believe this shift will naturally extend to the crypto space as mobile transaction infrastructure has improved significantly compared to a few years ago.

Remember account abstraction (Account Abstraction) in tools like Privy, unified interfaces, and mobile SDKs?

Today's mobile user onboarding experience is much smoother than it was two years ago.

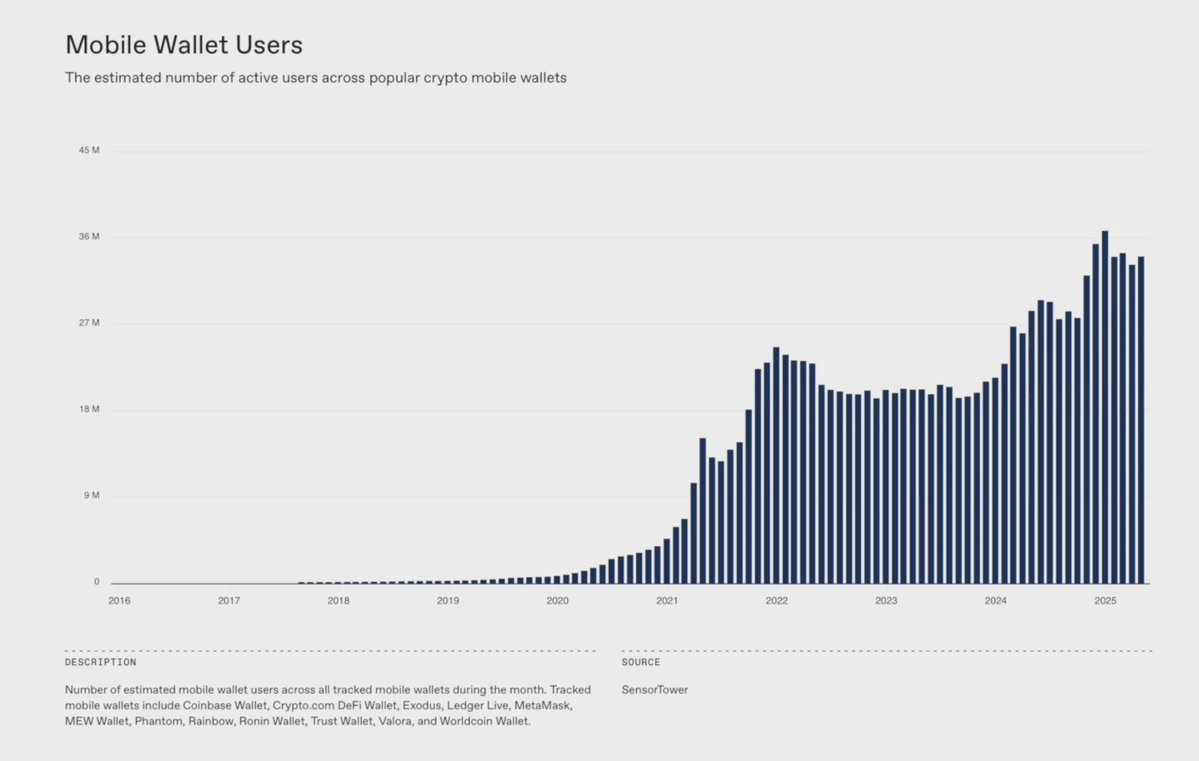

According to a16z Crypto research, the number of crypto mobile wallet users grew 23% year-over-year, and this trend shows no signs of slowing down.

Beyond Gen Z's changing consumption habits, we also saw more native mobile dApps emerge in 2025.

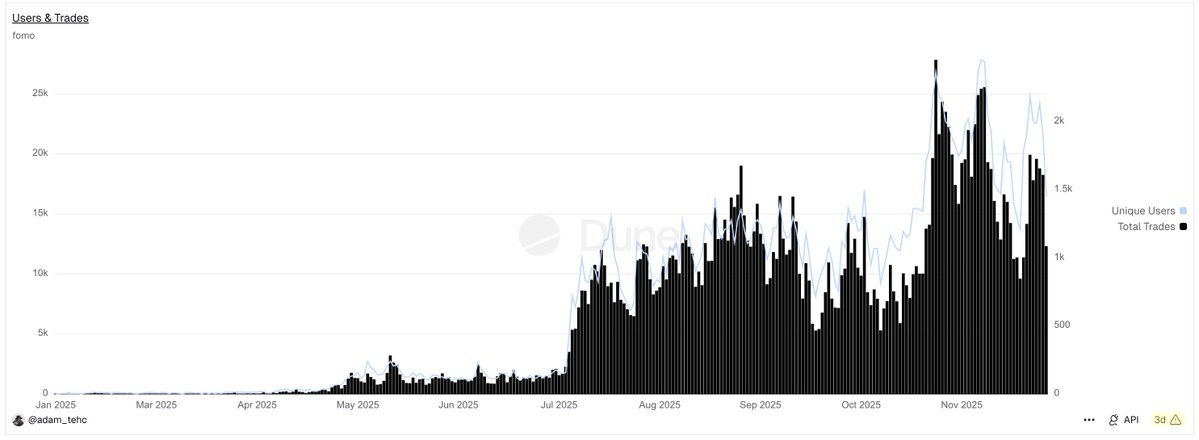

For example, Fomo App, as a social trading application, attracted a large number of new users with its intuitive and unified user experience, allowing anyone to participate in token trading easily, even without prior knowledge.

