Bitcoin (BTC) retail investors are setting new records as “structural decline” sets in this bull market.

Key points:

Bitcoin entities holding up to 1 BTC are sending less per day to Binance than ever before.

A tale of “structural decline” comes in the era of spot Bitcoin ETFs.

Whale positioning hints at a new BTC price bottom.

”Shrimp” Binance BTC inflows set all-time lows

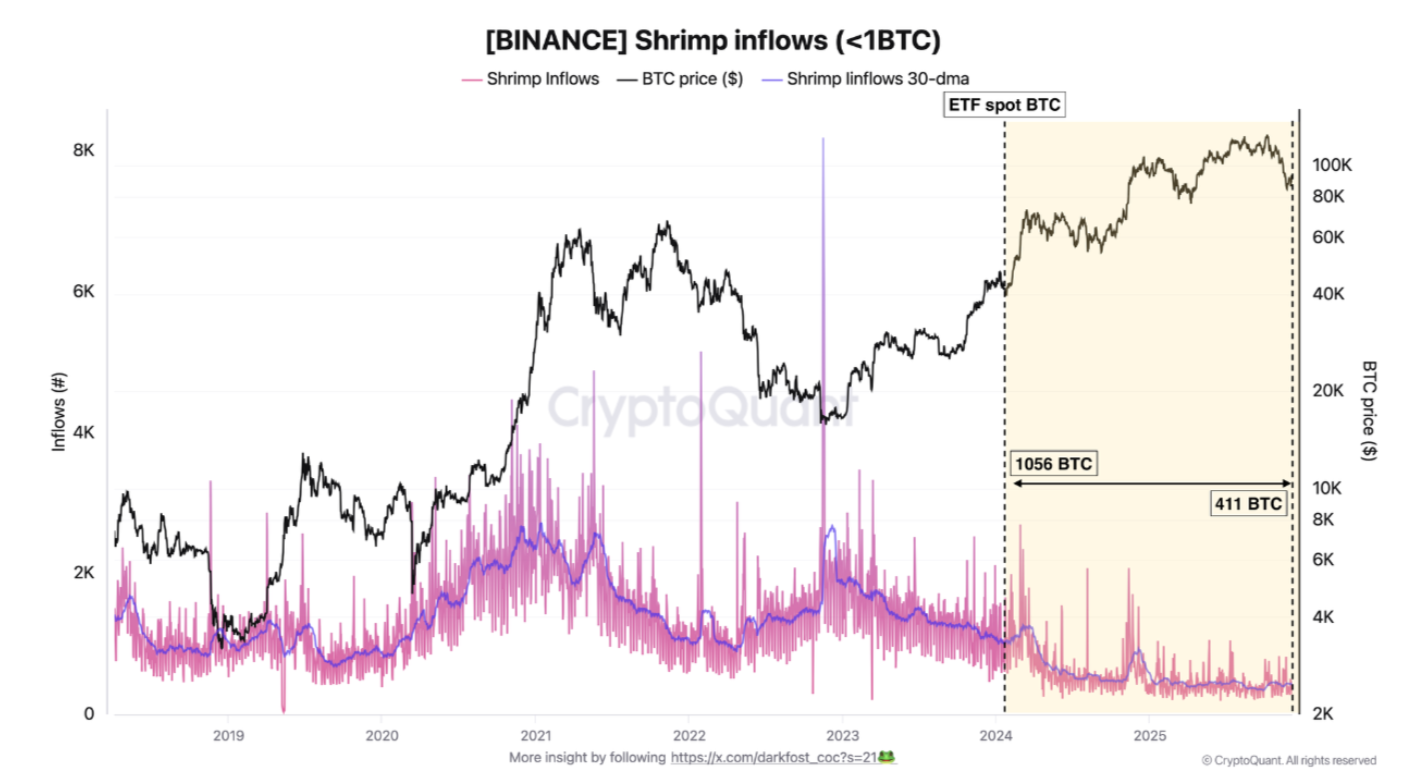

Data from onchain analytics platform CryptoQuant shows BTC inflows to largest crypto exchange Binance collapsing in 2025.

Bitcoin retail investors — entities holding up to 1 BTC ($90,000) — have largely withdrawn from the trading scene.

According to CryptoQuant, even compared to the 2022 bear market, the activity of these “shrimp” investors is a fraction of what it was.

“The activity of shrimps, meaning small Bitcoin holders (<1 BTC), has dropped to one of the lowest levels ever recorded,” contributor Darkfost confirmed in a QuickTake blog post on Monday.

In December 2022, daily inflows from shrimps to Binance alone totaled around 2,675 BTC ($242 million) per day, as measured using a 30-day simple moving average (SMA).

“Today, those inflows have collapsed to just 411 BTC, marking one of the lowest levels ever observed,” Darkfost continued.

“It’s not a simple pullback, it’s a structural decline.”

Retail’s seeming lack of interest has characterized recent Bitcoin history, even as prices reach unprecedented new heights.

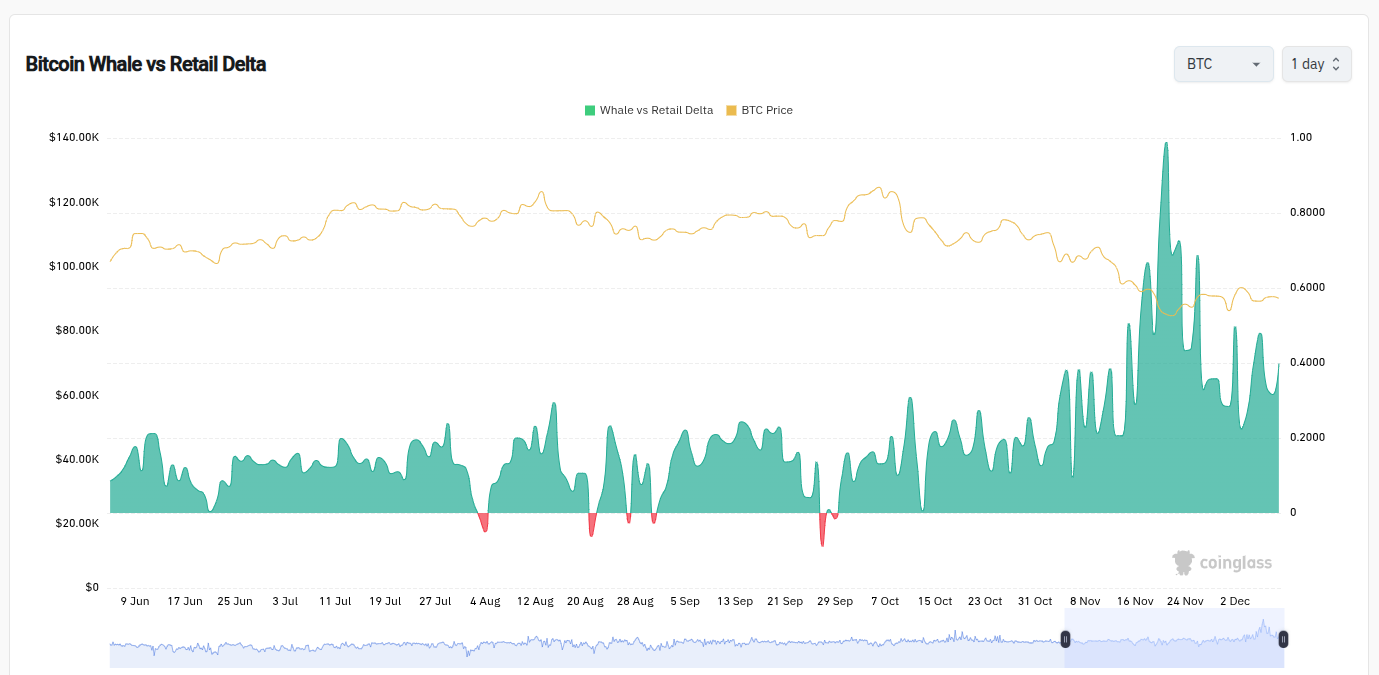

Meanwhile, during the drawdown over the past two months, one indicator comparing retail investors to whales has remained bullish.

Whale versus retail delta, which contrasts long positioning across both cohorts, is teasing a BTC price bottom signal.

“Whale vs. Retail Delta shows that, for the first time in Bitcoin’s history, whales are this heavily positioned in longs compared to retail traders,” Joao Wedson, founder and CEO of crypto analytics platform Alphractal, told X followers in late November.

“Whenever these levels got this high in the past, we saw local bottoms forming — but also large positions getting liquidated.”

Bitcoin ETFs “clearly contribute” to retail shifts

CryptoQuant, meanwhile, explained the retail downtrend within the context of the emergence of more suitable Bitcoin investment vehicles, namely the US spot Bitcoin exchange-traded funds (ETFs).

Related: Did BTC's Santa rally start at $89K? 5 things to know in Bitcoin this week

“ETFs have provided a frictionless way to gain exposure to Bitcoin without dealing with private keys, wallet security, exchange accounts or the risk of mismanaging custody,” Darkfost wrote.

“Of course, ETFs are not the only explanation, but they clearly contribute to a profound change in how retail participates in the market.”

As Cointelegraph reported, November was a testing time for the ETFs, with the largest, BlackRock’s iShares Bitcoin Trust (IBIT), seeing net outflows of $2.3 billion.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.