Developed in just 6 months, the app achieved an average daily trading volume of $3 million and peaked at $13 million in October.

With Fomo's rise, major players like Aave and Polymarket have also prioritized offering mobile savings and betting experiences. Newcomers like @sproutfi_xyz are experimenting with mobile-first yield models.

As mobile behavior continues to grow, I expect mobile dApps to be one of the fastest-expanding areas in 2026.

Give Me More Revenue

One of the main reasons people find this cycle hard to believe is simple:

Most tokens listed on major exchanges still generate little meaningful revenue, and even if they do, there's a lack of a value anchor linking it to the token or "share." Once the narrative fades, these tokens fail to attract sustainable buyers, and the next move is often only one direction—down.

Clearly, the crypto industry relies too much on speculation and pays insufficient attention to real business fundamentals.

Most DeFi projects fall into the trap of designing "Ponzi schemes" to drive early adoption, but the result each time is a focus on dumping after the Token Generation Event (TGE), rather than building an enduring product.

To date, only 60 protocols have generated over $1 million in revenue in the last 30 days. In contrast, there are about 5,000–7,000 IT companies in Web2 with monthly revenue at this level.

Fortunately, a shift began in 2025, aided by Trump's pro-crypto policies. These policies made profit-sharing possible and helped address the long-standing lack of value anchors for tokens.

Projects like Hyperliquid, Pump, Uniswap, Aave proactively focused on product and revenue growth. They recognize that crypto is an ecosystem centered around holding assets, naturally requiring active value flowback.

This is why buybacks became such a powerful value anchoring tool in 2025, as it is one of the clearest signals of alignment between team and investor interests.

So, which businesses generate the strongest revenue?

Crypto's primary use cases remain trading, yield, and payments.

However, due to fee compression in blockchain infrastructure, chain-level revenue is expected to decline by about 40% this year. In contrast, DEXs, exchanges, wallets, trading terminals, and applications were the biggest winners, growing 113%!

Bet more on applications and DEXs.

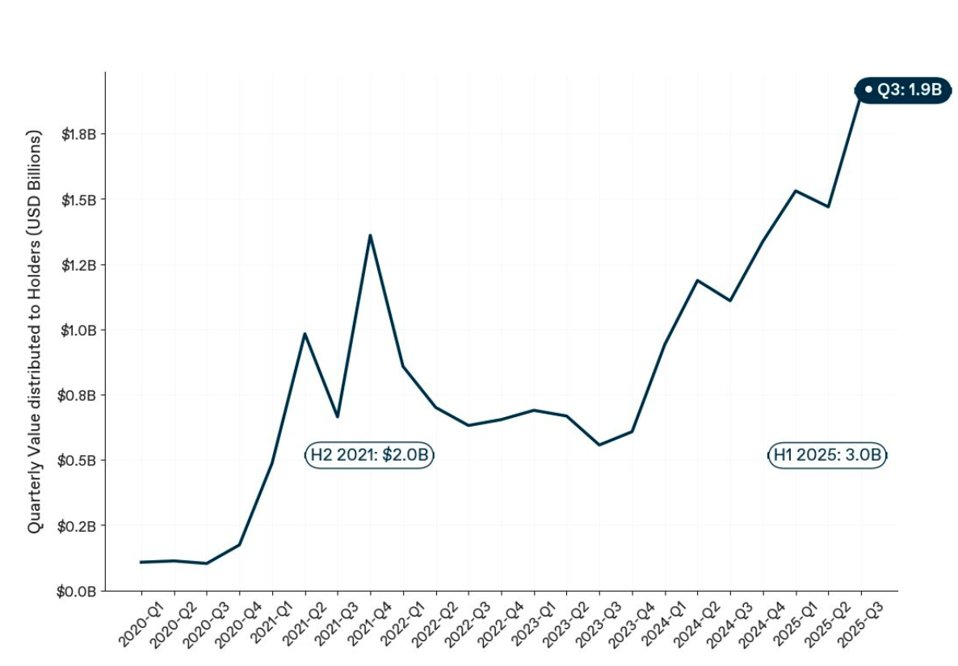

If you're still not convinced, according to 1kx research, we are actually experiencing the peak of value flowing to token holders in crypto history. See the data below:

Conclusion

The crypto industry is not over; it is evolving. We are undergoing a necessary "purification" that will make the crypto ecosystem better than ever, even ten times better.

Projects that survive, achieve real-world applications, generate real revenue, and create tokens with actual utility or value flowback will ultimately be the biggest winners.

2026 will be a crucial year.